Dish Network 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57

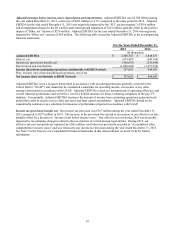

Business Segments

DISH

We offer Pay-TV services under the DISH brand and the Sling brand. We had 13.897 million Pay-TV subscribers in the

United States as of December 31, 2015 and are the nation’s third largest pay-TV provider. Competition has intensified

in recent years as the pay-TV industry has matured. To differentiate our DISH branded pay-TV service from our

competitors, we introduced the Hopper whole-home DVR during 2012 and have continued to add functionality and

simplicity for a more intuitive user experience. Our Hopper and Joey® whole-home DVR promotes a suite of integrated

features and functionality designed to maximize the convenience and ease of watching TV anytime and anywhere. It

also has several innovative features that a consumer can use, at his or her option, to watch and record television

programming, through their televisions, Internet-connected tablets, smartphones and computers. During the first quarter

2016, we made our next generation Hopper, the Hopper 3, available to customers nationwide. Among other things, the

Hopper 3 features 16 tuners, delivers an enhanced 4K Ultra HD experience, and supports up to seven TVs

simultaneously. There can be no assurance that these integrated features and functionality will positively affect our

results of operations or our gross new Pay-TV subscriber activations.

In addition, we bundle broadband and telephone services with our DISH branded pay-TV services. As of December 31,

2015, we had 0.623 million broadband subscribers in the United States. Connecting our subscribers’ receivers to

broadband service enhances the video experience and can be used by consumers to access DISH branded programming

services on mobile devices. We market our wireline and satellite broadband services under the dishNET brand. Our

dishNET satellite broadband service utilizes advanced technology and high-powered satellites launched by Hughes and

ViaSat to provide broadband coverage nationwide. This service primarily targets rural residents that are underserved, or

unserved, by wireline broadband, and provides download speeds of up to 15 Mbps and our dishNET branded wireline

broadband service provides download speeds of up to 40 Mbps. Currently, satellite capacity constraints limit our ability

to expand services in certain geographic areas. However, we expect these satellite capacity constraints to be mitigated

when additional next-generation satellites are successfully launched by Hughes and ViaSat and placed into commercial

operation, which is anticipated to occur in the second half of 2016.

Sling branded pay-TV services. We market our Sling TV services primarily to consumers who do not subscribe to

traditional satellite and cable pay-TV services. Our Sling TV services require an Internet connection and are available

on certain streaming-capable devices including TVs, tablets, computers, game consoles and smart phones. Prior to 2015,

we launched our Sling International video programming service (formerly known as DishWorld), which historically

represented a small percentage of our Pay-TV subscribers. Sling International now offers over 200 channels in 18

languages. In February 2015, we launched our Sling domestic service. The Sling domestic core package consists of

over 20 channels offered for a $20 monthly subscription. In addition to the core programming package, Sling domestic

offers additional tiers of programming, including sports, kids, movies, world news, lifestyle and spanish language and

additional premium content such as HBO, each available for an additional monthly fee. Sling TV programming is

offered live and on-demand and can be replayed as programming rights permit. On June 4, 2015, we also launched our

Sling Latino service. All Sling TV subscribers are included in our Pay-TV subscriber count.

Wireless

DISH Network Spectrum

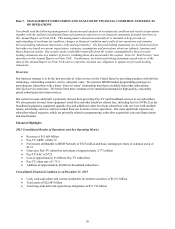

We have invested over $5.0 billion since 2008 to acquire certain wireless spectrum licenses and related assets. We will

need to make significant additional investments or partner with others to, among other things, commercialize, build-out,

and integrate these licenses and related assets, and any additional acquired licenses and related assets; and comply with

regulations applicable to such licenses. Depending on the nature and scope of such commercialization, build-out,

integration efforts, and regulatory compliance, any such investments or partnerships could vary significantly. In

addition, as we consider our options for the commercialization of our wireless spectrum, we may incur significant

additional expenses and may have to make significant investments related to, among other things, research and

development, wireless testing and wireless network infrastructure. We may also determine that additional wireless

spectrum licenses may be required to commercialize our wireless business and to compete with other wireless service