Dish Network 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-7

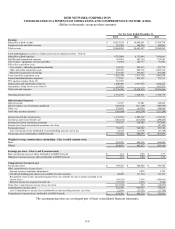

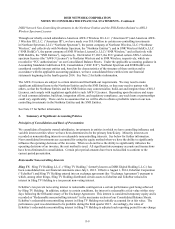

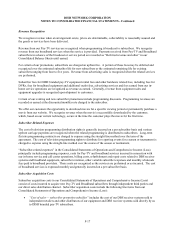

DISH NETWORK CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

For the Years Ended December 31,

2015 2014 2013

Cash Flows From Operating Activities:

N

et income (loss) $ 769,276 $ 928,902 $ 789,746

Less: Income (loss) from discontinued operations, net of tax — — (47,343)

Income (loss) from continuing operations $ 769,276 $ 928,902 $ 837,089

A

djustments to reconcile net income (loss) to net cash flows from operating activities:

Depreciation and amortization 1,000,048

1,077,936 1,054,026

Impairment of long-lived assets 123,352 — 437,575

Realized and unrealized losses (gains) on investments (287,250) 60,515 (387,675)

Non-cash, stock-based compensation 19,199 34,153 29,730

Deferred tax expense (benefit) 206,392

134,535 126,194

Change in long-term deferred revenue, distribution and carriage payments and other long-term liabilities 104,233 30,792 (2,352)

Other, net 18,323

106,752 68,339

Changes in current assets and current liabilities, net

Trade accounts receivable 88,901

6,305 (97,228)

Allowance for doubtful accounts (1,436) 8,649 2,147

Advances (to) from discontinued operations — — 48,803

Prepaid and accrued income taxes 64,775 85,586 26,397

Inventory 116,503

(5,090) (12,654)

Other current assets 15,632 (2,583) (71,324)

Trade accounts payable 56,633

(210,163) 109,052

Deferred revenue and other (21,714) 47,988 3,497

Accrued programming and other accrued expenses 163,213 103,854 137,581

Net cash flows from operating activities from continuing operations 2,436,080 2,408,131 2,309,197

Net cash flows from operating activities from discontinued operations, net — (30,007) (36,732)

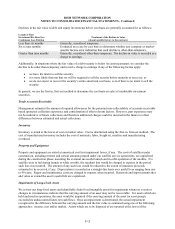

Cash Flows From Investing Activities:

Purchases of marketable investment securities (447,901) (4,119,489) (6,356,136)

Sales and maturities of marketable investment securities 2,054,805 7,054,104 4,999,639

Purchases of derivative financial instruments — (149,969) (805,996)

Settlement of derivative financial instruments — — 718,847

Purchases of property and equipment (761,694) (1,001,861) (1,116,573)

Capitalized interest related to FCC authorizations (Note 15) (352,683) (214,000) (136,926)

Purchases of FCC authorizations (Note 15) (8,970,389) (1,343,372) (328,134)

AWS-3 FCC license refunds (deposits) (Note 15) 400,000 (1,320,000) —

Change in restricted cash, cash equivalents and marketable investment securities 4,610 7,886 38,782

Other, net (897) 102,777 (48,360)

Net cash flows from investing activities from continuing operations (8,074,149) (983,924) (3,034,857)

Net cash flows from investing activities from discontinued operations, net, including $0 and $0 of purchases of

property and equipment, respectively — 20,847 13,773

Cash Flows From Financing Activities:

Proceeds from issuance of long-term debt — 2,000,000 2,300,000

Proceeds from issuance of restricted debt — — 2,600,000

Redemption of restricted debt — — (2,600,000)

Funding of restricted debt escrow —

— (2,596,750)

Release of restricted debt escrow — — 2,596,771

Redemption and repurchases of long-term debt (650,001) (1,099,999) (500,000)

Capital contributions from Northstar Manager and SNR Management (Note 15) 204,200 20,700 —

Repayment of long-term debt and capital lease obligations (31,525) (31,653) (37,869)

N

et proceeds from Class A common stock options exercised and stock issued under the Employee Stock Purchase Plan 33,868 50,934 76,512

Other, net 30,189

40,285 13,276

Net cash flows from financing activities from continuing operations (413,269) 980,267 1,851,940

Net cash flows from financing activities from discontinued operations, net — — (435)

Effect of exchange rates on cash and cash equivalents from discontinued operations — — 156

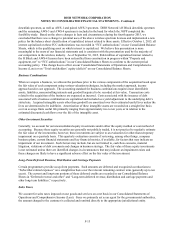

Net increase (decrease) in cash and cash equivalents from continuing operations (6,051,338) 2,404,474 1,126,280

Cash and cash equivalents, beginning of period from continuing operations 7,104,496 4,700,022 3,573,742

Cash and cash equivalents, end of period from continuing operations $ 1,053,158 $ 7,104,496 $ 4,700,022

Net increase (decrease) in cash and cash equivalents from discontinued operations — (9,160) (23,238)

Cash and cash equivalents, beginning of period from discontinued operations — 9,160 32,398

Cash and cash equivalents, end of period from discontinued operations $ — $ — $ 9,160

The accompanying notes are an integral part of these consolidated financial statements.