CarMax 2015 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.24

CRITICAL ACCOUNTING POLICIES

Our results of operations and financial condition as reflected in the consolidated financial statements have been

prepared in accordance with U.S. generally accepted accounting principles. Preparation of financial statements

requires management to make estimates and assumptions affecting the reported amounts of assets, liabilities, revenues,

expenses and the disclosures of contingent assets and liabilities. We use our historical experience and other relevant

factors when developing our estimates and assumptions. We regularly evaluate these estimates and assumptions.

Note 2 includes a discussion of significant accounting policies. The accounting policies discussed below are the ones

we consider critical to an understanding of our consolidated financial statements because their application places the

most significant demands on our judgment. Our financial results might have been different if different assumptions

had been used or other conditions had prevailed.

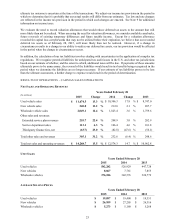

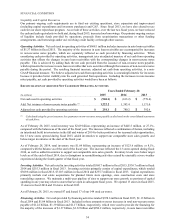

Financing and Securitization Transactions

We maintain a revolving securitization program composed of two warehouse facilities (“warehouse facilities”) that

we use to fund auto loan receivables originated by CAF until we elect to fund them through a term securitization or

alternative funding arrangement. We recognize transfers of auto loan receivables into the warehouse facilities and

term securitizations as secured borrowings, which result in recording the auto loan receivables and the related non-

recourse notes payable on our consolidated balance sheets. CAF income included in the consolidated statements of

earnings primarily reflects the interest and fee income generated by the auto loan receivables less the interest expense

associated with the debt issued to fund these receivables, a provision for estimated loan losses and direct CAF

expenses.

Auto loan receivables include amounts due from customers related to retail vehicle sales financed through CAF. The

receivables are presented net of an allowance for estimated loan losses. The allowance for loan losses represents an

estimate of the amount of net losses inherent in our portfolio of managed receivables as of the applicable reporting

date and anticipated to occur during the following 12 months. The allowance is primarily based on the credit quality

of the underlying receivables, historical loss trends and forecasted forward loss curves. We also take into account

recent trends in delinquencies and losses, recovery rates and the economic environment. The provision for loan losses

is the periodic expense of maintaining an adequate allowance.

See Notes 2(F), 2(I) and 4 for additional information on securitizations and auto loan receivables.

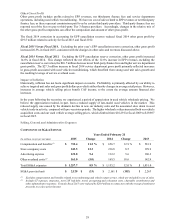

Revenue Recognition

We recognize revenue when the earnings process is complete, generally either at the time of sale to a customer or

upon delivery to a customer. As part of our customer service strategy, we guarantee the retail vehicles we sell with a 5-day,

money-back guarantee. We record a reserve for estimated returns based on historical experience and trends, and results

could be affected if future vehicle returns differ from historical averages.

We also sell ESPs and GAP on behalf of unrelated third parties, who are the primary obligors, to customers who

purchase a vehicle. The ESPs we currently offer on all used vehicles provide coverage up to 60 months (subject to mileage

limitations), while GAP covers the customer for the term of their finance contract. We recognize commission revenue at

the time of sale, net of a reserve for estimated contract cancellations. Periodically, we may receive additional commissions

based upon the level of underwriting profits of the third parties who administer the products. These additional commissions

are recognized as revenue when received. The reserve for cancellations is evaluated for each product, and is based on

forecasted forward cancellation curves utilizing historical experience, recent trends and credit mix of the customer base.

Our risk related to contract cancellations is limited to the commissions that we receive. Cancellations fluctuate

depending on the volume of ESP and GAP sales, customer financing default or prepayment rates, and shifts in

customer behavior related to changes in the coverage or term of the product. Results could be affected if actual events

differ from our estimates. A 10% change in the estimated cancellation rates would have changed cancellation reserves

by approximately $9.4 million as of February 28, 2015. See Note 8 for additional information on cancellation reserves.

Customers applying for financing who are not approved by CAF may be evaluated by other third-party finance

providers. These providers generally either pay us or are paid a fixed, pre-negotiated fee per contract. We recognize

these fees at the time of sale.

We collect sales taxes and other taxes from customers on behalf of governmental authorities at the time of sale. These

taxes are accounted for on a net basis and are not included in net sales and operating revenues or cost of sales.

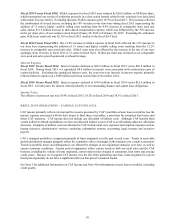

Income Taxes

Estimates and judgments are used in the calculation of certain tax liabilities and in the determination of the

recoverability of certain deferred tax assets. In the ordinary course of business, transactions occur for which the