CarMax 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

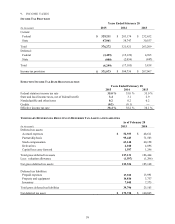

Except for amounts for which a valuation allowance has been provided, we believe it is more likely than not that the

results of future operations will generate sufficient taxable income to realize the deferred tax assets. The valuation

allowance as of February 28, 2015, relates to capital loss carryforwards that are not more likely than not to be utilized

prior to their expiration.

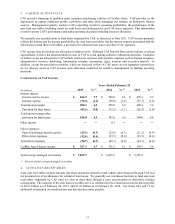

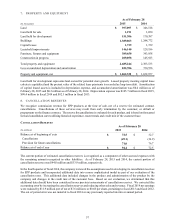

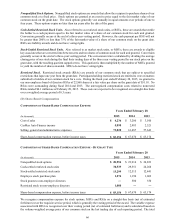

RECONCILIATION OF UNRECOGNIZED TAX BENEFITS

Years Ended February 28

(In thousands) 2015 2014 2013

Balance at beginning of year $ 26,330 $ 25,059 $ 20,930

Increases for tax positions of prior years 1,549 1,523 1,685

Decreases for tax positions of prior years (5,999) (4,658) (596)

Increases based on tax positions related to the current year 5,467 5,960 7,491

Settlements (612) (809) (4,136)

Lapse of statute (1,784) (745) (315)

Balance at end of year $ 24,951 $ 26,330 $ 25,059

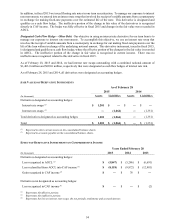

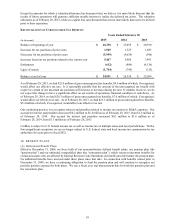

As of February 28, 2015, we had $25.0 million of gross unrecognized tax benefits, $9.6 million of which, if recognized,

would affect our effective tax rate. It is reasonably possible that the amount of the unrecognized tax benefit with

respect to certain of our uncertain tax positions will increase or decrease during the next 12 months; however, we do

not expect the change to have a significant effect on our results of operations, financial condition or cash flows. As

of February 28, 2014, we had $26.3 million of gross unrecognized tax benefits, $7.6 million of which, if recognized,

would affect our effective tax rate. As of February 28, 2013, we had $25.1 million of gross unrecognized tax benefits,

$5.4 million of which, if recognized, would affect our effective tax rate.

Our continuing practice is to recognize interest and penalties related to income tax matters in SG&A expenses. Our

accrual for interest and penalties decreased $0.2 million to $1.4 million as of February 28, 2015, from $1.6 million as

of February 28, 2014. Our accrual for interest and penalties increased $0.3 million to $1.6 million as of

February 28, 2014, from $1.3 million as of February 28, 2013.

CarMax is subject to U.S. federal income tax as well as income tax of multiple states and local jurisdictions. With a

few insignificant exceptions, we are no longer subject to U.S. federal, state and local income tax examinations by tax

authorities for years prior to fiscal 2012.

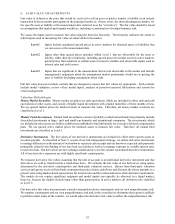

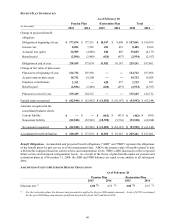

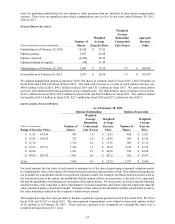

10. BENEFIT PLANS

(A) Retirement Benefit Plans

Effective December 31, 2008, we froze both of our noncontributory defined benefit plans: our pension plan (the

“pension plan”) and our unfunded, nonqualified plan (the “restoration plan”), which restores retirement benefits for

certain associates who are affected by Internal Revenue Code limitations on benefits provided under the pension plan.

No additional benefits have accrued under these plans since that date. In connection with benefits earned prior to

December 31, 2008, we have a continuing obligation to fund the pension plan and will continue to recognize net

periodic pension expense for both plans. We use a fiscal year end measurement date for both the pension plan and

the restoration plan.