CarMax 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

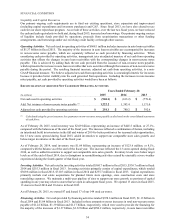

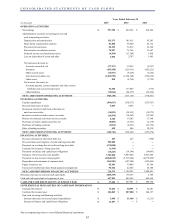

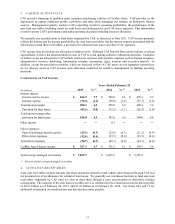

CONSOLIDATED STATEMENTS OF CASH FLOWS

See accompanying notes to consolidated financial statements.

43

\

Years Ended February 28

(In thousands) 2015 2014 2013

OPERATING ACTIVITIES:

Net earnings $ 597,358 $ 492,586 $ 434,284

Adjustments to reconcile net earnings to net cash

used in operating activities:

Depreciation and amortization 115,173

101,911 95,283

Share-based compensation expense 81,880

66,480 62,112

Provision for loan losses 82,343

72,212 56,168

Provision for cancellation reserves 70,987

76,746 31,667

Deferred income tax (benefit) provision (4,299) (17,185) 3,858

Loss on disposition of assets and other 3,852

2,707 1,945

Net (increase) decrease in:

Accounts receivable, net (57,767) 12,038 (5,527)

Inventory (445,450) (123,611) (425,221)

Other current assets (16,947) (3,019) (3,252)

Auto loan receivables, net (1,369,999) (1,324,142) (992,239)

Other assets 825

(6,754) (1,722)

Net increase (decrease) in:

Accounts payable, accrued expenses and other current

liabilities and accrued income taxes 51,960

117,405 (575)

Other liabilities (78,046) (80,537) (35,222)

NET CASH USED IN OPERATING ACTIVITIES (968,130) (613,163) (778,441)

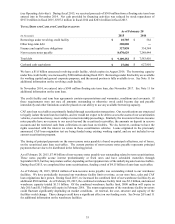

INVESTING ACTIVITIES:

Capital expenditures (309,817) (310,317) (235,707)

Proceeds from sales of assets 5,869

5,095 ―

Increase in restricted cash from collections on

auto loan receivables (34,823) (35,012) (19,973)

Increase in restricted cash in reserve accounts (16,556) (10,403) (13,385)

Release of restricted cash from reserve accounts 6,346

19,202 17,368

Purchases of money market securities, net (8,604) (3,661) (2,139)

Purchases of trading securities (3,814) (2,051) (31,756)

Sales of trading securities 655

466 30,318

NET CASH USED IN INVESTING ACTIVITIES (360,744) (336,681) (255,274)

FINANCING ACTIVITIES:

Increase (decrease) in short-term debt, net 203

227 (588)

Proceeds from revolving line of credit and long-term debt 985,000

― ―

Payments on revolving line of credit and long-term debt (675,000) ― ―

Cash paid for issuance of long-term debt (1,190) ― ―

Payments on finance and capital lease obligations (18,243) (19,596) (14,083)

Issuances of non-recourse notes payable 7,783,000

6,907,000 5,851,000

Payments on non-recourse notes payable (6,560,815) (5,513,646) (4,679,999)

Repurchase and retirement of common stock (916,981) (307,248) (203,405)

Equity issuances, net 82,463

39,000 63,396

Excess tax benefits from share-based payment arrangements 50,142

22,644 24,100

NET CASH PROVIDED BY FINANCING ACTIVITIES 728,579 1,128,381

1,040,421

(Decrease) increase in cash and cash equivalents (600,295) 178,537

6,706

Cash and cash equivalents at beginning of year 627,901

449,364 442,658

CASH AND CASH EQUIVALENTS AT END OF YEAR $ 27,606 $ 627,901 $ 449,364

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION

Cash paid for interest $ 33,043 $ 30,991 $ 32,601

Cash paid for income taxes $ 346,865 $ 287,000 $ 244,337

Non-cash investing and financing activities:

Increase (decrease) in accrued capital expenditures $ 3,698 $ 11,468 $ (1,211)

Increase in finance and capital lease obligations $ 11,697 $ ― $ ―