Dish Network 2015 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-39

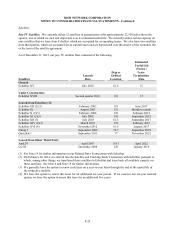

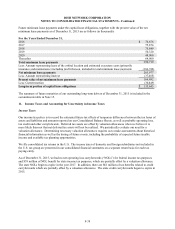

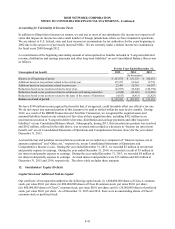

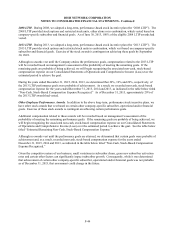

The components of the (benefit from) provision for income taxes were as follows:

For the Years Ended December 31,

2015 2014 2013

(In thousands)

Current (benefit) provision:

Federal $ 144,990 $ 180,282 $ 162,737

State 18,811 (44,565) (2,421)

Foreign (3,517) 6,588 13,316

Total from continuing operations 160,284 142,305 173,632

Deferred (benefit) provision:

Federal 165,294 310,977 102,971

State 30,059 15,776 23,223

Foreign — (190,253) —

Increase (decrease) in valuation allowance 11,039 (1,965) —

Total from continuing operations 206,392 134,535 126,194

Total (benefit) provision $ 366,676 $ 276,840 $ 299,826

Our $1.136 billion of “Income (loss) before income taxes” on our Consolidated Statements of Operations and

Comprehensive Income (Loss) included income of $3 million related to our foreign operations.

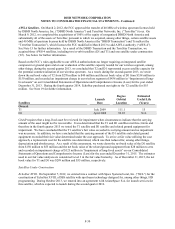

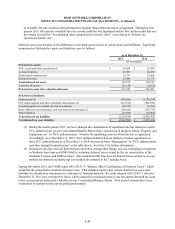

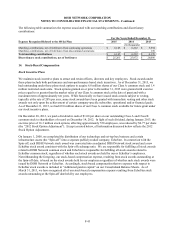

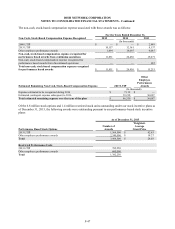

The following table shows the principal reasons for the difference between the effective income tax rate and the

statutory federal tax rate:

For the Years Ended December 31,

2015 2014 2013

% of pre-tax (income)/loss

Statutory rate 35.0 35.0 35.0

State income taxes, net of federal benefit 3.3 1.1 1.3

Reversal of uncertain tax positions (1) (1.0) (3.5) (9.0)

Foreign tax planning strategies, net of federal benefit (2) — (9.8) —

Amounts reclassified from accumulated other comprehensive income (loss) (3) (5.5) — —

Increase (decrease) in valuation allowance 1.0 (0.2) —

Other (0.5) 0.4 (0.9)

Total (benefit) provision for income taxes 32.3 23.0 26.4

(1) Our effective tax rate for the year ended December 31, 2013 was favorably impacted by the $102 million

reversal of an uncertain tax position that was resolved during the third quarter 2013.

(2) Our effective tax rate for the year ended December 31, 2014 was favorably impacted by tax planning strategies

related to the tax structure of certain foreign legal entities, net of federal benefit, totaling $118 million.

(3) Our effective tax rate for the year ended December 31, 2015 was favorably impacted by a $63 million credit

that was previously recorded in “Accumulated other comprehensive income (loss)” and was released to our

income tax provision during the year ended December 31, 2015.

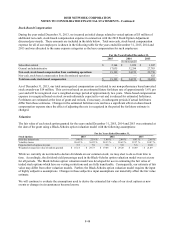

Prior to December 31, 2012, we had

established a valuation allowance against all deferred tax assets that were capital in nature. At December 31,

2012, it was determined that these deferred tax assets were realizable and the valuation allowance was released,

including the valuation allowance related to a specific portfolio of available-for-sale securities for which

changes in fair value had historically been recognized as a separate component of “Accumulated other

comprehensive income (loss).” Under the intra-period tax allocation rules, a credit of $63 million was recorded

in “Accumulated other comprehensive income (loss)” on our Consolidated Balance Sheets related to the release

of this valuation allowance. We elected to use the aggregate portfolio method to determine when the $63

million would be released from “Accumulated other comprehensive income (loss)” to “Income tax (provision)

benefit, net” on our Consolidated Statements of Operations and Comprehensive Income (Loss). Under the

aggregate portfolio approach, the intra-period tax allocation remaining in “Accumulated other comprehensive

income (loss)” is not released to “Income tax (provision) benefit, net” until such time that the specific portfolio