Dish Network 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

We may need additional capital, which may not be available on acceptable terms or at all, to continue investing in our

business and to finance acquisitions and other strategic transactions.

We may need to raise significant additional capital in the future, which may not be available on acceptable terms or at

all, to among other things, continue investing in our business, construct and launch new satellites, and to pursue

acquisitions and other strategic transactions. Weakness in the equity markets could make it difficult for us to raise equity

financing without incurring substantial dilution to our existing shareholders. Adverse changes in the credit markets,

including rising interest rates, could increase our borrowing costs and/or make it more difficult for us to obtain financing for

our operations or refinance existing indebtedness. In addition, economic weakness or weak results of operations may

limit our ability to generate sufficient internal cash to fund investments, capital expenditures, acquisitions and other

strategic transactions, as well as to fund ongoing operations and service our debt. Furthermore, our borrowing costs can

be affected by short and long-term debt ratings assigned by independent rating agencies, which are based, in significant part,

on our performance as measured by their credit metrics. A decrease in these ratings would likely increase our cost of

borrowing and/or make it more difficult for us to obtain financing. A severe disruption in the global financial markets could

impact some of the financial institutions with which we do business, and such instability could also affect our access to

financing. As a result, these conditions make it difficult for us to accurately forecast and plan future business activities

because we may not have access to funding sources necessary for us to pursue organic and strategic business

development opportunities.

See “We have made substantial investments to acquire certain wireless spectrum licenses and other related assets. In

addition, we have made substantial non-controlling investments in the Northstar Entities and the SNR Entities related to

AWS-3 wireless spectrum licenses” above for more information.

From time to time a portion of our investment portfolio may be invested in securities that have limited liquidity and

may not be immediately accessible to support our financing needs, including investments in public companies that are

highly speculative and have experienced and continue to experience volatility.

From time to time a portion of our investment portfolio may be invested in strategic investments, and as a result, a

portion of our portfolio may have restricted liquidity. If the credit ratings of these securities deteriorate or there is a lack

of liquidity in the marketplace, we may be required to record impairment charges. Moreover, the uncertainty of

domestic and global financial markets can greatly affect the volatility and value of our marketable investment securities.

In addition, a portion of our investment portfolio may include strategic and financial investments in debt and equity

securities of public companies that are highly speculative and experience volatility. Typically, these investments are

concentrated in a small number of companies. The fair value of these investments can be significantly impacted by the

risk of adverse changes in securities markets generally, as well as risks related to the performance of the companies

whose securities we have invested in, risks associated with specific industries, and other factors. These investments are

subject to significant fluctuations in fair value due to the volatility of the securities markets and of the underlying

businesses. The concentration of these investments as a percentage of our overall investment portfolio fluctuates from

time to time based on, among other things, the size of our investment portfolio and our ability to liquidate these

investments. In addition, because our portfolio may be concentrated in a limited number of companies, we may

experience a significant loss if any of these companies, among other things, defaults on its obligations, performs poorly,

does not generate adequate cash flow to fund its operations, is unable to obtain necessary financing on acceptable terms,

or at all, or files for bankruptcy, or if the sectors in which these companies operate experience a market downturn. To

the extent we require access to funds, we may need to sell these securities under unfavorable market conditions, record

impairment charges and fall short of our financing needs.

We have substantial debt outstanding and may incur additional debt.

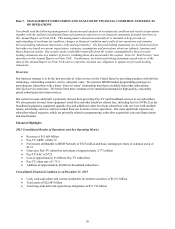

As of December 31, 2015, our total long-term debt and capital lease obligations, including the debt of our subsidiaries,

was $13.756 billion. On February 1, 2016, we redeemed the $1.5 billion principal balance of our 7 1/8% Senior Notes

due 2016 using a substantial portion of our available cash and investment securities on hand. Following repayment of

our 7 1/8% Senior Notes due 2016, our total long-term debt and capital lease obligations, including the debt of our

subsidiaries, was approximately $12.3 billion.