CarMax 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

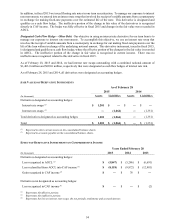

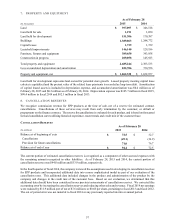

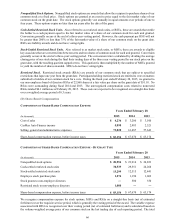

FAIR VALUE OF PLAN ASSETS AND FAIR VALUE HIERARCHY

As of February 28

(In thousands) 2015 2014

Mutual funds (Level 1):

Equity securities (1) $ 84,303 $ 78,576

Equity securities – international (2) 17,114 15,649

Fixed income securities (3) 32,549 29,500

Collective funds (Level 2):

Short-term investments (4) 1,341 1,046

Investment payables, net (58) (59)

Total $ 135,249 $ 124,712

(1) Includes large-, mid- and small-cap companies primarily from diverse U.S. industries including pharmaceutical, bank, oil

and gas, retail and computer sectors; approximately 95% of securities relate to U.S. entities and 5% of securities relate to

non-U.S. entities as of February 28, 2015 (95% and 5%, respectively, as of February 28, 2014) .

(2) Consists of equity securities of primarily foreign corporations from diverse industries including bank, pharmaceutical,

insurance, telecommunication, food, and oil and gas sectors; 100% of securities relate to non-U.S. entities as of

February 28, 2015 (100% relate to non-U.S. entities, as of February 28, 2014).

(3) Includes debt securities of U.S. and foreign governments, their agencies and corporations, and diverse investments in

mortgage-backed securities and banks; approximately 85% of securities relate to U.S. entities and 15% of securities relate to

non-U.S. entities as of February 28, 2015 (90% and 10%, respectively, as of February 28, 2014).

(4) Includes pooled funds representing short-term instruments that include governments, their agencies and corporations and

large-, mid- and small-cap companies primarily from the U.S. bank sector; nearly 100% of securities relate to U.S. entities

as of February 28, 2015 (nearly 100% as of February 28, 2014).

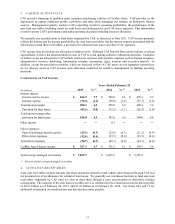

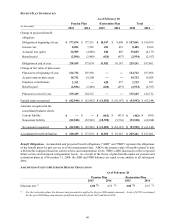

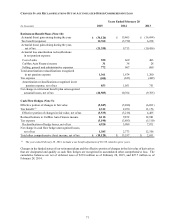

Plan Assets. Our pension plan assets are held in trust and management sets the investment policies and strategies.

Long-term strategic investment objectives include asset preservation and appropriately balancing risk and return. We

oversee the investment allocation process, which includes selecting investment managers, setting long-term strategic

targets and monitoring asset allocations and performance. Target allocations for plan assets are guidelines, not

limitations, and occasionally plan fiduciaries may approve allocations above or below the targets. We target allocating

75% of plan assets to equity and equity-related instruments and 25% to fixed income securities. Equity securities are

currently composed of mutual funds that include highly diversified investments in large-, mid- and small-cap

companies located in the United States and internationally. The fixed income securities are currently composed of

mutual funds that include investments in debt securities, mortgage-backed securities, corporate bonds and other debt

obligations primarily in the United States. We do not expect any plan assets to be returned to us during fiscal 2016.

Plan assets also include collective funds, which are public investment vehicles with the underlying assets representing

high quality, short-term instruments that include securities of governments, their agencies and corporations and large,

mid, and small cap companies located in the United States and internationally.

The fair values of the plan’s assets are provided by the plan’s trustee and the investment managers. Within the fair

value hierarchy (see Note 6), the mutual funds are classified as Level 1 as quoted active market prices for identical

assets are used to measure fair value. The collective funds are public investment vehicles valued using a net asset

value (“NAV”) provided by the plan’s trustee as a practical expedient for measuring the fair value. The NAV is based

on the underlying net assets owned by the fund divided by the number of shares outstanding. The NAV’s unit price

is quoted on a private market that was not active. However, the NAV is based on the fair value of the underlying

securities within the fund, which were traded on an active market and valued at the closing price reported on the active

market on which those individual securities are traded. The collective funds may be liquidated with minimal

restrictions and are classified as Level 2.

Funding Policy. For the pension plan, we contribute amounts sufficient to meet minimum funding requirements as

set forth in the employee benefit and tax laws, plus any additional amounts as we may determine to be appropriate.

We do not expect to make any contributions to the pension plan in fiscal 2016. For the non-funded restoration plan,

we contribute an amount equal to the benefit payments.