Dish Network 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

competition could have a material adverse effect on our business, results of operations and financial condition or

otherwise disrupt our business. In particular, consumers have shown increased interest in viewing certain video

programming in any place, at any time and/or on any broadband-connected device they choose. Online content

providers may cause our subscribers to disconnect our services (“cord cutting”), downgrade to smaller, less expensive

programming packages (“cord shaving”) or elect to purchase through these online content providers a certain portion of

the services that they would have historically purchased from us, such as pay per view movies, resulting in less revenue

to us.

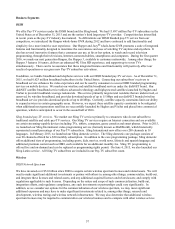

We implement new marketing promotions from time to time that are intended to increase our gross new Pay-TV

subscriber activations. During 2015 and early 2016, we launched various marketing promotions offering certain DISH

branded pay-TV programming packages without a price increase for a limited time period. While we plan to implement

other new marketing efforts, there can be no assurance that we will ultimately be successful in increasing our gross new

Pay-TV subscriber activations. Additionally, in response to our efforts, we may face increased competitive pressures,

including aggressive marketing, more aggressive retention efforts, bundled discount offers combining broadband, video

and/or wireless services and other discounted promotional offers.

Our Pay-TV subscriber base has recently been declining due to, among other things, the factors described above. There

can be no assurance that our Pay-TV subscriber base will not continue to decline. In the event that our Pay-TV

subscriber base continues to decline, it could have a material adverse long-term effect on our business, results of

operations, financial condition and cash flow.

Programming

Our ability to compete successfully will depend, among other things, on our ability to continue to obtain desirable

programming and deliver it to our subscribers at competitive prices. Programming costs represent a large percentage of

our “Subscriber-related expenses” and the largest component of our total expense. We expect these costs to continue to

increase, especially for local broadcast channels and sports programming. In addition, certain programming costs are

rising at a much faster rate than wages or inflation. Further, programming costs continue to increase due to contractual

price increases and the renewal of long-term programming contracts on less favorable pricing terms. Going forward, our

margins may face pressure if we are unable to renew our long-term programming contracts on acceptable pricing and

other economic terms.

Increases in programming costs generally cause us to increase the rates that we charge to our subscribers, which could in

turn cause our existing Pay-TV subscribers to disconnect our service or cause potential new Pay-TV subscribers to

choose not to subscribe to our service. Additionally, even if our subscribers do not disconnect our services, they may

purchase through new and existing online content providers a certain portion of the services that they would have

historically purchased from us, such as pay-per-view movies, resulting in less revenue to us.

Furthermore, our gross new Pay-TV subscriber activations and Pay-TV churn rate may be negatively impacted if we are

unable to renew our long-term programming contracts before they expire. Our gross new Pay-TV subscriber activations,

net Pay-TV subscriber additions and Pay-TV churn rate have been negatively impacted as a result of multiple

programming interruptions and threatened programming interruptions in connection with the scheduled expiration of

programming carriage contracts with several content providers, including, among others, Turner Networks, 21st Century

Fox and certain local network affiliates. In particular, we suffered from lower gross new Pay-TV subscriber activations,

lower net Pay-TV subscriber additions and higher Pay-TV churn rate beginning in the fourth quarter 2014 and

continuing in the first quarter 2015, when, among others, certain programming from 21st Century Fox, including Fox

entertainment and news channels, was not available on our service. We cannot predict with any certainty the impact to

our gross new Pay-TV subscriber activations, net Pay-TV subscriber additions and Pay-TV churn rate resulting from

similar programming interruptions that may occur in the future. As a result, we may at times suffer from periods of

lower gross new Pay-TV subscriber activations, lower net Pay-TV subscriber additions and higher Pay-TV churn rates as

we did beginning in the fourth quarter 2014 and continuing in the first quarter 2015.