CarMax 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

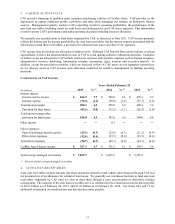

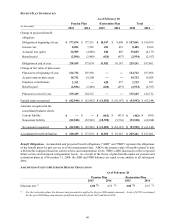

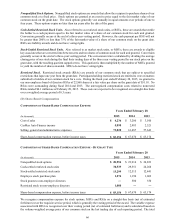

BENEFIT PLAN INFORMATION

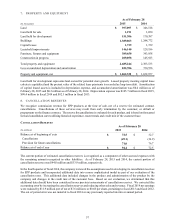

As of February 28

Pension Plan Restoration Plan Total

(In thousands) 2015 2014 2015 2014 2015 2014

Change in projected benefit

obligation:

Obligation at beginning of year $ 177,674 $ 177,531 $ 10,187 $ 9,408 $ 187,861 $ 186,939

Interest cost 8,032 7,583 453 433

8,485 8,016

Actuarial loss (gain) 34,989 (4,980) 840 803

35,829 (4,177)

Benefits paid (2,506) (2,460) (428) (457)

(2,934) (2,917)

Obligation at end of year 218,189 177,674 11,052 10,187

229,241

187,861

Change in fair value of plan assets:

Plan assets at beginning of year 124,712 107,968 ― ― 124,712 107,968

Actual return on plan assets 10,732 19,204 ― ― 10,732 19,204

Employer contributions 2,311 ― 428 457

2,739 457

Benefits paid (2,506) (2,460) (428) (457)

(2,934) (2,917)

Plan assets at end of year 135,249 124,712 ― ― 135,249

124,712

Funded status recognized $ (82,940) $ (52,962) $ (11,052) $ (10,187) $ (93,992) $ (63,149)

Amounts recognized in the

consolidated balance sheets:

Current liability $ ―$ ―$ (462)

$ (451) $ (462)

$ (451)

Noncurrent liability (82,940) (52,962) (10,590) (9,736)

(93,530) (62,698)

Net amount recognized $ (82,940) $ (52,962) $ (11,052) $ (10,187) $ (93,992) $ (63,149)

Accumulated benefit obligation $ 218,189 $ 177,674 $ 11,052 $ 10,187 $ 229,241 $ 187,861

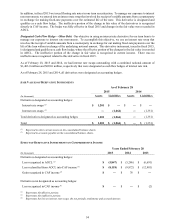

Benefit Obligations. Accumulated and projected benefit obligations (“ABO” and “PBO”) represent the obligations

of the benefit plans for past service as of the measurement date. ABO is the present value of benefits earned to date

with benefits computed based on current service and compensation levels. PBO is ABO increased to reflect expected

future service and increased compensation levels. As a result of the freeze of plan benefits under our pension and

restoration plans as of December 31, 2008, the ABO and PBO balances are equal to one another at all subsequent

dates.

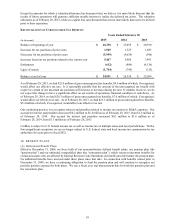

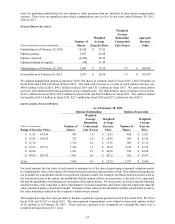

ASSUMPTIONS USED TO DETERMINE BENEFIT OBLIGATIONS

As of February 28

Pension Plan Restoration Plan

2015 2014 2015 2014

Discount rate (1) 4.00 % 4.55 % 4.00 % 4.55 %

(1) For the restoration plan, the discount rate presented is applied to the pre-2004 annuity amounts. A rate of 4.50% is assumed

for the post-2004 lump sum amounts paid from the plan for fiscal 2015 and fiscal 2014.