CarMax 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

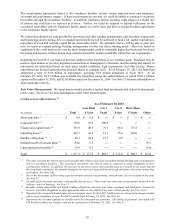

We typically use term securitizations to provide long-term funding for most of the auto loan receivables initially

securitized through the warehouse facilities. In these transactions, a pool of auto loan receivables is sold to a

bankruptcy-remote, special purpose entity that, in turn, transfers the receivables to a special purpose securitization

trust. The securitization trust issues asset-backed securities, secured or otherwise supported by the transferred

receivables, and the proceeds from the sale of the asset-backed securities are used to finance the securitized

receivables.

We are required to evaluate term securitization trusts for consolidation. In our capacity as servicer, we have the power

to direct the activities of the trusts that most significantly impact the economic performance of the trusts. In addition,

we have the obligation to absorb losses (subject to limitations) and the rights to receive any returns of the trusts, which

could be significant. Accordingly, we are the primary beneficiary of the trusts and are required to consolidate them.

We recognize transfers of auto loan receivables into the warehouse facilities and term securitizations (“securitization

vehicles”) as secured borrowings, which result in recording the auto loan receivables and the related non-recourse

notes payable on our consolidated balance sheets.

The securitized receivables can only be used as collateral to settle obligations of the securitization vehicles. The

securitization vehicles and investors have no recourse to our assets beyond the securitized receivables, the amounts

on deposit in reserve accounts and the restricted cash from collections on auto loan receivables. We have not provided

financial or other support to the securitization vehicles that was not previously contractually required, and there are

no additional arrangements, guarantees or other commitments that could require us to provide financial support to the

securitization vehicles.

See Notes 4 and 11 for additional information on auto loan receivables and non-recourse notes payable.

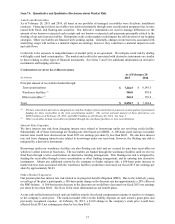

(G) Fair Value of Financial Instruments

Due to the short-term nature and/or variable rates associated with these financial instruments, the carrying value of

our cash and cash equivalents, restricted cash, accounts receivable, money market securities, accounts payable, short-

term debt and long-term debt approximates fair value. Our derivative instruments and mutual funds are recorded at

fair value. Auto loan receivables are presented net of an allowance for estimated loan losses. See Note 6 for additional

information on fair value measurements.

(H) Inventory

Inventory is primarily comprised of vehicles held for sale or currently undergoing reconditioning and is stated at the

lower of cost or market. Vehicle inventory cost is determined by specific identification. Parts and labor used to

recondition vehicles, as well as transportation and other incremental expenses associated with acquiring and

reconditioning vehicles, are included in inventory.

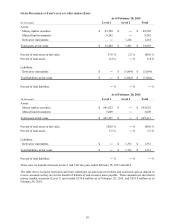

(I) Auto Loan Receivables, Net

Auto loan receivables include amounts due from customers related to retail vehicle sales financed through CAF. The

receivables are presented net of an allowance for estimated loan losses. The allowance for loan losses represents an

estimate of the amount of net losses inherent in our portfolio of managed receivables as of the applicable reporting

date and anticipated to occur during the following 12 months. The allowance is primarily based on the credit quality

of the underlying receivables, historical loss trends and forecasted forward loss curves. We also take into account

recent trends in delinquencies and losses, recovery rates and the economic environment. The provision for loan losses

is the periodic expense of maintaining an adequate allowance.

An account is considered delinquent when the related customer fails to make a substantial portion of a scheduled

payment on or before the due date. In general, accounts are charged-off on the last business day of the month during

which the earliest of the following occurs: the receivable is 120 days or more delinquent as of the last business day

of the month, the related vehicle is repossessed and liquidated, or the receivable is otherwise deemed uncollectible.

For purposes of determining impairment, auto loans are evaluated collectively, as they represent a large group of

smaller-balance homogeneous loans, and therefore, are not individually evaluated for impairment. See Note 4 for

additional information on auto loan receivables.

Interest income and expenses related to auto loans are included in CAF income. Interest income on auto loan

receivables is recognized when earned based on contractual loan terms. All loans continue to accrue interest until

repayment or charge-off. Direct costs associated with loan originations are not considered material, and thus, are

expensed as incurred. See Note 3 for additional information on CAF income.