CarMax 2015 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.8

rate, the term of the loan or the loan-to-value ratio. As part of our previously disclosed loan origination test, CAF

currently provides financing for a small percentage of customers who would typically be financed by a Tier 3 provider.

We do not offer financing to dealers purchasing vehicles at our wholesale auctions. However, we have made

arrangements to have third-party financing available to our auction customers.

Suppliers for Used Vehicles

We acquire a significant percentage of our retail used vehicle inventory directly from consumers through our appraisal

process, as well as through other sources, including local, regional and online auctions. We also, to a lesser extent,

acquire used vehicle inventory from wholesalers, franchised and independent dealers and fleet owners, such as leasing

companies and rental companies. The used vehicle inventory we acquire directly from consumers through our

appraisal process helps provide an inventory of makes and models that reflects consumer preferences in each market.

The supply of late-model used vehicles is influenced by a variety of factors, including the total number of vehicles in

operation; the rate of new vehicle sales, which in turn generate used car trade-ins, and the number of used vehicles

sold or remarketed through retail channels, wholesale transactions and at automotive auctions. According to industry

sources, there were approximately 250 million light vehicles in operation in the U.S. as of December 31, 2014. During

calendar year 2014, more than 16 million new cars and 39 million used cars were sold at retail, many of which were

accompanied by trade-ins, and more than 9 million vehicles were sold at wholesale auctions.

Based on the large number of vehicles remarketed each year, consumer acceptance of our in-store appraisal process,

our experience and success in acquiring vehicles from auctions and other sources, and the large size of the U.S. auction

market relative to our needs, we believe that sources of used vehicles will continue to be sufficient to meet our current

and future needs.

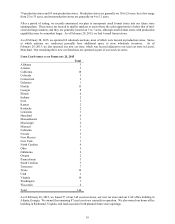

Seasonality

Historically, our business has been seasonal. Our stores typically experience their strongest traffic and sales in the

spring and summer quarters. Sales are typically slowest in the fall quarter. We typically experience an increase in

traffic and sales in February and March, coinciding with tax refund season.

Systems

Our stores are supported by proprietary information systems that improve the customer experience while providing

tightly integrated automation of all operating functions, including our credit processing information system. Our

proprietary store technology provides our management with real-time information about many aspects of store

operations, such as inventory management, pricing, vehicle transfers, wholesale auctions and sales consultant

productivity.

Our proprietary centralized inventory management and pricing system tracks each vehicle throughout the sales process

and allows us to buy the mix of makes, models, age, mileage and price points tailored to customer buying preferences

at each CarMax location. Leveraging our more than twenty years of experience buying and selling millions of used

vehicles, our system generates recommended initial retail price points, as well as retail price markdowns for specific

vehicles based on algorithms that take into account factors that include sales history, consumer interest and seasonal

patterns. We believe this systematic approach to vehicle pricing allows us to optimize inventory turns, which reduces

the depreciation risk inherent in used cars and helps us to achieve our targeted gross profit dollars per unit. Because

of the pricing discipline afforded by our inventory management and pricing system, generally more than 99% of our

entire used car inventory offered at retail is sold at retail.

Marketing and Advertising

Our marketing strategies are focused on developing awareness of the advantages of shopping at our stores and on

carmax.com and on attracting customers who are already considering buying or selling a vehicle. We implement these

strategies through both traditional and digital methods, including social media. Our carmax.com website and related

mobile apps are marketing tools for communicating the CarMax consumer offer in detail, sophisticated search engines

for finding the right vehicle and sales channels for customers who prefer to initiate part of the shopping and sales

process online. The website and mobile apps also include a variety of other customer service features including

initiation of vehicle transfers and scheduling appointments. Information on the thousands of cars available in our

nationwide inventory is updated several times per day. Our survey data indicates that during fiscal 2015,

approximately 89% of customers who purchased a vehicle from us had first visited us online.