Dish Network 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.75

we acquire new subscribers, the more our positive ongoing cash flow from existing subscribers is offset by the negative

upfront cash flow associated with acquiring new subscribers. Finally, our future cash flow is impacted by the rate at

which we make general investments and any cash flow from financing activities.

Our subscriber-specific investments to acquire new subscribers have a significant impact on our cash flow. While fewer

subscribers might translate into lower ongoing cash flow in the long-term, cash flow is actually aided, in the short-term,

by the reduction in subscriber-specific investment spending. As a result, a slow-down in our business due to external or

internal factors does not introduce the same level of short-term liquidity risk as it might in other industries.

Subscriber Base

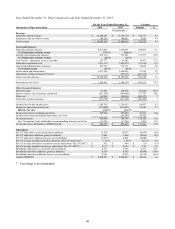

We lost approximately 81,000 net Pay-TV subscribers during the year ended December 31, 2015, compared to the loss

of approximately 79,000 net Pay-TV subscribers during the same period in 2014. The increase in net Pay-TV subscriber

losses versus the same period in 2014 resulted from a higher Pay-TV churn rate, partially offset by higher gross new

Pay-TV subscriber activations, primarily related to the activation of Sling TV subscribers, which are reported net of

disconnects. Our Sling domestic service was launched in February 2015. See “Results of Operations” above for further

information.

Subscriber Acquisition and Retention Costs

We incur significant upfront costs to acquire subscribers, including advertising, retailer incentives, equipment subsidies,

installation services, and/or new customer promotions. While we attempt to recoup these upfront costs over the lives of

their subscription, there can be no assurance that we will be successful in achieving that objective. With respect to our

DISH branded pay-TV service, we employ business rules such as minimum credit requirements for prospective

customers and contractual commitments to receive service for a minimum term. We strive to provide outstanding

customer service, to increase the likelihood of customers keeping their Pay-TV services over longer periods of time. Our

subscriber acquisition costs may vary significantly from period to period.

We incur significant costs to retain our existing DISH branded pay-TV customers, mostly by upgrading their equipment

to HD and DVR receivers and by providing retention credits. As with our subscriber acquisition costs, our retention

upgrade spending includes the cost of equipment and installation services. In certain circumstances, we also offer

programming at no additional charge and/or promotional pricing for limited periods to existing customers in exchange

for a contractual commitment to receive service for a minimum term. A component of our retention efforts includes the

installation of equipment for customers who move. Our subscriber retention costs may vary significantly from period to

period.

Seasonality

Historically, the first half of the year generally produces fewer gross new Pay-TV subscriber activations than the second

half of the year, as is typical in the pay-TV industry. In addition, the first and fourth quarters generally produce a lower

churn rate than the second and third quarters. However, we cannot provide assurance that this will continue in the future.

Satellites

Operation of our DISH branded pay-TV service requires that we have adequate satellite transmission capacity for the

programming that we offer. Moreover, current competitive conditions require that we continue to expand our offering of

new programming. While we generally have had in-orbit satellite capacity sufficient to transmit our existing channels

and some backup capacity to recover the transmission of certain critical programming, our backup capacity is limited. In

the event of a failure or loss of any of our owned or leased satellites, we may need to acquire or lease additional satellite

capacity or relocate one of our other satellites and use it as a replacement for the failed or lost satellite. Such a failure

could result in a prolonged loss of critical programming or a significant delay in our plans to expand programming as

necessary to remain competitive and cause us to expend a significant portion of our cash to acquire or lease additional

satellite capacity.