Dish Network 2015 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-22

6.

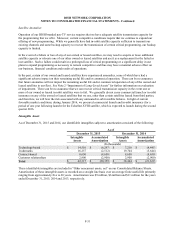

Marketable Investment Securities, Restricted Cash and Cash Equivalents, and Other Investment

Securities

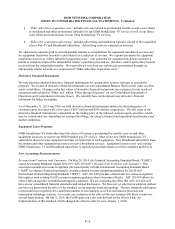

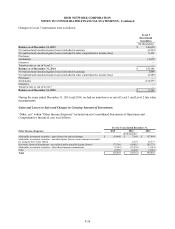

Our marketable investment securities, restricted cash and cash equivalents, and other investment securities consisted

of the following:

As of December 31,

2015 2014

(In thousands)

Marketable investment securities:

Current marketable investment securities - strategic $ 259,145 $ 711,213

Current marketable investment securities - other 298,766 1,420,532

Total current marketable investment securities 557,911 2,131,745

Restricted marketable investment securities (1) 82,280 76,970

Total marketable investment securities 640,191 2,208,715

Restricted cash and cash equivalents (1) 94 10,014

Other investment securities:

Investment in EchoStar preferred tracking stock - cost method 228,795 228,795

Investment in HSSC preferred tracking stock - cost method 87,409 87,409

Other investment securities - cost method 11,046 11,046

Total other investment securities 327,250 327,250

Total marketable investment securities, restricted cash and cash

equivalents, and other investment securities $ 967,535 $ 2,545,979

(1) Restricted marketable investment securities and restricted cash and cash equivalents are included in “Restricted

cash and marketable investment securities” on our Consolidated Balance Sheets.

Marketable Investment Securities

Our marketable investment securities portfolio consists of various debt and equity instruments, all of which are

classified as available-for-sale, except as specified below. See Note 2 for further information.

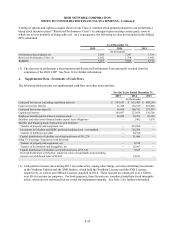

Current Marketable Investment Securities - Strategic

Our current strategic marketable investment securities portfolio includes strategic and financial debt and equity

investments in public companies that are highly speculative and have experienced and continue to experience

volatility. As of December 31, 2015, this portfolio consisted of securities of a small number of issuers, and as a

result the value of that portfolio depends, among other things, on the performance of those issuers. The fair value of

certain of the debt and equity securities in this portfolio can be adversely impacted by, among other things, the

issuers’ respective performance and ability to obtain any necessary additional financing on acceptable terms, or at

all.

Current Marketable Investment Securities – Other

Our current marketable investment securities portfolio includes investments in various debt instruments including,

among others, commercial paper, corporate securities and U.S. treasury and/or agency securities.

Commercial paper consists mainly of unsecured short-term, promissory notes issued primarily by corporations with

maturities ranging up to 365 days. Corporate securities consist of debt instruments issued by corporations with

various maturities normally less than 18 months. U. S. Treasury and agency securities consist of debt instruments

issued by the federal government and other government agencies.