CarMax 2015 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities.

Our common stock is listed and traded on the New York Stock Exchange under the ticker symbol KMX. We are

authorized to issue up to 350,000,000 shares of common stock and up to 20,000,000 shares of preferred stock. As of

February 28, 2015, there were 208,869,688 shares of CarMax common stock outstanding and we had approximately

4,100 shareholders of record. As of that date, there were no preferred shares outstanding.

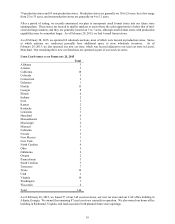

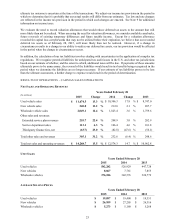

The following table presents the quarterly high and low sales prices per share for our common stock for each quarter

during the last two fiscal years, as reported on the New York Stock Exchange composite tape.

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Fiscal 2015

High

$ 49.68 $53.70 $57.28 $68.71

Low

$ 42.54 $43.80 $43.27 $55.86

Fiscal 2014

High $ 48.86 $ 50.00 $ 52.47 $ 53.08

Low $ 38.13 $ 42.21 $ 45.91 $ 43.90

We have not paid any dividends on our common stock and do not plan to pay dividends on our common stock for the

foreseeable future. We anticipate that for the foreseeable future any cash flow generated from our operations will be

used to fund our existing operations, capital expenditures and share repurchase program.

During the fourth quarter of fiscal 2015, we sold no CarMax equity securities that were not registered under the

Securities Act of 1933, as amended.

Issuer Purchases of Equity Securities

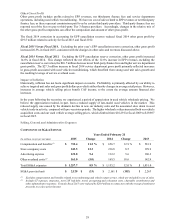

The following table provides information relating to the company’s repurchase of common stock during the fourth

quarter of fiscal 2015. The table does not include transactions related to employee equity awards or the exercises of

employee stock options.

Approximate

Dollar Value

Total Number of Shares that

Total Number Average of Shares Purchased May Yet Be

of Shares Price Paid as Part of Publicly Purchased Under

Period Purchased per Share Announced Programs the Programs (1)

December 1-31, 2014 1,714,282 $ 59.22 1,714,282 $ 2,478,034,222

January 1-31, 2015 1,087,039 $ 63.81 1,087,039 $ 2,408,945,235

February 1-28, 2015 608,169 $ 65.25 608,169 $ 2,369,263,123

Total 3,409,490 3,409,490

(1) In fiscal 2013, our board of directors authorized the repurchase of up to $800 million of our common stock which was

exhausted in fiscal 2015. In fiscal 2015, our board of directors authorized the repurchase of up to an additional $3.0 billion

of our common stock of which $1 billion expires on December 31, 2015, and $2 billion expires on December 31, 2016.

Purchases may be made in open market or privately negotiated transactions at management’s discretion and the timing and

amount of repurchases are determined based on share price, market conditions, legal requirements and other factors. Shares

repurchased are deemed authorized but unissued shares of common stock.