CarMax 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55

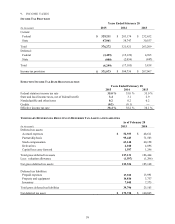

6. FAIR VALUE MEASUREMENTS

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants in the principal market or, if none exists, the most advantageous market, for

the specific asset or liability at the measurement date (referred to as the “exit price”). The fair value should be based

on assumptions that market participants would use, including a consideration of nonperformance risk.

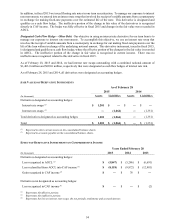

We assess the inputs used to measure fair value using the three-tier hierarchy. The hierarchy indicates the extent to

which inputs used in measuring fair value are observable in the market.

Level 1 Inputs include unadjusted quoted prices in active markets for identical assets or liabilities that

we can access at the measurement date.

Level 2 Inputs other than quoted prices included within Level 1 that are observable for the asset or

liability, either directly or indirectly, including quoted prices for similar assets in active markets,

quoted prices from identical or similar assets in inactive markets and observable inputs such as

interest rates and yield curves.

Level 3 Inputs that are significant to the measurement that are not observable in the market and include

management's judgments about the assumptions market participants would use in pricing the

asset or liability (including assumptions about risk).

Our fair value processes include controls that are designed to ensure that fair values are appropriate. Such controls

include model validation, review of key model inputs, analysis of period-over-period fluctuations and reviews by

senior management.

Valuation Methodologies

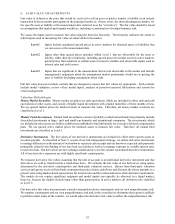

Money Market Securities. Money market securities are cash equivalents, which are included in either cash and cash

equivalents or other assets, and consist of highly liquid investments with original maturities of three months or less.

We use quoted market prices for identical assets to measure fair value. Therefore, all money market securities are

classified as Level 1.

Mutual Fund Investments. Mutual fund investments consist of publicly traded mutual funds that primarily include

diversified investments in large-, mid- and small-cap domestic and international companies. The investments, which

are included in other assets, are held in a rabbi trust established to fund informally our executive deferred compensation

plan. We use quoted active market prices for identical assets to measure fair value. Therefore, all mutual fund

investments are classified as Level 1.

Derivative Instruments. The fair values of our derivative instruments are included in either other current assets or

accounts payable. As described in Note 5, as part of our risk management strategy, we utilize derivative instruments

to manage differences in the amount of our known or expected cash receipts and our known or expected cash payments

principally related to the funding of our auto loan receivables as well as to manage exposure to variable interest rates

on our term loan. Our derivatives are not exchange-traded and are over-the-counter customized derivative instruments.

All of our derivative exposures are with highly rated bank counterparties.

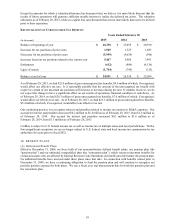

We measure derivative fair values assuming that the unit of account is an individual derivative instrument and that

derivatives are sold or transferred on a stand-alone basis. We estimate the fair value of our derivatives using quotes

determined by the derivative counterparties and third-party valuation services. Quotes from third-party valuation

services and quotes received from bank counterparties project future cash flows and discount the future amounts to a

present value using market-based expectations for interest rates and the contractual terms of the derivative instruments.

The models do not require significant judgment and model inputs can typically be observed in a liquid market;

however, because the models include inputs other than quoted prices in active markets, all derivatives are classified

as Level 2.

Our derivative fair value measurements consider assumptions about counterparty and our own nonperformance risk.

We monitor counterparty and our own nonperformance risk and, in the event that we determine that a party is unlikely

to perform under terms of the contract, we would adjust the derivative fair value to reflect the nonperformance risk.