CarMax 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

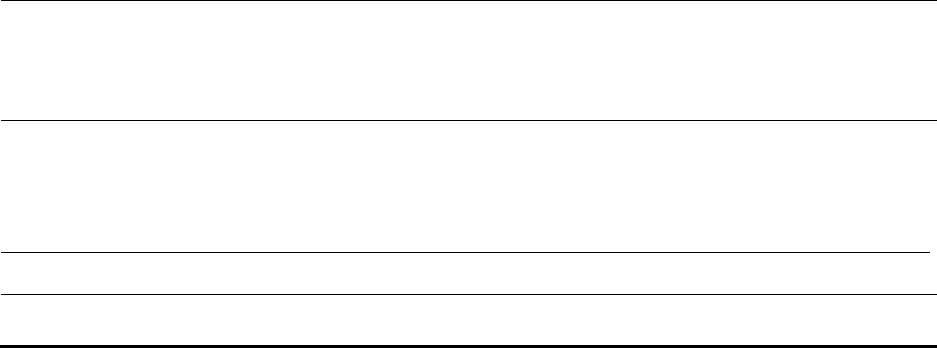

64

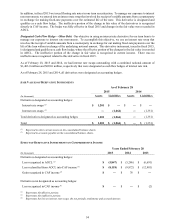

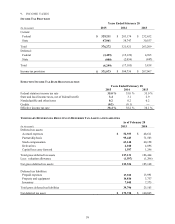

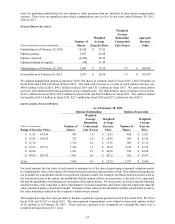

11. DEBT

As of February 28

(In thousands) 2015 2014

Short-term revolving credit facility $ 785 $ 582

Current portion of long-term debt 10,000 ―

Current portion of finance and capital lease obligations 21,554 18,459

Current portion of non-recourse notes payable 258,163 223,938

Total current debt 290,502 242,979

Long-term debt 300,000 ―

Finance and capital lease obligations, excluding current portion 306,284

315,925

N

on-recourse notes payable, excluding current portion 8,212,466 7,024,506

Total debt, excluding current portion 8,818,750 7,340,431

Total debt $ 9,109,252 $ 7,583,410

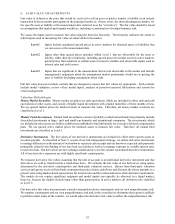

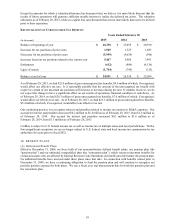

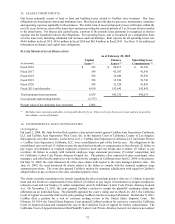

Revolving Credit Facility. During fiscal 2015, we increased the borrowing capacity under our unsecured revolving

credit facility (the “credit facility”) by $300 million to $1.0 billion. The terms of the credit facility were generally

unchanged and the expiration date remains August 2016. Borrowings under the credit facility are available for

working capital and general corporate purposes. Borrowings accrue interest at variable rates based on LIBOR, the

federal funds rate, or the prime rate, depending on the type of borrowing, and we pay a commitment fee on the unused

portions of the available funds. Borrowings under the credit facility are either due ‘on demand’ or at maturity

depending on the type of borrowing. Borrowings with ‘on demand’ repayment terms are presented as short-term debt

while amounts due at maturity are presented as long-term debt with expected repayments within the next fiscal year

presented as a component of current portion of long-term debt. As of February 28, 2015, the unused capacity of

$989 million was fully available to us.

The weighted average interest rate on outstanding short-term and long-term debt was 1.6% in fiscal 2015 and 1.5% in

fiscal 2014 and 1.8% in fiscal 2013.

Term Loan. In November 2014, we entered into a $300 million term loan with total outstanding principal due in

November 2017. The term loan accrues interest at variable rates (1.67% as of February 28, 2015) based on the LIBOR

rate, the federal funds rate, or the prime rate. As of February 28, 2015, $300 million remained outstanding and no

repayments are anticipated to be made within the next 12 months. Borrowings under the loan are available for working

capital and general corporate purposes. In December 2014, we entered into an interest rate derivative contract to

manage our exposure to variable interest rates associated with this term loan.

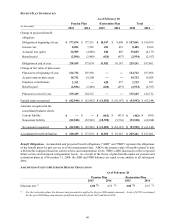

Finance and Capital Lease Obligations. Finance and capital lease obligations relate primarily to stores subject to

sale-leaseback transactions that did not qualify for sale accounting, and therefore, are accounted for as financings.

The leases were structured at varying interest rates and generally have initial lease terms ranging from 15 to 20 years

with payments made monthly. Payments on the leases are recognized as interest expense and a reduction of the

obligations. We have not entered into any sale-leaseback transactions since fiscal 2009. During fiscal 2015, finance

lease obligations were increased by $11.7 million related to leases that were modified or extended beyond the original

lease term. See Note 15 for information on future minimum lease obligations.

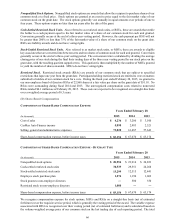

Non-Recourse Notes Payable. The non-recourse notes payable relate to auto loan receivables funded through term

securitizations and our warehouse facilities. The timing of principal payments on the non-recourse notes payable is

based on the timing of principal collections and defaults on the securitized auto loan receivables. The current portion

of non-recourse notes payable represents principal payments that are due to be distributed in the following period.

As of February 28, 2015, $7.48 billion of non-recourse notes payable was outstanding related to term securitizations.

These notes payable accrue interest predominantly at fixed rates and have scheduled maturities through

September 2021, but may mature earlier, depending upon the repayment rate of the underlying auto loan receivables.