Dish Network 2015 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-34

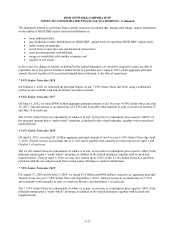

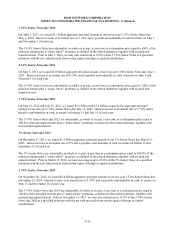

10. Long-Term Debt and Capital Lease Obligations

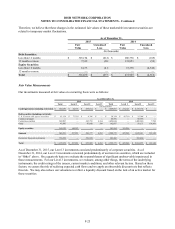

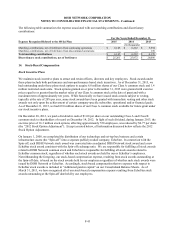

Fair Value of our Long-Term Debt

The following table summarizes the carrying and fair values of our debt facilities as of December 31, 2015 and

2014:

As of December 31,

2015 2014

Carrying

Value Fair Value

Carrying

Value Fair Value

(In thousands)

7 3/4% Senior Notes due 2015 (1) $ — $ — $ 650,001 $ 664,321

7 1/8% Senior Notes due 2016 (2) 1,500,000 1,506,750 1,500,000 1,580,625

4 5/8% Senior Notes due 2017 900,000 922,770 900,000 933,750

4 1/4% Senior Notes due 2018 1,200,000 1,207,560 1,200,000 1,245,600

7 7/8% Senior Notes due 2019 1,400,000 1,525,440 1,400,000 1,589,700

5 1/8% Senior Notes due 2020 1,100,000 1,100,000 1,100,000 1,100,000

6 3/4% Senior Notes due 2021 2,000,000 2,021,020 2,000,000 2,157,500

5 7/8% Senior Notes due 2022 2,000,000 1,889,780 2,000,000 2,055,000

5% Senior Notes due 2023 1,500,000 1,297,500 1,500,000 1,470,000

5 7/8% Senior Notes due 2024 2,000,000 1,765,000 2,000,000 2,019,800

Other notes payable 30,996 30,996 34,084 34,084

Subtotal 13,630,996 $ 13,266,816 14,284,085 $ 14,850,380

Unamortized deferred financing costs and debt

discounts, net (41,563) (51,473)

Capital lease obligations (3) 166,492 194,914

Total long-term debt and capital lease obligations

(including current portion) $ 13,755,925 $ 14,427,526

(1) On June 1, 2015, we redeemed the principal balance of our 7 3/4% Senior Notes due 2015.

(2) On February 1, 2016, we redeemed the principal balance of our 7 1/8% Senior Notes due 2016.

(3) Disclosure regarding fair value of capital leases is not required.

We estimated the fair value of our publicly traded long-term debt using market prices in less active markets

(Level 2).

Our Senior Notes are:

x general unsecured senior obligations of DISH DBS Corporation (“DISH DBS”);

x ranked equally in right of payment with all of DISH DBS’ and the guarantors’ existing and future

unsecured senior debt; and

x ranked effectively junior to our and the guarantors’ current and future secured senior indebtedness up to the

value of the collateral securing such indebtedness.