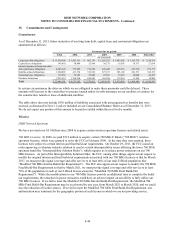

Dish Network 2015 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-46

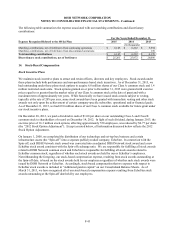

2008 LTIP. During 2008, we adopted a long-term, performance-based stock incentive plan (the “2008 LTIP”). The

2008 LTIP provided stock options and restricted stock units, either alone or in combination, which vested based on

company-specific subscriber and financial goals. As of June 30, 2013, 100% of the eligible 2008 LTIP awards had

vested.

2013 LTIP. During 2013, we adopted a long-term, performance-based stock incentive plan (the “2013 LTIP”). The

2013 LTIP provides stock options and restricted stock units in combination, which vest based on company-specific

subscriber and financial goals. Exercise of the stock awards is contingent on achieving these goals by September

30, 2022.

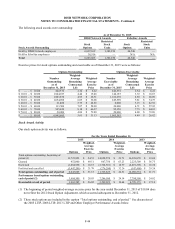

Although no awards vest until the Company attains the performance goals, compensation related to the 2013 LTIP

will be recorded based on management’s assessment of the probability of meeting the remaining goals. If the

remaining goals are probable of being achieved, we will begin recognizing the associated non-cash, stock-based

compensation expense on our Consolidated Statements of Operations and Comprehensive Income (Loss) over the

estimated period to achieve the goal.

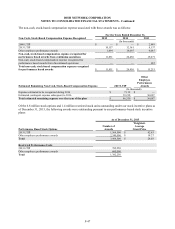

During the years ended December 31, 2015, 2014, 2013, we determined that 30%, 10% and 20%, respectively, of

the 2013 LTIP performance goals were probable of achievement. As a result, we recorded non-cash, stock-based

compensation expense for the years ended December 31, 2015, 2014 and 2013, as indicated in the table below titled

“Non-Cash, Stock-Based Compensation Expense Recognized.” As of December 31, 2015, approximately 20% of

the 2013 LTIP awards had vested.

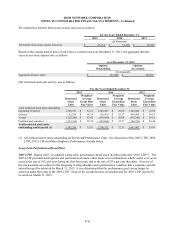

Other Employee Performance Awards. In addition to the above long-term, performance stock incentive plans, we

have other stock awards that vest based on certain other company-specific subscriber, operational and/or financial

goals. Exercise of these stock awards is contingent on achieving certain performance goals.

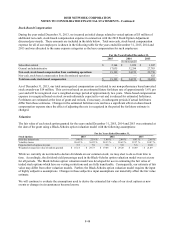

Additional compensation related to these awards will be recorded based on management’s assessment of the

probability of meeting the remaining performance goals. If the remaining goals are probable of being achieved, we

will begin recognizing the associated non-cash, stock-based compensation expense on our Consolidated Statements

of Operations and Comprehensive Income (Loss) over the estimated period to achieve the goal. See the table below

titled “Estimated Remaining Non-Cash, Stock-Based Compensation Expense.”

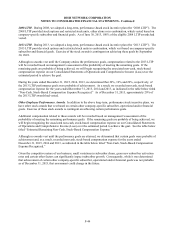

Although no awards vest until the performance goals are attained, we determined that certain goals were probable of

achievement and, as a result, recorded non-cash, stock-based compensation expense for the years ended

December 31, 2015, 2014 and 2013, as indicated in the table below titled “Non-Cash, Stock-Based Compensation

Expense Recognized.”

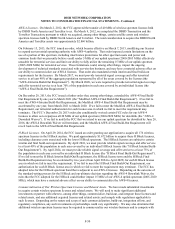

Given the competitive nature of our business, small variations in subscriber churn, gross new subscriber activation

rates and certain other factors can significantly impact subscriber growth. Consequently, while it was determined

that achievement of certain other company-specific subscriber, operational and/or financial goals was not probable

as of December 31, 2015, that assessment could change in the future.