CarMax 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

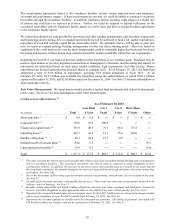

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

Auto Loan Receivables

As of February 28, 2015 and 2014, all loans in our portfolio of managed receivables were fixed-rate installment

contracts. Financing for these receivables was achieved primarily through asset securitization programs that, in turn,

issued both fixed- and floating-rate securities. Our derivative instruments are used to manage differences in the

amount of our known or expected cash receipts and our known or expected cash payments principally related to the

funding of our auto loan receivables. Disruptions in the credit markets could impact the effectiveness of our hedging

strategies. Other receivables are financed with working capital. Generally, changes in interest rates associated with

underlying swaps will not have a material impact on earnings; however, they could have a material impact on cash

and cash flows.

Credit risk is the exposure to nonperformance of another party to an agreement. We mitigate credit risk by dealing

with highly rated bank counterparties. The market and credit risks associated with derivative instruments are similar

to those relating to other types of financial instruments. See Notes 5 and 6 for additional information on derivative

instruments and hedging activities.

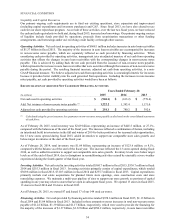

COMPOSITION OF AUTO LOAN RECEIVABLES

As of February 28

(In millions) 2015 2014

Principal amount of receivables funded through:

Term securitizations $ 7,226.5 $ 6,145.5

Warehouse facilities (1) 986.0 879.0

Other receivables (2) 246.2 159.9

Total $ 8,458.7 $ 7,184.4

(1) We have entered into derivatives designated as cash flow hedges of forecasted interest payments in anticipation of permanent

funding for these receivables in the term securitization market. The current notional amount of these derivatives was

$988.0 million as of February 28, 2015, and $869.0 million as of February 28, 2014. See Note 5.

(2) Other receivables include receivables not funded through the warehouse facilities or term securitizations.

Interest Rate Exposure

We have interest rate risk from changing interest rates related to borrowings under our revolving credit facility.

Substantially all of these borrowings are floating-rate debt based on LIBOR. A 100-basis point increase in market

interest rates would have decreased our fiscal 2015 net earnings per share by less than $0.01. We also have interest

rate risk from changing interest rates related to borrowings under our term loan; however, the floating rate risk is

mitigated by a derivative instrument.

Borrowings under our warehouse facilities are also floating rate debt and are secured by auto loan receivables on

which we collect interest at fixed rates. The receivables are funded through the warehouse facilities until we elect to

fund them through a term securitization or alternative funding arrangement. This floating-rate risk is mitigated by

funding the receivables through a term securitization or other funding arrangement, and by entering into derivative

instruments. Absent any additional actions by the company to further mitigate risk, a 100-basis point increase in

market interest rates associated with the warehouse facilities would have decreased our fiscal 2015 net earnings per

share by approximately $0.03.

Other Market Exposures

Our pension plan has interest rate risk related to its projected benefit obligation (PBO). Due to the relatively young

overall age of the plan’s participants, a 100-basis point change in the discount rate has approximately a 20% effect on

the PBO balance. A 100-basis point decrease in the discount rate would have decreased our fiscal 2015 net earnings

per share by less than $0.01. See Note 10 for more information on our benefit plans.

As our cash-settled restricted stock units are liability awards, the related compensation expense is sensitive to changes

in the company’s stock price. The mark-to-market effect on the liability depends on each award’s grant price and

previously recognized expense. At February 28, 2015, a $1.00 change in the company’s stock price would have

affected fiscal 2015 net earnings per share by less than $0.01.