Dish Network 2015 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-45

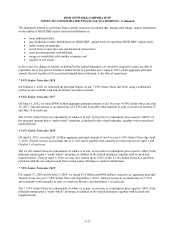

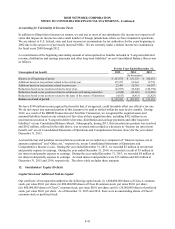

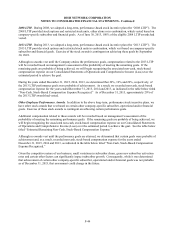

We realized tax benefits from stock awards exercised as follows:

For the Years Ended December 31,

2015 2014 2013

(In thousands)

Tax benefit from stock awards exercised $ 33,716 $ 52,366 $ 38,947

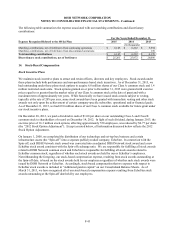

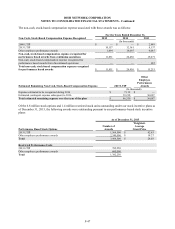

Based on the closing market price of our Class A common stock on December 31, 2015, the aggregate intrinsic

value of our stock options was as follows:

As of December 31, 2015

Options

Outstanding

Options

Exercisable

(In thousands)

Aggregate intrinsic value $ 187,409 $ 60,660

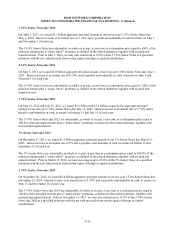

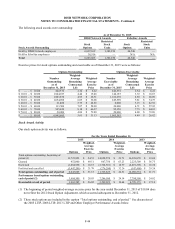

Our restricted stock unit activity was as follows:

For the Years Ended December 31,

2015 2014 2013

Restricted

Stock

Units

Weighted-

Average

Grant Date

Fair Value

Restricted

Stock

Units

Weighted-

Average

Grant Date

Fair Value

Restricted

Stock

Units

Weighted-

Average

Grant Date

Fair Value

Total restricted stock units outstanding,

beginning of period 1,798,331 $ 32.31 1,943,497 $ 29.09 1,185,080 $ 22.99

Granted 62,530 $ 68.79 316,500 $ 63.57 990,000 $ 36.53

Vested (125,280) $ 63.92 (278,000) $ 45.04 (135,250) $ 29.19

Forfeited and cancelled (353,331) $ 28.76 (183,666) $ 32.77 (96,333) $ 30.46

Total restricted stock units

outstanding, end of period (1) 1,382,250 $ 32.01 1,798,331 $ 32.31 1,943,497 $ 29.09

(1) All restricted stock units outstanding are Restricted Performance Units. See discussion of the 2005 LTIP, 2008

LTIP, 2013 LTIP and Other Employee Performance Awards below.

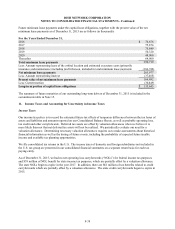

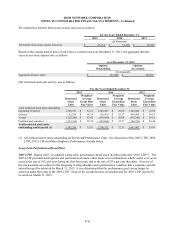

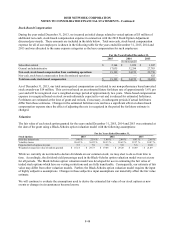

Long-Term Performance-Based Plans

2005 LTIP. During 2005, we adopted a long-term, performance-based stock incentive plan (the “2005 LTIP”). The

2005 LTIP provided stock options and restricted stock units, either alone or in combination, which vested over seven

years at the rate of 10% per year during the first four years, and at the rate of 20% per year thereafter. Exercise of

the stock awards was subject to the foregoing vesting schedule and a performance condition that a company-specific

subscriber goal be achieved by March 31, 2015. It was determined that the performance goal can no longer be

achieved under the terms of the 2005 LTIP. None of the awards became exercisable and the 2005 LTIP expired by

its terms on March 31, 2015.