CarMax 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

FINANCIAL CONDITION

Liquidity and Capital Resources

Our primary ongoing cash requirements are to fund our existing operations, store expansion and improvement

(including capital expenditures and inventory purchases) and CAF. Since fiscal 2013, we have also elected to use

cash for our share repurchase program. As a result of these activities, over the last two fiscal years, we have reduced

the cash and cash equivalents we hold and, during fiscal 2015, increased our borrowings. Our primary ongoing sources

of liquidity include funds provided by operations, proceeds from securitization transactions or other funding

arrangements, and borrowings under our revolving credit facility or through other sources.

Operating Activities. Net cash used in operating activities of $968.1 million includes increases in auto loan receivables

of $1.37 billion in fiscal 2015. The majority of the increases in auto loan receivables are accompanied by increases

in non-recourse notes payable, which are separately reflected as cash provided by financing activities. When

considering cash provided by operating activities, management uses an adjusted measure of net cash from operating

activities that offsets the changes in auto loan receivables with the corresponding changes in non-recourse notes

payable. This is achieved by adding back the net cash provided from the issuance of non-recourse notes payable,

which represents the increase in auto loan receivables that were securitized through the issuance of non-recourse notes

payable during the period. The resulting financial measure, adjusted net cash from operating activities, is a non-

GAAP financial measure. We believe adjusted net cash from operating activities is a meaningful metric for investors

because it provides better visibility into the cash generated from operations. Including the increases in non-recourse

notes payable, net cash provided by operating activities would have been as follows:

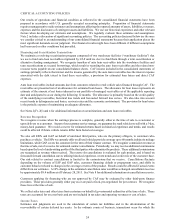

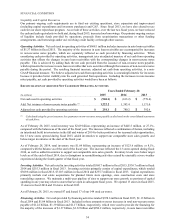

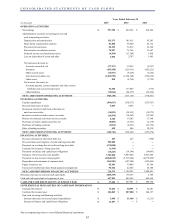

RECONCILIATION OF ADJUSTED NET CASH FROM OPERATING ACTIVITIES

Years Ended February 28

(In millions) 2015 2014 2013

N

et cash used in operating activities $ (968.1)

$ (613.2) $ (778.4)

Add: Net issuance of non-recourse notes payable (1) 1,222.2 1,393.4 1,171.0

Adjusted net cash provided by operating activities $ 254.1 $ 780.2 $ 392.6

(1) Calculated using the gross issuances less payments on non-recourse notes payable as disclosed on the consolidated statements

of cash flows.

As of February 28, 2015, total inventory was $2.09 billion, representing an increase of $445.5 million, or 27.1%,

compared with the balance as of the start of the fiscal year. The increase reflected a combination of factors, including

an intentional build in inventories in the fall and winter of 2014 to better position us for seasonal sales opportunities,

the 13 new stores opened during fiscal 2015, added inventories to support our comparable store sales growth, and

below-target inventories at the start of the fiscal year.

As of February 28, 2014, total inventory was $1.64 billion, representing an increase of $123.6 million, or 8.1%,

compared with the balance as of the start of the fiscal year. The increase reflected the 13 stores opened during fiscal

2014, as well as added inventories to support our comparable store sales growth. Inventory levels were below target

levels as of the end of fiscal 2014, due to disruptions in reconditioning activities caused by unusually severe weather

experienced during the fourth quarter of that fiscal year.

Investing Activities. Net cash used in investing activities totaled $360.7 million in fiscal 2015, $336.7 million in fiscal

2014 and $255.3 million in fiscal 2013. Investing activities primarily consist of capital expenditures, which totaled

$309.8 million in fiscal 2015, $310.3 million in fiscal 2014 and $235.7 million in fiscal 2013. Capital expenditures

primarily include real estate acquisitions for planned future store openings, store construction costs and store

remodeling expenses. We maintain a multi-year pipeline of sites to support our store growth, so portions of capital

spending in one year may relate to stores that we open in subsequent fiscal years. We opened 13 stores in fiscal 2015,

13 stores in fiscal 2014 and 10 stores in fiscal 2013.

As of February 28, 2015, we owned 87 and leased 57 of our 144 used car stores.

Financing Activities. Net cash provided by financing activities totaled $728.6 million in fiscal 2015, $1.13 billion in

fiscal 2014 and $1.04 billion in fiscal 2013. Included in these amounts were net increases in total non-recourse notes

payable of $1.22 billion, $1.39 billion and $1.17 billion, respectively, which were used to provide the financing for

the majority of the increases of $1.37 billion, $1.32 billion and $992.2 million, respectively, in auto loan receivables