CarMax 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

period, which is generally the vesting period of the award. We estimate the fair value of stock options using a binomial

valuation model. Key assumptions used in estimating the fair value of options are dividend yield, expected volatility,

risk-free interest rate and expected term. The fair value of restricted stock is based on the volume-weighted average

market value on the date of the grant. The fair value of stock-settled restricted stock units is determined using a

Monte-Carlo simulation based on the expected market price of our common stock on the vesting date and the expected

number of converted common shares. Cash-settled restricted stock units are liability awards with fair value

measurement based on the market price of CarMax common stock as of the end of each reporting period. Share-based

compensation expense is recorded in either cost of sales, CAF income or SG&A expenses based on the recipients’

respective function.

We record deferred tax assets for awards that result in deductions on our income tax returns, based on the amount of

compensation expense recognized and the statutory tax rate in the jurisdiction in which we will receive a deduction.

Differences between the deferred tax assets recognized for financial reporting purposes and the actual tax deduction

reported on the income tax return are recorded in capital in excess of par value (if the tax deduction exceeds the

deferred tax asset) or in the consolidated statements of earnings (if the deferred tax asset exceeds the tax deduction

and no capital in excess of par value exists from previous awards). See Note 12 for additional information on stock-

based compensation.

(V) Derivative Instruments and Hedging Activities

We enter into derivative instruments to manage exposures that arise from business activities that result in the future

known receipt or payment of uncertain cash amounts, the values of which are impacted by interest rates. We recognize

the derivatives at fair value as either current assets or current liabilities on the consolidated balance sheets, and where

applicable, such contracts covered by master netting agreements are reported net. Gross positive fair values are netted

with gross negative fair values by counterparty. The accounting for changes in the fair value of derivatives depends

on the intended use of the derivative, whether we have elected to designate a derivative in a hedging relationship and

apply hedge accounting and whether the hedging relationship has satisfied the criteria necessary to apply hedge

accounting. We may enter into derivative contracts that are intended to economically hedge certain risks, even though

hedge accounting may not apply or we do not elect to apply hedge accounting. See Note 5 for additional information

on derivative instruments and hedging activities.

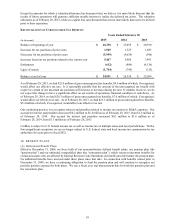

(W) Income Taxes

We file a consolidated federal income tax return for a majority of our subsidiaries. Certain subsidiaries are required

to file separate partnership or corporate federal income tax returns. Deferred income taxes reflect the impact of

temporary differences between the amounts of assets and liabilities recognized for financial reporting purposes and

the amounts recognized for income tax purposes, measured by applying currently enacted tax laws. A deferred tax

asset is recognized if it is more likely than not that a benefit will be realized. Changes in tax laws and tax rates are

reflected in the income tax provision in the period in which the changes are enacted.

We recognize tax liabilities when, despite our belief that our tax return positions are supportable, we believe that

certain positions may not be fully sustained upon review by tax authorities. Benefits from tax positions are measured

at the highest tax benefit that is greater than 50% likely of being realized upon settlement. The current portion of

these tax liabilities is included in accrued income taxes and any noncurrent portion is included in other liabilities. To

the extent that the final tax outcome of these matters is different from the amounts recorded, the differences impact

income tax expense in the period in which the determination is made. Interest and penalties related to income tax

matters are included in SG&A expenses. See Note 9 for additional information on income taxes.

(X) Net Earnings Per Share

Basic net earnings per share is computed by dividing net earnings available for basic common shares by the weighted

average number of shares of common stock outstanding. Diluted net earnings per share is computed by dividing net

earnings available for diluted common shares by the sum of the weighted average number of shares of common stock

outstanding and dilutive potential common stock. Diluted net earnings per share is calculated using the “if-converted”

treasury stock method. See Note 13 for additional information on net earnings per share.

(Y) Recent Accounting Pronouncements

In February 2013, the Financial Accounting Standards Board (“FASB”) issued an accounting pronouncement related

to liabilities (FASB ASU 2013-04), which amends the guidance in former FASB ASC Topic 405. The amendments

provide guidance on the recognition, measurement and disclosure of obligations resulting from joint and several

liability arrangements, including debt arrangements, other contractual obligations, and settled litigation and judicial

rulings. We adopted this pronouncement for our fiscal year beginning March 1, 2014, and there was no effect on our

consolidated financial statements.