CarMax 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

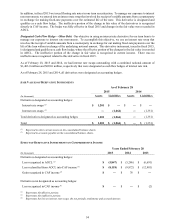

In addition, in fiscal 2015 we issued floating rate notes in one term securitization. To manage our exposure to interest

rate movements, we entered into an interest rate swap that involved the receipt of variable amounts from a counterparty

in exchange for making fixed-rate payments over the estimated life of the note. This derivative is designated and

qualifies as a cash flow hedge. The ineffective portion of the change in fair value of the derivatives is recognized

directly in CAF income. The hedge was fully effective in fiscal 2015 and changes in the fair value were recorded in

AOCL.

Designated Cash Flow Hedge – Other Debt. Our objective in using an interest rate derivative for our term loan is to

manage our exposure to interest rate movements. To accomplish this objective, we use an interest rate swap that

involves the receipt of variable amounts from a counterparty in exchange for our making fixed-rate payments over the

life of the loan without exchange of the underlying notional amount. This derivative instrument, issued in fiscal 2015,

is designated and qualifies as a cash flow hedge, where the effective portion of the changes in the fair value is recorded

in AOCL. The ineffective portion of the change in fair value is recognized in current income. There was no

ineffectiveness recognized related to this derivative in fiscal 2015.

As of February 28, 2015 and 2014, we had interest rate swaps outstanding with a combined notional amount of

$1,403.0 million and $869.0 million, respectively that were designated as cash flow hedges of interest rate risk.

As of February 28, 2015 and 2014, all derivatives were designated as accounting hedges.

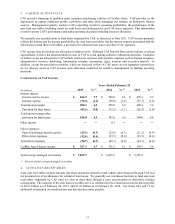

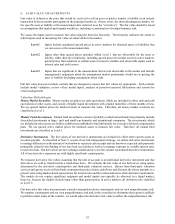

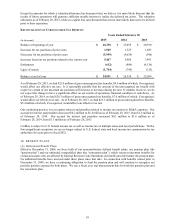

FAIR VALUES OF DERIVATIVE INSTRUMENTS

As of February 28

2015 2014

(In thousands) Assets Liabilities Assets Liabilities

Derivatives designated as accounting hedges:

Interest rate swaps (1)

$ 1,201 $ ― $ ― $ ―

Interest rate swaps (2)

― (1,064) ― (1,351)

Total derivatives designated as accounting hedges 1,201 (1,064) ― (1,351)

Total

$ 1,201 $ (1,064) $ ― $ (1,351)

(1) Reported in other current assets on the consolidated balance sheets.

(2) Reported in accounts payable on the consolidated balance sheets.

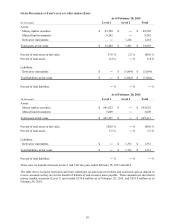

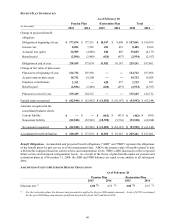

EFFECT OF DERIVATIVE INSTRUMENTS ON COMPREHENSIVE INCOME

Years Ended February 28

(In thousands) 2015 2014 2013

Derivatives designated as accounting hedges:

Loss recognized in AOCL (1)

$ (5,847)

$ (5,286) $ (6,691)

Loss reclassified from AOCL into CAF income (1) $ (8,118)

$ (9,872) $ (12,981)

Gain recognized in CAF income (2)

$ ― $ 76 $ ―

Derivatives not designated as accounting hedges:

Loss recognized in CAF income (3)

$ ― $ ― $ (2)

(1) Represents the effective portion.

(2) Represents the ineffective portion.

(3) Represents the loss on interest rate swaps, the net periodic settlements and accrued interest.