Dish Network 2015 Annual Report Download - page 113

Download and view the complete annual report

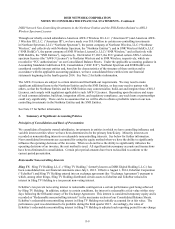

Please find page 113 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-9

DISH Network Non-Controlling Investments in the Northstar Entities and the SNR Entities Related to AWS-3

Wireless Spectrum Licenses

Through our wholly-owned subsidiaries American AWS-3 Wireless II L.L.C. (“American II”) and American AWS-

3 Wireless III L.L.C. (“American III”), we have made over $10.0 billion in certain non-controlling investments

in Northstar Spectrum, LLC (“Northstar Spectrum”), the parent company of Northstar Wireless, LLC (“Northstar

Wireless,” and collectively with Northstar Spectrum, the “Northstar Entities”), and in SNR Wireless HoldCo, LLC

(“SNR HoldCo”), the parent company of SNR Wireless LicenseCo, LLC (“SNR Wireless,” and collectively with

SNR HoldCo, the “SNR Entities”), respectively. On October 27, 2015, the FCC granted certain AWS-3 wireless

spectrum licenses (the “AWS-3 Licenses”) to Northstar Wireless and to SNR Wireless, respectively, which are

recorded in “FCC authorizations” on our Consolidated Balance Sheets. Under the applicable accounting guidance in

Accounting Standards Codification 810, Consolidation (“ASC 810”), Northstar Spectrum and SNR HoldCo are

considered variable interest entities and, based on the characteristics of the structure of these entities and in

accordance with the applicable accounting guidance, we have consolidated these entities into our financial

statements beginning in the fourth quarter 2014. See Note 2 for further information.

The AWS-3 Licenses are subject to certain interim and final build-out requirements. We may need to make

significant additional loans to the Northstar Entities and to the SNR Entities, or they may need to partner with

others, so that the Northstar Entities and the SNR Entities may commercialize, build-out and integrate these AWS-3

Licenses, and comply with regulations applicable to such AWS-3 Licenses. Depending upon the nature and scope

of such commercialization, build-out, integration efforts, and regulatory compliance, any such loans or partnerships

could vary significantly. There can be no assurance that we will be able to obtain a profitable return on our non-

controlling investments in the Northstar Entities and the SNR Entities.

See Note 15 for further information.

2. Summary of Significant Accounting Policies

Principles of Consolidation and Basis of Presentation

We consolidate all majority owned subsidiaries, investments in entities in which we have controlling influence and

variable interest entities where we have been determined to be the primary beneficiary. Minority interests are

recorded as noncontrolling interests or redeemable noncontrolling interests. See below for further information.

Non-consolidated investments are accounted for using the equity method when we have the ability to significantly

influence the operating decisions of the investee. When we do not have the ability to significantly influence the

operating decisions of an investee, the cost method is used. All significant intercompany accounts and transactions

have been eliminated in consolidation. Certain prior period amounts have been reclassified to conform to the

current period presentation.

Redeemable Noncontrolling Interests

Sling TV. Sling TV Holding L.L.C. (“Sling TV Holding,” formerly known as DISH Digital Holding L.L.C.) has

been consolidated into our financial statements since July 1, 2012. Effective August 1, 2014, EchoStar Corporation

(“EchoStar”) and Sling TV Holding entered into an exchange agreement (the “Exchange Agreement”) pursuant to

which, among other things, Sling TV Holding distributed certain assets to EchoStar and EchoStar reduced its

interest in Sling TV Holding to a ten percent non-voting interest.

EchoStar’s ten percent non-voting interest is redeemable contingent on a certain performance goal being achieved

by Sling TV Holding. In addition, subject to certain conditions, the interest is redeemable at fair value within

sixty

days following the fifth anniversary of the Exchange Agreement. This interest is considered temporary equity and is

recorded as “Redeemable noncontrolling interests” in the mezzanine section of our Consolidated Balance Sheets.

EchoStar’s redeemable noncontrolling interest in Sling TV Holding was initially accounted for at fair value. The

performance goal was determined to be probable during the third quarter 2015. Accordingly, the value of

EchoStar’s redeemable noncontrolling interest in Sling TV Holding is adjusted each reporting period for any change