Dish Network 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.69

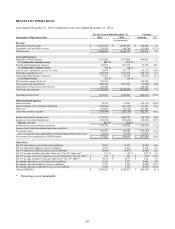

Pay-TV subscribers. DISH lost approximately 79,000 net Pay-TV subscribers during the year ended December 31,

2014, compared to the addition of approximately 1,000 net Pay-TV subscribers during the same period in 2013. The

decrease in net Pay-TV subscriber additions versus the same period in 2013 primarily resulted from lower gross new

Pay-TV subscriber activations and programming interruptions in connection with the scheduled expiration of certain

programming carriage contracts with several content providers.

During the year ended December 31, 2014, DISH activated approximately 2.601 million gross new Pay-TV subscribers

compared to approximately 2.666 million gross new Pay-TV subscribers during the same period in 2013, a decrease of

2.4%. Our gross new Pay-TV subscriber activations during 2014 were negatively impacted by programming

interruptions in connection with the scheduled expiration of certain programming carriage contracts with several content

providers. In addition, our gross new Pay-TV subscriber activations continue to be negatively impacted by increased

competitive pressures, including aggressive marketing, discounted promotional offers, and more aggressive retention

efforts.

Our Pay-TV churn rate for the year ended December 31, 2014 was 1.59% compared to 1.58% for the same period in

2013. Our Pay-TV churn rate continues to be adversely affected by increased competitive pressures, including

aggressive marketing and discounted promotional offers. Our Pay-TV churn rate is also impacted by, among other

things, the credit quality of previously acquired subscribers, our ability to consistently provide outstanding customer

service, price increases, programming interruptions in connection with the scheduled expiration of certain programming

carriage contracts with several content providers, our ability to control piracy and other forms of fraud, and the level of

our retention efforts.

Our gross new Pay-TV subscriber activations, net Pay-TV subscriber additions and Pay-TV churn rate have been

negatively impacted as a result of multiple programming interruptions and threatened programming interruptions in

connection with the scheduled expiration of programming carriage contracts with several content providers, including,

among others, Turner Networks, 21st Century Fox and certain local network affiliates. In particular, we suffered from

lower gross new Pay-TV subscriber activations, lower net Pay-TV subscriber additions and higher Pay-TV churn rate

beginning in the fourth quarter 2014 and continuing in the first quarter 2015, when, among others, certain programming

from 21st Century Fox, including Fox entertainment and news channels, was not available on our service. Although we

believe that the impact of the programming interruptions that occurred beginning in the fourth quarter 2014 and

continued in the first quarter 2015 has now subsided, we cannot predict with any certainty the impact to our gross new

Pay-TV subscriber activations, net Pay-TV subscriber additions and Pay-TV churn rate resulting from similar

programming interruptions that may occur in the future. As a result, we may at times suffer from periods of lower gross

new Pay-TV subscriber activations, lower net Pay-TV subscriber additions and higher Pay-TV churn rates as we did

beginning in the fourth quarter 2014 and continuing in the first quarter 2015.

Broadband subscribers. DISH gained approximately 141,000 net Broadband subscribers during the year ended

December 31, 2014 compared to the addition of approximately 253,000 net Broadband subscribers during the same

period in 2013. This decrease in net Broadband subscriber additions versus the same period in 2013 resulted from lower

gross new Broadband subscriber activations and a higher number of customer disconnects. During the years ended

December 31, 2014 and 2013, DISH activated approximately 295,000 and 343,000 gross new Broadband subscribers,

respectively. Gross new Broadband subscriber activations declined primarily due to stricter credit policies and satellite

capacity constraints in certain geographic areas. Customer disconnects were higher due to a larger Broadband subscriber

base during the year ended December 31, 2014 compared to the same period in 2013.

Subscriber-related revenue. “Subscriber-related revenue” totaled $14.495 billion for the year ended December 31,

2014, an increase of $730 million or 5.3% compared to the same period in 2013. The change in “Subscriber-related

revenue” from the same period in 2013 was primarily related to the increase in Pay-TV ARPU discussed below and

increased revenue from broadband services. Included in “Subscriber-related revenue” was $376 million and $221

million of revenue related to our broadband services for the years ended December 31, 2014 and 2013, respectively,

representing 2.6% and 1.6% of our total “Subscriber-related revenue,” respectively.