Dish Network 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-20

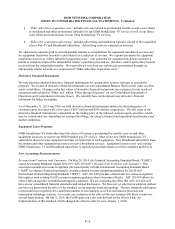

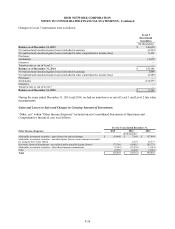

Vesting of options and rights to acquire shares of our Class A common stock granted pursuant to our performance

based stock incentive plans (“Restricted Performance Units”) is contingent upon meeting certain goals, some of

which are not yet probable of being achieved. As a consequence, the following are also not included in the diluted

EPS calculation.

As of December 31,

2015 2014 2013

(In thousands)

Performance based options (1) 3,905 7,247 7,791

Restricted Performance Units (1) 1,382 1,798 1,943

Total (1) 5,287 9,045 9,734

(1) The decrease in performance based options and Restricted Performance Units primarily resulted from the

expiration of the 2005 LTIP. See Note 14 for further information.

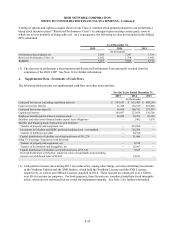

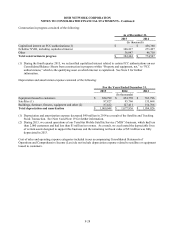

4. Supplemental Data - Statements of Cash Flows

The following table presents our supplemental cash flow and other non-cash data.

For the Years Ended December 31,

2015 2014 2013

(In thousands)

Cash paid for interest (including capitalized interest) $ 854,147 $ 833,483 $ 880,244

Cash received for interest 21,380 138,529 201,480

Cash paid for income taxes (1) 16,014 160,732 273,597

Capitalized interest 369,897 223,658 136,508

Employee benefits paid in Class A common stock 26,026 25,781 24,230

Satellites and other assets financed under capital lease obligations — 3,462 1,070

Satellite and Tracking Stock Transaction with EchoStar:

Transfer of property and equipment, net — 432,080 —

Investment in EchoStar and HSSC preferred tracking stock - cost method — 316,204 —

Transfer of liabilities and other — 44,540 —

Capital distribution to EchoStar, net of deferred taxes of $31,274 — 51,466 —

Sling TV Exchange Transaction with EchoStar:

Transfer of property and equipment, net — 8,978 —

Transfer of investments and intangibles, net — 25,097 —

Capital distribution to EchoStar, net of deferred taxes of $3,542 — 5,845 —

Deemed distribution to EchoStar- initial fair value of redeemable noncontrolling

interest, net of deferred taxes of $8,489 — 14,011 —

(1) Cash paid for income taxes during 2015 was reduced by, among other things, our non-controlling investments

in the Northstar Entities and the SNR Entities, which hold the Northstar Licenses and the SNR Licenses,

respectively, as well as our H Block Licenses acquired in 2014. These licenses are amortized over a fifteen-

year life for income tax purposes. For book purposes, these licenses are considered indefinite-lived intangible

assets, which are not amortized but are tested for impairment annually. See Note 2 for further information.