Dish Network 2015 Annual Report Download - page 118

Download and view the complete annual report

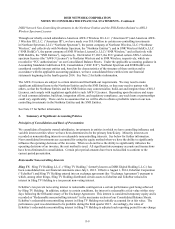

Please find page 118 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-14

The DBS FCC licenses were assessed quantitatively in 2014 and 2013. Our quantitative assessments consisted of a

discounted cash flow analysis encompassing future cash flows from satellites transmitting from such licensed orbital

locations, including revenue attributable to programming offerings from such satellites, the direct operating and

subscriber acquisition costs related to such programming, and future capital costs for replacement

satellites. Projected revenue and cost amounts included projected subscribers. In conducting our annual impairment

test in 2014 and 2013, we determined that the fair value of the DBS FCC licenses exceeded its carrying amount.

Wireless Spectrum Licenses. We combine our AWS-4 and H Block wireless spectrum licenses and the Northstar

Licenses and SNR Licenses into a single unit of accounting. For 2015, management performed a qualitative

assessment to determine whether it is more likely than not that the fair value of these licenses exceeds the carrying

amount of these licenses. In our assessment, we considered several qualitative factors, including, among others,

macroeconomic conditions, industry and market conditions, relevant company specific events, and perception of the

market. In contemplating all factors in their totality, we concluded that it is more likely than not that the fair value

of these licenses exceeds the carrying amount of these licenses. As such, no further analysis was required.

The AWS-4 and H Block wireless spectrum licenses were assessed quantitatively in 2014 and 2013. Our

quantitative assessment consisted of an income approach and a market approach. The income approach consisted of

a probability weighted analysis considering estimated future cash flows discounted at a rate commensurate with the

risk involved. The market approach benchmarked the fair value of the AWS-4 and H-Block wireless spectrum

licenses against the carrying amount of these licenses. In conducting our annual impairment test in 2014 and 2013,

we determined that the fair value of the AWS-4 and H Block wireless spectrum licenses exceeded the carrying

amount of these licenses.

Our 700 MHz wireless spectrum licenses are assessed as a single unit of accounting. For 2015, management

performed a qualitative assessment to determine whether it is more likely than not that the fair value of the 700 MHz

wireless spectrum licenses exceeds its carrying amount. In our assessment, we considered several qualitative

factors, including, among others, macroeconomic conditions, industry and market conditions, relevant company

specific events, and perception of the market. In contemplating all factors in their totality, we concluded that it is

more likely than not that the fair value of these licenses exceeds its carrying amount. As such, no further analysis

was required.

The 700 MHz wireless spectrum licenses were assessed quantitatively in 2014 and 2013, in which the estimated fair

value for the 700 MHz licenses was determined using the market approach. The market approach benchmarks the

fair value of the 700 MHz licenses against its carrying amount. In conducting our annual impairment test in 2014

and 2013, we determined that the fair value of the 700 MHz wireless spectrum licenses exceeded its carrying

amount.

Changes in circumstances or market conditions could result in a write-down of any of the above wireless spectrum

licenses in the future.

Capitalized Interest

We capitalize interest associated with the acquisition or construction of certain assets, including, among other

things, satellites and wireless spectrum licenses. Capitalization of interest begins when, among other things, steps

are taken to prepare the asset for its intended use and ceases when the asset is ready for its intended use or when

these activities are substantially suspended.

We are currently preparing for the commercialization of our AWS-4 and H Block wireless spectrum licenses, and

interest expense related to their carrying amount is being capitalized. In addition, on October 27, 2015, the FCC

granted certain AWS-3 Licenses to Northstar Wireless and to SNR Wireless, respectively, in which we have made

certain non-controlling investments. Northstar Wireless and SNR Wireless are preparing for the commercialization

of their AWS-3 Licenses, and began capitalizing interest related to these AWS-3 Licenses as of October 27, 2015.

Also during fourth quarter 2015, the Third Generation Partnership Project (“3GPP”) approved Band 66 and

completed a feasibility study for another band of spectrum. Band 66 includes DISH Network’s current AWS-4