CarMax 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

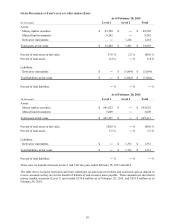

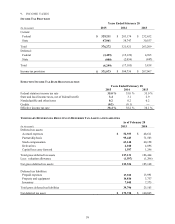

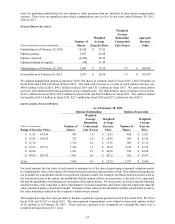

ESTIMATED FUTURE BENEFIT PAYMENTS

Pension Restoration

(In thousands) Plan Plan

Fiscal 2016 $ 2,500 $ 462

Fiscal 2017 $ 2,798 $ 474

Fiscal 2018 $ 3,097 $ 482

Fiscal 2019 $ 3,474 $ 482

Fiscal 2020 $ 3,867 $ 492

Fiscal 2021 to 2025 $ 26,563 $ 2,904

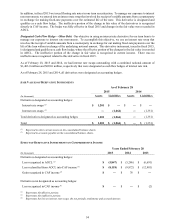

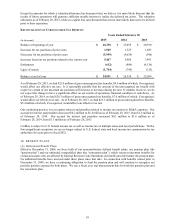

COMPONENTS OF NET PENSION EXPENSE

Years Ended February 28

(In thousands) Pension Plan Restoration Plan Total

2015 2014 2013 2015 2014 2013 2015 2014 2013

Interest cost $ 8,032 $ 7,583 $ 7,299 $ 453 $ 433 $ 458 $ 8,485 $ 8,016 $ 7,757

Expected return on

plan assets (9,030) (7,916) (7,591) ― ― ― (9,030) (7,916) (7,591)

Recognized actuarial

loss

1,361

1,674 1,200 ― ― ― 1,361

1,674 1,200

N

et pension expense $ 363 $ 1,341 $ 908 $ 453 $ 433 $ 458 $ 816 $ 1,774 $ 1,366

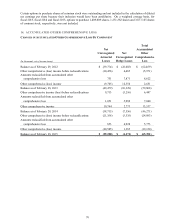

CHANGES RECOGNIZED IN ACCUMULATED OTHER COMPREHENSIVE LOSS

Years Ended February 28

Pension Plan Restoration Plan Total

(In thousands) 2015 2014 2015 2014 2015 2014

N

et actuarial loss (gain) $ 33,286 $ (16,268) $ 840 $ 803 $ 34,126 $ (15,465)

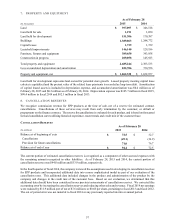

In fiscal 2016, we anticipate that $1.9 million in estimated actuarial losses of the pension plan will be amortized from

accumulated other comprehensive loss. We do not anticipate that any appreciable estimated actuarial losses will be

amortized from accumulated other comprehensive loss for the restoration plan.

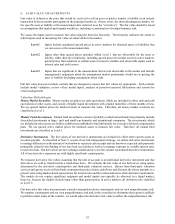

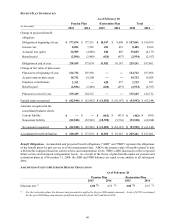

ASSUMPTIONS USED TO DETERMINE NET PENSION EXPENSE

Years Ended February 28

Pension Plan Restoration Plan

2015 2014 2013 2015 2014 2013

Discount rate (1) 4.55 % 4.30 % 4.75 % 4.55 %

4.30 % 4.75 %

Expected rate of return on plan assets 7.75 % 7.75 % 7.75 % ― ― ―

(1) For the restoration plan, the discount rate presented is applied to the pre-2004 annuity amounts. A rate of 4.50% is assumed

for post-2004 lump sum amounts paid from the plan for fiscal 2015, fiscal 2014 and fiscal 2013.