Dish Network 2015 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-40

of available-for-sale securities that generated the original intra-period allocation is liquidated. During the first

quarter 2015, this specific available-for-sale security portfolio was liquidated and the $63 million credit that was

previously recorded in “Accumulated other comprehensive income (loss)” was released to “Income tax

(provision) benefit, net.”

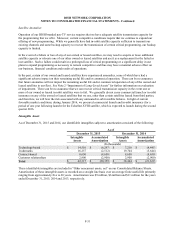

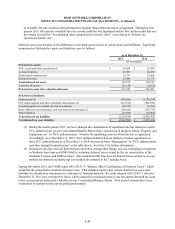

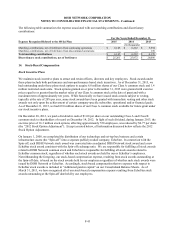

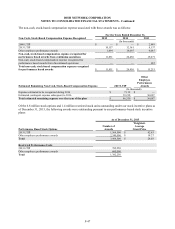

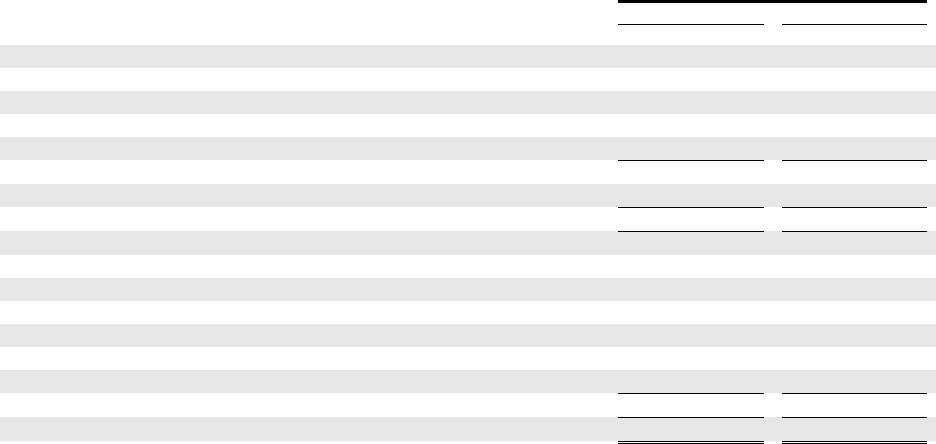

Deferred taxes arise because of the differences in the book and tax bases of certain assets and liabilities. Significant

components of deferred tax assets and liabilities were as follows:

As of December 31,

2015 2014

(In thousands)

Deferred tax assets:

N

OL, credit and other carryforwards $ 69,558 $ 55,280

Accrued expenses 41,081 46,456

Stock-based compensation 15,753 19,994

Deferred revenue 27,980 32,373

Total deferred tax assets 154,372 154,103

Valuation allowance (21,143) (8,652)

Deferred tax asset after valuation allowance 133,229 145,451

Deferred tax liabilities:

Depreciation (1) (994,026) (1,249,529)

FCC authorizations and other intangible amortization (1) (975,725) (581,030)

Unrealized gains on available for sale investments (82,535) (8,296)

Bases difference in partnerships and cost method investments (2) (138,160) (130,736)

Other liabilities (27,572) (32,904)

Total deferred tax liabilities (2,218,018) (2,002,495)

Net deferred tax asset (liability) $ (2,084,789) $ (1,857,044)

(1) During the fourth quarter 2015, we have changed the classification of capitalized interest related to certain

FCC authorizations on our Consolidated Balance Sheets from construction in progress within “Property and

Equipment, net” to “FCC authorizations,” which is the qualifying asset on which interest is capitalized.

Accordingly, as of December 31, 2015, $167 million of deferred taxes related to interest capitalized on

these FCC authorizations as of December 31, 2014 was moved from “Depreciation” to “FCC authorizations

and other intangible amortization” in the table above. See Note 2 for further information.

(2) Included in this line item are deferred taxes related to, among other things, our non-controlling investments

in Northstar Spectrum and SNR HoldCo, including deferred taxes created by the tax amortization of the

Northstar Licenses and SNR Licenses. Also included in this line item are deferred taxes related to our cost

method investments, including our cost method investments in the Tracking Stock.

During November 2015, the FASB issued ASU 2015-17, “Balance Sheet Classification of Deferred Taxes,” which

simplifies the presentation of deferred income taxes. This standard requires that current deferred tax assets and

liabilities be classified as noncurrent in a statement of financial position. We early adopted ASU 2015-17 effective

December 31, 2015 on a retrospective basis, which resulted in a reclassification of our net current deferred tax asset

to the net noncurrent deferred tax liabilities in our Consolidated Balance Sheets. Prior period amounts have been

reclassified to conform to the current period presentation.