Dish Network 2015 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-23

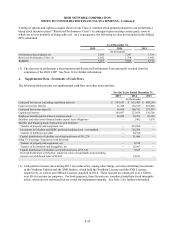

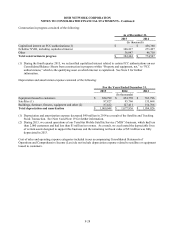

Restricted Cash, Cash Equivalents and Marketable Investment Securities

As of December 31, 2015 and 2014, our restricted marketable investment securities, together with our restricted

cash, included amounts required as collateral for our letters of credit.

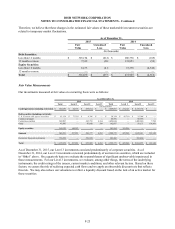

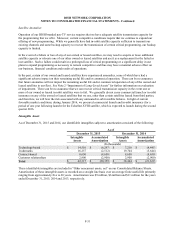

Other Investment Securities

We have strategic investments in certain debt and equity securities that are included in noncurrent “Other investment

securities” on our Consolidated Balance Sheets and accounted for using the cost, equity and/or available-for-sale

methods of accounting.

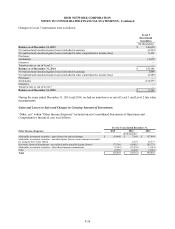

Our ability to realize value from our strategic investments in securities that are not publicly traded depends on the

success of the issuers’ businesses and their ability to obtain sufficient capital, on acceptable terms or at all, and to

execute their business plans. Because private markets are not as liquid as public markets, there is also increased risk

that we will not be able to sell these investments, or that when we desire to sell them we will not be able to obtain

fair value for them.

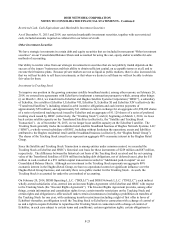

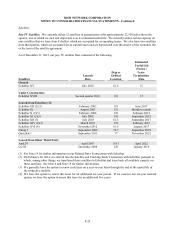

Investment in Tracking Stock

To improve our position in the growing consumer satellite broadband market, among other reasons, on February 20,

2014, we entered into agreements with EchoStar to implement a transaction pursuant to which, among other things:

(i) on March 1, 2014, we transferred to EchoStar and Hughes Satellite Systems Corporation (“HSSC”), a subsidiary

of EchoStar, five satellites (EchoStar I, EchoStar VII, EchoStar X, EchoStar XI and EchoStar XIV (collectively the

“Transferred Satellites”), including related in-orbit incentive obligations and cash interest payments of

approximately $59 million), and approximately $11 million in cash in exchange for an aggregate of 6,290,499 shares

of a series of preferred tracking stock issued by EchoStar and an aggregate of 81.128 shares of a series of preferred

tracking stock issued by HSSC (collectively, the “Tracking Stock”); and (ii) beginning on March 1, 2014, we lease

back certain satellite capacity on the Transferred Satellites (collectively, the “Satellite and Tracking Stock

Transaction”). As of November 30, 2015, we no longer lease satellite capacity on the EchoStar I satellite. The

Tracking Stock generally tracks the residential retail satellite broadband business of Hughes Network Systems, LLC

(“HNS”), a wholly-owned subsidiary of HSSC, including without limitation the operations, assets and liabilities

attributed to the Hughes residential retail satellite broadband business (collectively, the “Hughes Retail Group”).

The shares of the Tracking Stock issued to us represent an aggregate 80% economic interest in the Hughes Retail

Group.

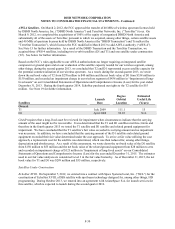

Since the Satellite and Tracking Stock Transaction is among entities under common control, we recorded the

Tracking Stock at EchoStar and HSSC’s historical cost basis for these instruments of $229 million and $87 million,

respectively. The difference between the historical cost basis of the Tracking Stock received and the net carrying

value of the Transferred Satellites of $356 million (including debt obligations, net of deferred taxes), plus the $11

million in cash, resulted in a $51 million capital transaction recorded in “Additional paid-in capital” on our

Consolidated Balance Sheets. Although our investment in the Tracking Stock represents an aggregate 80%

economic interest in the Hughes Retail Group, we have no operational control or significant influence over the

Hughes Retail Group business, and currently there is no public market for the Tracking Stock. As such, the

Tracking Stock is accounted for under the cost method of accounting.

On February 20, 2014, DISH Operating L.L.C. (“DOLLC”) and DISH Network L.L.C. (“DNLLC”), each indirect

wholly-owned subsidiaries of us, entered into an Investor Rights Agreement with EchoStar and HSSC with respect

to the Tracking Stock (the “Investor Rights Agreement”). The Investor Rights Agreement provides, among other

things, certain information and consultation rights for us; certain transfer restrictions on the Tracking Stock and

certain rights and obligations to offer and sell under certain circumstances (including a prohibition on transfers of

the Tracking Stock for one year, with continuing transfer restrictions (including a right of first offer in favor of

EchoStar) thereafter, an obligation to sell the Tracking Stock to EchoStar in connection with a change of control of

us and a right to require EchoStar to repurchase the Tracking Stock in connection with a change of control of

EchoStar, in each case subject to certain terms and conditions); certain registration rights; certain obligations to