CarMax 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

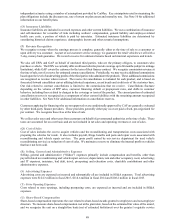

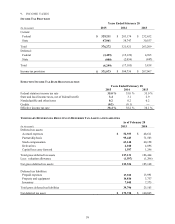

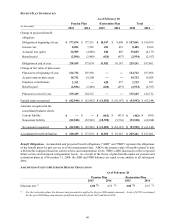

9. INCOME TAXES

INCOME TAX PROVISION

Years Ended February 28

(In thousands) 2015 2014 2013

Current:

Federal $ 329,211 $ 283,174 $ 232,652

State 47,061 38,747 30,557

Total 376,272 321,921 263,209

Deferred:

Federal (3,499) (15,129) 4,705

State (800) (2,056) (847)

Total (4,299) (17,185) 3,858

Income tax provision $ 371,973 $ 304,736 $ 267,067

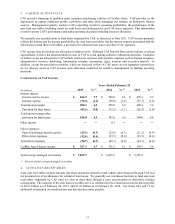

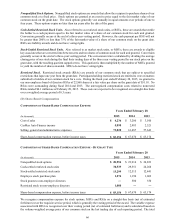

EFFECTIVE INCOME TAX RATE RECONCILIATION

Years Ended February 28

2015 2014 2013

Federal statutory income tax rate 35.0 % 35.0 % 35.0 %

State and local income taxes, net of federal benefit 3.4 3.1 2.9

N

ondeductible and other items 0.2 0.2 0.2

Credits

(0.2) (0.1) ―

Effective income tax rate 38.4 % 38.2 % 38.1 %

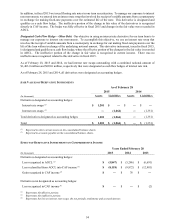

TEMPORARY DIFFERENCES RESULTING IN DEFERRED TAX ASSETS AND LIABILITIES

As of February 28

(In thousands)

2015 2014

Deferred tax assets:

Accrued expenses

$ 52,933 $ 48,611

Partnership basis

95,443 71,503

Stock compensation

63,148 60,158

Derivatives

4,010 4,896

Capital loss carry forward

1,597 1,296

Total gross deferred tax assets 217,131

186,464

Less: valuation allowance (1,597) (1,296)

N

et gross deferred tax assets 215,534

185,168

Deferred tax liabilities:

Prepaid expenses 17,935

13,991

Property and equipment

14,816 3,737

Inventory

7,045 7,375

Total gross deferred tax liabilities 39,796

25,103

N

et deferred tax asset $ 175,738 $ 160,065