CarMax 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

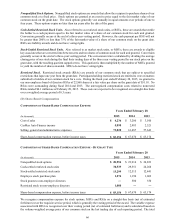

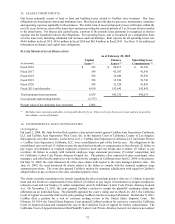

15. LEASE COMMITMENTS

Our leases primarily consist of land or land and building leases related to CarMax store locations. Our lease

obligations are based upon contractual minimum rates. Most leases provide that we pay taxes, maintenance, insurance

and operating expenses applicable to the premises. The initial term of most real property leases will expire within the

next 20 years; however, most of the leases have options providing for renewal periods of 5 to 20 years at terms similar

to the initial terms. For finance and capital leases, a portion of the periodic lease payments is recognized as interest

expense and the remainder reduces the obligations. For operating leases, rent is recognized on a straight-line basis

over the lease term, including scheduled rent increases and rent holidays. Rent expense for all operating leases was

$44.6 million in fiscal 2015, $43.6 million in fiscal 2014 and $42.8 million in fiscal 2013. See Note 11 for additional

information on finance and capital lease obligations.

FUTURE MINIMUM LEASE OBLIGATIONS

As of February 28, 2015

Capital Finance Operating Lease

(In thousands) Lease (1) Leases (1) Commitments

(1)

Fiscal 2016 $ 333 $ 48,217 $ 43,156

Fiscal 2017 354 42,587 41,543

Fiscal 2018 354 36,040 39,510

Fiscal 2019 354 33,526 38,743

Fiscal 2020 354 32,320 36,829

Fiscal 2021 and thereafter 4,810 152,642 242,892

Total minimum lease payments 6,559 345,332 442,673

Less amounts representing interest (3,753)

Present value of net minimum lease payments $ 2,806

(1) Excludes taxes, insurance and other costs payable directly by us. These costs vary from year to year and are incurred in

the ordinary course of business.

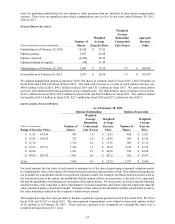

16. COMMITMENTS AND CONTINGENCIES

(A) Litigation

On April 2, 2008, Mr. John Fowler filed a putative class action lawsuit against CarMax Auto Superstores California,

LLC and CarMax Auto Superstores West Coast, Inc. in the Superior Court of California, County of Los Angeles.

Subsequently, two other lawsuits, Leena Areso et al. v. CarMax Auto Superstores California, LLC and Justin Weaver

v. CarMax Auto Superstores California, LLC, were consolidated as part of the Fowler case. The allegations in the

consolidated case involved: (1) failure to provide meal and rest breaks or compensation in lieu thereof; (2) failure to

pay wages of terminated or resigned employees related to meal and rest breaks and overtime; (3) failure to pay

overtime; (4) failure to comply with itemized employee wage statement provisions; (5) unfair competition; and

(6) California’s Labor Code Private Attorney General Act. The putative class consisted of sales consultants, sales

managers, and other hourly employees who worked for the company in California from April 2, 2004, to the present.

On May 12, 2009, the court dismissed all of the class claims with respect to the sales manager putative class. On

June 16, 2009, the court dismissed all claims related to the failure to comply with the itemized employee wage

statement provisions. The court also granted CarMax's motion for summary adjudication with regard to CarMax's

alleged failure to pay overtime to the sales consultant putative class.

The claims currently remaining in the lawsuit regarding the sales consultant putative class are: (1) failure to provide

meal and rest breaks or compensation in lieu thereof; (2) failure to pay wages of terminated or resigned employees

related to meal and rest breaks; (3) unfair competition; and (4) California’s Labor Code Private Attorney General

Act. On November 21, 2011, the court granted CarMax’s motion to compel the plaintiffs’ remaining claims into

arbitration on an individual basis. The plaintiffs appealed the court’s ruling and on March 26, 2013, the California

Court of Appeal reversed the trial court's order granting CarMax's motion to compel arbitration. On October 8, 2013,

CarMax filed a petition for a writ of certiorari seeking review in the United States Supreme Court. On

February 24, 2014, the United States Supreme Court granted CarMax's petition for certiorari, vacated the California

Court of Appeal decision and remanded the case to the California Court of Appeal for further consideration. The

California Court of Appeal determined that Plaintiffs' Labor Code Private Attorney General Act claim is not subject