Dish Network 2015 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-77

Professional Services Agreement. Prior to 2010, in connection with the Spin-off, we entered into various

agreements with EchoStar including the Transition Services Agreement, Satellite Procurement Agreement and

Services Agreement, which all expired on January 1, 2010 and were replaced by a Professional Services Agreement.

During 2009, we and EchoStar agreed that EchoStar shall continue to have the right, but not the obligation, to

receive the following services from us, among others, certain of which were previously provided under the

Transition Services Agreement: information technology, travel and event coordination, internal audit, legal,

accounting and tax, benefits administration, program acquisition services and other support services. Additionally,

we and EchoStar agreed that we shall continue to have the right, but not the obligation, to engage EchoStar to

manage the process of procuring new satellite capacity for us (previously provided under the Satellite Procurement

Agreement) and receive logistics, procurement and quality assurance services from EchoStar (previously provided

under the Services Agreement) and other support services. The Professional Services Agreement renewed on

January 1, 2016 for an additional one-year period until January 1, 2017 and renews automatically for successive

one-year periods thereafter, unless terminated earlier by either party upon at least 60 days notice. However, either

party may terminate the Professional Services Agreement in part with respect to any particular service it receives for

any reason upon at least 30 days notice. Revenue for services provided by us to EchoStar under the Professional

Services Agreement is recorded in “Equipment sales, services and other revenue - EchoStar” on our Consolidated

Statements of Operations and Comprehensive Income (Loss).

Other Agreements - EchoStar

Receiver Agreement. EchoStar is currently our primary supplier of set-top box receivers. Effective January 1, 2012,

we and EchoStar entered into a receiver agreement (the “2012 Receiver Agreement”) pursuant to which we have the

right, but not the obligation, to purchase digital set-top boxes, related accessories, and other equipment. On

November 4, 2015, we and EchoStar amended the 2012 Receiver Agreement to extend the term thereof for one

additional year until December 31, 2016.

The 2012 Receiver Agreement allows us to purchase digital set-top boxes,

related accessories and other equipment from EchoStar either: (i) at a cost (decreasing as EchoStar reduces costs and

increasing as costs increase) plus a dollar mark-up which will depend upon the cost of the product subject to a collar

on EchoStar’s mark-up; or (ii) at cost plus a fixed margin, which will depend on the nature of the equipment

purchased. Under the 2012 Receiver Agreement, EchoStar’s margins will be increased if they are able to reduce the

costs of their digital set-top boxes and their margins will be reduced if these costs increase. EchoStar provides us

with standard manufacturer warranties for the goods sold under the 2012 Receiver Agreement. Additionally, the

2012 Receiver Agreement includes an indemnification provision, whereby the parties indemnify each other for

certain intellectual property matters. We are able to terminate the 2012 Receiver Agreement for any reason upon at

least 60 days notice to EchoStar. EchoStar is able to terminate the 2012 Receiver Agreement if certain entities

acquire us.

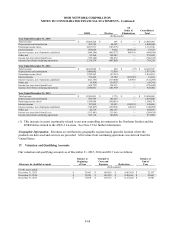

For the years ended December 31, 2015, 2014 and 2013, we purchased set-top boxes and other equipment from

EchoStar of $753 million, $1.114 billion and $1.242 billion, respectively. Included in these amounts are purchases

of certain broadband equipment from EchoStar under the 2012 Receiver Agreement. These amounts are initially

included in “Inventory” and are subsequently capitalized as “Property and equipment, net” on our Consolidated

Balance Sheets or expensed as “Subscriber acquisition costs” or “Subscriber-related expenses” on our Consolidated

Statements of Operations and Comprehensive Income (Loss) when the equipment is deployed.

Tax Sharing Agreement. In connection with the Spin-off, we entered into a tax sharing agreement with EchoStar

which governs our respective rights, responsibilities and obligations after the Spin-off with respect to taxes for the

periods ending on or before the Spin-off. Generally, all pre-Spin-off taxes, including any taxes that are incurred as a

result of restructuring activities undertaken to implement the Spin-off, are borne by us, and we will indemnify

EchoStar for such taxes. However, we are not liable for and will not indemnify EchoStar for any taxes that are

incurred as a result of the Spin-off or certain related transactions failing to qualify as tax-free distributions pursuant

to any provision of Section 355 or Section 361 of the Internal Revenue Code of 1986, as amended (the “Code”)

because of: (i) a direct or indirect acquisition of any of EchoStar’s stock, stock options or assets; (ii) any action that

EchoStar takes or fails to take; or (iii) any action that EchoStar takes that is inconsistent with the information and

representations furnished to the Internal Revenue Service (“IRS”) in connection with the request for the private

letter ruling, or to counsel in connection with any opinion being delivered by counsel with respect to the Spin-off or