CarMax 2015 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

(see Operating Activities). During fiscal 2015, we received proceeds of $300 million from a floating rate term loan

entered into in November 2014. Net cash provided by financing activities was reduced by stock repurchases of

$917.0 million in fiscal 2015, $307.2 million in fiscal 2014 and $203.4 million in fiscal 2013.

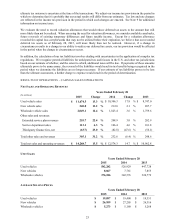

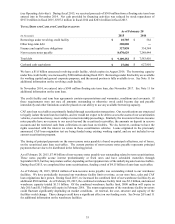

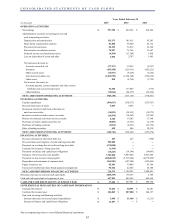

TOTAL DEBT AND CASH AND CASH EQUIVALENTS

As of February 28

(In thousands) 2015 2014

Borrowings under revolving credit facility $ 10,785 $ 582

Other long-term debt 300,000 ―

Finance and capital lease obligations 327,838 334,384

N

on-recourse notes payable 8,470,629 7,248,444

Total debt $ 9,109,252 $ 7,583,410

Cash and cash equivalents $ 27,606 $ 627,901

We have a $1.0 billion unsecured revolving credit facility, which expires in August 2016. The borrowing capacity

under this credit facility was increased by $300 million during fiscal 2015. Borrowings under this facility are available

for working capital and general corporate purposes, and the unused portion is fully available to us. See Note 11 for

additional information on the revolving credit facility.

In November 2014, we entered into a $300 million floating rate term loan, due November 2017. See Note 11 for

additional information on the term loan.

The credit facility and term loan agreements contain representations and warranties, conditions and covenants. If

these requirements were not met, all amounts outstanding or otherwise owed could become due and payable

immediately and other limitations could be placed on our ability to use any available borrowing capacity.

CAF auto loan receivables are primarily funded through securitization transactions. Our securitizations are structured

to legally isolate the auto loan receivables, and we would not expect to be able to access the assets of our securitization

vehicles, even in insolvency, receivership or conservatorship proceedings. Similarly, the investors in the non-recourse

notes payable have no recourse to our assets beyond the securitized receivables, the amounts on deposit in reserve

accounts and the restricted cash from collections on auto loan receivables. We do, however, continue to have the

rights associated with the interest we retain in these securitization vehicles. Loans originated in the previously

announced CAF loan origination test are being funded using existing working capital, and are not included in our

current securitization program.

The timing of principal payments on the non-recourse notes payable is based on principal collections, net of losses,

on the securitized auto loan receivables. The current portion of non-recourse notes payable represents principal

payments that are due to be distributed in the following period.

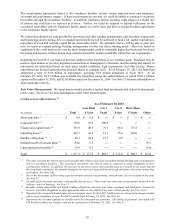

As of February 28, 2015, $7.48 billion of non-recourse notes payable was outstanding related to term securitizations.

These notes payable accrue interest predominantly at fixed rates and have scheduled maturities through

September 2021, but they may mature earlier, depending on the repayment rate of the underlying auto loan receivables.

During fiscal 2015, we completed four term securitizations, funding a total of $4.15 billion of auto loan receivables.

As of February 28, 2015, $986.0 million of non-recourse notes payable was outstanding related to our warehouse

facilities. We have periodically increased our warehouse facility limit over time, as our store base, sales and CAF

loan originations have grown. During fiscal 2015, we increased the combined limit of our warehouse facilities by an

additional $500 million. As of February 28, 2015, the combined warehouse facility limit was $2.3 billion, and unused

warehouse capacity totaled $1.31 billion. Of the combined warehouse facility limit, $800 million will expire in

July 2015 and $1.5 billion will expire in February 2016. The return requirements of the warehouse facility investors

could fluctuate significantly depending on market conditions. At renewal, the cost, structure and capacity of the

facilities could change. These changes could have a significant effect on our funding costs. See Notes 2(F) and 11

for additional information on the warehouse facilities.