Dish Network 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

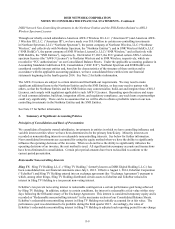

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-10

in redemption value above the initial fair value (adjusted for the operating results of Sling TV Holding attributable

to EchoStar subsequent to August 1, 2014), with the offset recorded in “Additional paid-in capital,” net of deferred

taxes, on our Consolidated Balance Sheets. The operating results of Sling TV Holding attributable to EchoStar are

recorded as “Redeemable noncontrolling interests” in our Consolidated Balance Sheets effective August 1, 2014,

with the offset recorded in “Net income (loss) attributable to noncontrolling interests, net of tax” on our

Consolidated Statements of Operations and Comprehensive Income (Loss). See Note 19 for further information on

Sling TV Holding and the Exchange Agreement.

Northstar Wireless. Northstar Wireless is a wholly-owned subsidiary of Northstar Spectrum, which is an entity

owned by Northstar Manager, LLC (“Northstar Manager”) and us. Under the applicable accounting guidance in

ASC 810, Northstar Spectrum is considered a variable interest entity and, based on the characteristics of the

structure of this entity and in accordance with the applicable accounting guidance, we have consolidated Northstar

Spectrum into our financial statements beginning in the fourth quarter 2014. After the five-year anniversary of the

grant of the Northstar Licenses (and in certain circumstances, prior to the five-year anniversary of the grant of the

Northstar Licenses), Northstar Manager has the ability, but not the obligation, to require Northstar Spectrum to

purchase Northstar Manager’s ownership interests in Northstar Spectrum (the “Northstar Put Right”) for a purchase

price that generally equals its equity contribution to Northstar Spectrum plus a fixed annual rate of return. In the

event that the Northstar Put Right is exercised by Northstar Manager, the consummation of the sale will be subject

to FCC approval. Northstar Spectrum does not have a call right with respect to Northstar Manager’s ownership

interests in Northstar Spectrum. Although Northstar Manager is the sole manager of Northstar Spectrum, Northstar

Manager’s ownership interest is considered temporary equity under the applicable accounting guidance and is thus

recorded as part of “Redeemable noncontrolling interests” in the mezzanine section of our Consolidated Balance

Sheets. Northstar Manager’s ownership interest in Northstar Spectrum was initially accounted for at fair value.

Subsequently, Northstar Manager’s ownership interest in Northstar Spectrum is increased by the fixed annual rate of

return through “Redeemable noncontrolling interests” in our Consolidated Balance Sheets, with the offset recorded

in “Net income (loss) attributable to noncontrolling interest, net of tax” on our Consolidated Statements of

Operations and Comprehensive Income (Loss). The operating results of Northstar Spectrum attributable to

Northstar Manager are recorded as “Redeemable noncontrolling interests” in our Consolidated Balance Sheets, with

the offset recorded in “Net income (loss) attributable to noncontrolling interests, net of tax” on our Consolidated

Statements of Operations and Comprehensive Income (Loss). See Note 15 for further information.

SNR Wireless. SNR Wireless is a wholly-owned subsidiary of SNR HoldCo, which is an entity owned by SNR

Wireless Management, LLC (“SNR Management”) and us. Under the applicable accounting guidance in ASC 810,

SNR HoldCo is considered a variable interest entity and, based on the characteristics of the structure of this entity

and in accordance with the applicable accounting guidance, we have consolidated SNR HoldCo into our financial

statements beginning in the fourth quarter 2014. After the five-year anniversary of the grant of the SNR Licenses

(and in certain circumstances, prior to the five-year anniversary of the grant of the SNR Licenses), SNR

Management has the ability, but not the obligation, to require SNR HoldCo to purchase SNR Management’s

ownership interests in SNR HoldCo (the “SNR Put Right”) for a purchase price that generally equals its equity

contribution to SNR HoldCo plus a fixed annual rate of return. In the event that the SNR Put Right is exercised by

SNR Management, the consummation of the sale will be subject to FCC approval. SNR HoldCo does not have a

call right with respect to SNR Management’s ownership interests in SNR HoldCo. Although SNR Management is

the sole manager of SNR HoldCo, SNR Management’s ownership interest is considered temporary equity under the

applicable accounting guidance and is thus recorded as part of “Redeemable noncontrolling interests” in the

mezzanine section of our Consolidated Balance Sheets. SNR Management’s ownership interest in SNR HoldCo

was initially accounted for at fair value. Subsequently, SNR Management’s ownership interest in SNR HoldCo is

increased by the fixed annual rate of return through “Redeemable noncontrolling interests” in our Consolidated

Balance Sheets, with the offset recorded in “Net income (loss) attributable to noncontrolling interest, net of tax” on

our Statements of Operations and Comprehensive Income (Loss). The operating results of SNR HoldCo attributable

to SNR Management are recorded as “Redeemable noncontrolling interests” in our Consolidated Balance Sheets,

with the offset recorded in “Net income (loss) attributable to noncontrolling interests, net of tax” on our

Consolidated Statements of Operations and Comprehensive Income (Loss). See Note 15 for further information.