Dish Network 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-25

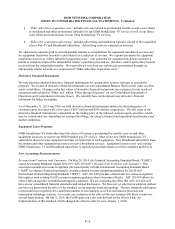

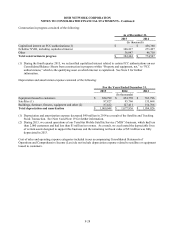

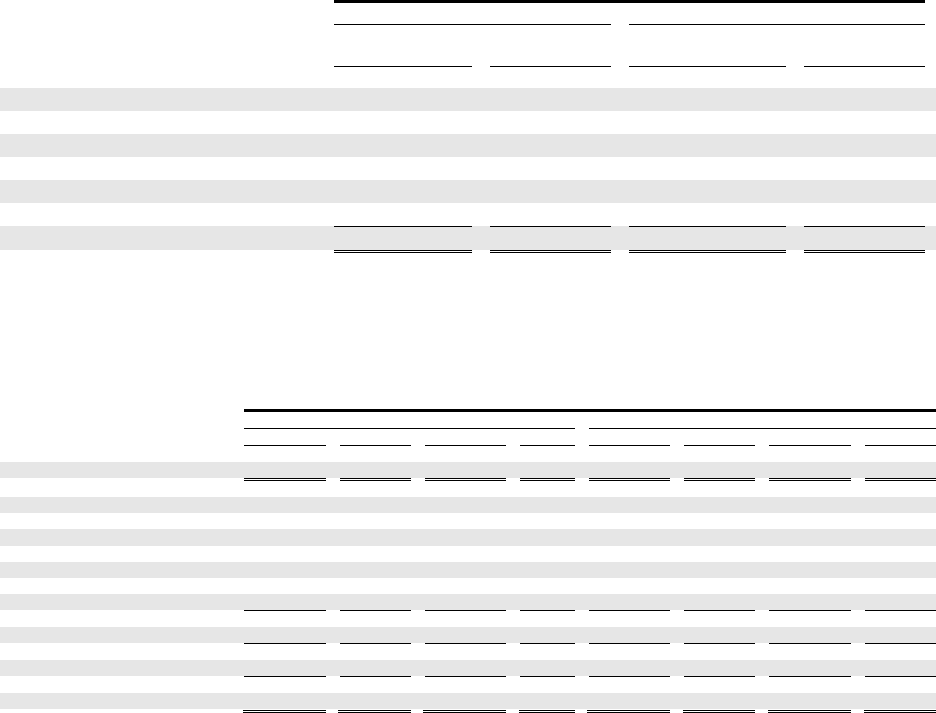

Therefore, we believe that these changes in the estimated fair values of these marketable investment securities are

related to temporary market fluctuations.

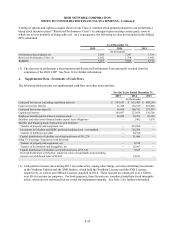

As of December 31,

2015 2014

Fair Unrealized Fair Unrealized

Value Loss Value Loss

(In thousands)

Debt Securities:

Less than 12 months $ 303,194 $ (612) $ 280,738 $ (105)

12 months or more 7,512 (20) 135,853 (59)

Equity Securities:

Less than 12 months 6,133 (41) 15,338 (4,346)

12 months or more — — — —

Total $ 316,839 $ (673) $ 431,929 $ (4,510)

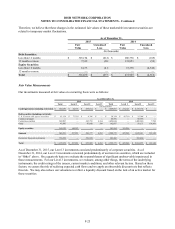

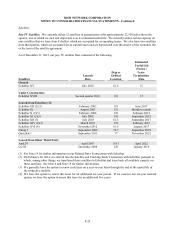

Fair Value Measurements

Our investments measured at fair value on a recurring basis were as follows:

As of December 31,

2015 2014

Total Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3

(In thousands)

Cash Equivalents (including restricted) $ 920,689 $ 82,675 $ 838,014 $ — $ 7,009,897 $ 274,123 $ 6,735,774 $ —

Debt securities (including restricted):

U. S. Treasury and agency securities $ 82,124 $ 77,328 $ 4,796 $ — $ 58,254 $ 42,710 $ 15,544 $ —

Commercial paper — — — — 68,556 — 68,556 —

Corporate securities 349,897 — 343,733 6,164 1,496,044 — 1,488,340 7,704

Other 47,847 — 47,648 199 192,607 — 58,171 134,436

Equity securities 160,323 160,323 — — 393,254 393,254 — —

Subtotal 640,191 237,651 396,177 6,363 2,208,715 435,964 1,630,611 142,140

Derivative financial instruments 556,828 — 556,828 — 383,460 — 383,460 —

Total $ 1,197,019 $ 237,651 $ 953,005 $ 6,363 $ 2,592,175 $ 435,964 $ 2,014,071 $ 142,140

As of December 31, 2015, our Level 3 investments consisted predominately of corporate securities. As of

December 31, 2014, our Level 3 investments consisted predominately of auction rate securities, which are included

in “Other” above. On a quarterly basis we evaluate the reasonableness of significant unobservable inputs used in

those measurements. For our Level 3 investments, we evaluate, among other things, the terms of the underlying

instruments, the credit ratings of the issuers, current market conditions, and other relevant factors. Based on these

factors, we assess the risk of realizing expected cash flows and we apply an observable discount rate that reflects

this risk. We may also reduce our valuations to reflect a liquidity discount based on the lack of an active market for

these securities.