Dish Network 2015 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-12

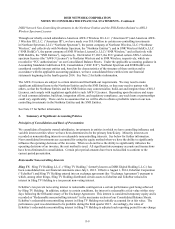

Declines in the fair value of debt and equity investments below cost basis are generally accounted for as follows:

Length of Time

Investment Has Been In a

Continuous Loss Position

Treatment of the Decline in Value

(absent specific factors to the contrary)

Less than six months Generally, considered temporary.

Six to nine months

Evaluated on a case by case basis to determine whether any company or market-

specific factors exist indicating that such decline is other-than-temporary.

Greater than nine months

Generally, considered other-than-temporary. The decline in value is recorded as a

charge to earnings.

Additionally, in situations where the fair value of a debt security is below its carrying amount, we consider the

decline to be other-than-temporary and record a charge to earnings if any of the following factors apply:

x we have the intent to sell the security,

x it is more likely than not that we will be required to sell the security before maturity or recovery, or

x we do not expect to recover the security’s entire amortized cost basis, even if there is no intent to sell the

security.

In general, we use the first in, first out method to determine the cost basis on sales of marketable investment

securities.

Trade Accounts Receivable

Management estimates the amount of required allowances for the potential non-collectability of accounts receivable

based upon past collection experience and consideration of other relevant factors. However, past experience may

not be indicative of future collections and therefore additional charges could be incurred in the future to reflect

differences between estimated and actual collections.

Inventory

Inventory is stated at the lower of cost or market value. Cost is determined using the first-in, first-out method. The

cost of manufactured inventory includes the cost of materials, labor, freight-in, royalties and manufacturing

overhead.

Property and Equipment

Property and equipment are stated at amortized cost less impairment losses, if any. The costs of satellites under

construction, including interest and certain amounts prepaid under our satellite service agreements, are capitalized

during the construction phase, assuming the eventual successful launch and in-orbit operation of the satellite. If a

satellite were to fail during launch or while in-orbit, the resultant loss would be charged to expense in the period

such loss was incurred. The amount of any such loss would be reduced to the extent of insurance proceeds

estimated to be received, if any. Depreciation is recorded on a straight-line basis over useful lives ranging from one

to 40 years. Repair and maintenance costs are charged to expense when incurred. Renewals and improvements that

add value or extend the asset’s useful life are capitalized.

Impairment of Long-Lived Assets

We review our long-lived assets and identifiable finite-lived intangible assets for impairment whenever events or

changes in circumstances indicate that the carrying amount of an asset may not be recoverable. For assets which are

held and used in operations, the asset would be impaired if the carrying amount of the asset (or asset group)

exceeded its undiscounted future net cash flows. Once an impairment is determined, the actual impairment

recognized is the difference between the carrying amount and the fair value as estimated using one of the following

approaches: income, cost and/or market. Assets which are to be disposed of are reported at the lower of the