CarMax 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

45

1. BUSINESS AND BACKGROUND

CarMax, Inc. (“we,” “our,” “us,” “CarMax” and “the company”), including its wholly owned subsidiaries, is the

largest retailer of used vehicles in the United States. We operate in two reportable segments: CarMax Sales Operations

and CarMax Auto Finance (“CAF”). Our CarMax Sales Operations segment consists of all aspects of our auto

merchandising and service operations, excluding financing provided by CAF. Our CAF segment consists solely of

our own finance operation that provides vehicle financing through CarMax stores.

We seek to deliver an unrivaled customer experience by offering a broad selection of high quality used vehicles and

related products and services at low, no-haggle prices using a customer-friendly sales process in an attractive, modern

sales facility. We provide customers with a full range of related products and services, including the appraisal and

purchase of vehicles directly from consumers; the financing of vehicle purchases through CAF and third-party

financing providers; the sale of extended protection plan (“EPP”) products, which include extended service plans

(“ESP”) and guaranteed asset protection (“GAP”); and vehicle repair service. Vehicles purchased through the

appraisal process that do not meet our retail standards are sold to licensed dealers through on-site wholesale auctions.

At select locations we also sell new vehicles under franchise agreements.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(A) Basis of Presentation and Use of Estimates

The consolidated financial statements include the accounts of CarMax and our wholly owned subsidiaries. All

significant intercompany balances and transactions have been eliminated in consolidation. The preparation of

financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires

management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and

expenses and the disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Certain prior year amounts have been reclassified to conform to the current year’s presentation. Amounts and

percentages may not total due to rounding.

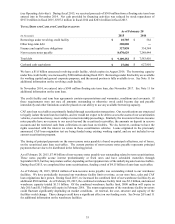

(B) Cash and Cash Equivalents

Cash equivalents of approximately $48,000 as of February 28, 2015, and $607.0 million as of February 28, 2014,

consisted of highly liquid investments with original maturities of three months or less.

(C) Restricted Cash from Collections on Auto Loan Receivables

Cash equivalents totaling $294.1 million as of February 28, 2015, and $259.3 million as of February 28, 2014,

consisted of collections of principal, interest and fee payments on securitized auto loan receivables that are restricted

for payment to the securitization investors pursuant to the applicable securitization agreements.

(D) Marketable Securities

The Company classifies its marketable securities as trading. These securities consisted primarily of mutual funds

reported at fair value with unrealized gains and losses reflected as a component of other expense. Marketable securities

as of February 28, 2015 and 2014 pertain to the Company's restricted investments held in a rabbi trust. Proceeds from

the sales of marketable securities were $0.7 million and $0.5 million in fiscal 2015 and 2014, respectively. Realized

and unrealized gains of $0.2 million and $0 were recognized during fiscal 2015 and fiscal 2014, respectively.

(E) Accounts Receivable, Net

Accounts receivable, net of an allowance for doubtful accounts, includes certain amounts due from third-party finance

providers and customers and other miscellaneous receivables. The allowance for doubtful accounts is estimated based

on historical experience and trends.

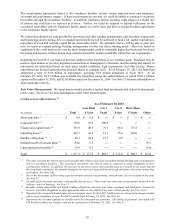

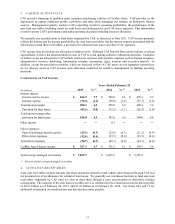

(F) Securitizations

We maintain a revolving securitization program composed of two warehouse facilities (“warehouse facilities”) that

we use to fund auto loan receivables originated by CAF until we elect to fund them through a term securitization or

alternative funding arrangement. We sell the auto loan receivables to one of two wholly owned, bankruptcy-remote,

special purpose entities that transfer an undivided percentage ownership interest in the receivables, but not the

receivables themselves, to entities formed by third-party investors. These entities issue asset-backed commercial

paper or utilize other funding sources supported by the transferred receivables, and the proceeds are used to finance

the securitized receivables.