Dish Network 2015 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-43

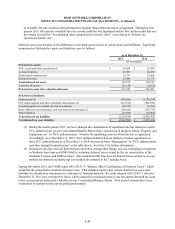

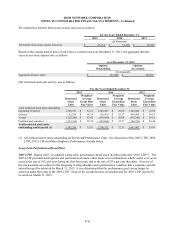

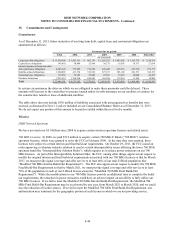

The following table summarizes the expense associated with our matching contributions and discretionary

contributions:

For the Years Ended December 31,

Expense Recognized Related to the 401(k) Plan 2015 2014 2013

(In thousands)

Matching contributions, net of forfeitures from continuing operations $ 6,145 $ 6,222 $ 5,994

Matching contributions, net of forfeitures from discontinued operations — — 176

Total matching contributions $ 6,145 $ 6,222 $ 6,170

Discretionary stock contributions, net of forfeitures $ 25,261 $ 25,972 $ 26,096

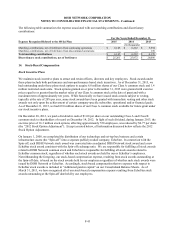

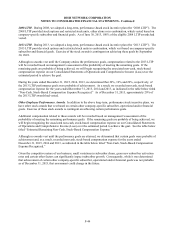

14. Stock-Based Compensation

Stock Incentive Plans

We maintain stock incentive plans to attract and retain officers, directors and key employees. Stock awards under

these plans include both performance and non-performance based stock incentives. As of December 31, 2015, we

had outstanding under these plans stock options to acquire 6.8 million shares of our Class A common stock and 1.4

million restricted stock units. Stock options granted on or prior to December 31, 2015 were granted with exercise

prices equal to or greater than the market value of our Class A common stock at the date of grant and with a

maximum term of approximately ten years. While historically we have issued stock awards subject to vesting,

typically at the rate of 20% per year, some stock awards have been granted with immediate vesting and other stock

awards vest only upon the achievement of certain company-specific subscriber, operational and/or financial goals.

As of December 31, 2015, we had 69.0 million shares of our Class A common stock available for future grant under

our stock incentive plans.

On December 28, 2012, we paid a dividend in cash of $1.00 per share on our outstanding Class A and Class B

common stock to shareholders of record on December 14, 2012. In light of such dividend, during January 2013, the

exercise price of 16.3 million stock options, affecting approximately 550 employees, was reduced by $0.77 per share

(the “2012 Stock Option Adjustment”). Except as noted below, all information discussed below reflects the 2012

Stock Option Adjustment.

On January 1, 2008, we completed the distribution of our technology and set-top box business and certain

infrastructure assets (the “Spin-off”) into a separate publicly-traded company, EchoStar. In connection with the

Spin-off, each DISH Network stock award was converted into an adjusted DISH Network stock award and a new

EchoStar stock award consistent with the Spin-off exchange ratio. We are responsible for fulfilling all stock awards

related to DISH Network common stock and EchoStar is responsible for fulfilling all stock awards related to

EchoStar common stock, regardless of whether such stock awards are held by our or EchoStar’s employees.

Notwithstanding the foregoing, our stock-based compensation expense, resulting from stock awards outstanding at

the Spin-off date, is based on the stock awards held by our employees regardless of whether such stock awards were

issued by DISH Network or EchoStar. Accordingly, stock-based compensation that we expense with respect to

EchoStar stock awards is included in “Additional paid-in capital” on our Consolidated Balance Sheets. As of

March 31, 2013, we have recognized all of our stock-based compensation expense resulting from EchoStar stock

awards outstanding at the Spin-off date held by our employees.