CarMax 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX, INC. • ANNUAL REPORT • FISCAL YEAR 2015

CARMAX

Table of contents

-

Page 1

CA R MA X, I NC . • AN N UAL R EP OR T • F IS C A L Y E A R 2015 CARMAX -

Page 2

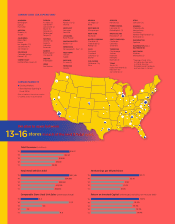

... NORTH CAROLINA Providence* (2) SOUTH CAROLINA Baton Rouge MASSACHUSETTS Charlottesville Harrisonburg Lynchburg Norfolk / Virginia Beach (2) Richmond (2) WASHINGTON Bakersï¬eld Fresno Los Angeles (10) Sacramento (4) San Diego (2) COLORADO Atlanta* (6) Augusta Columbus Savannah ILLINOIS... -

Page 3

... that differentiates CarMax starts with the quality of our vehicles and the world class experience we offer our customers. Our goal is to provide a seamless experience whether a customer starts on our website or in one of our stores. While we continue to refine the new store design that we... -

Page 4

.... CarMax regularly adds new training and reviews existing material to guarantee that the curriculum meets the needs of associates and the business. Over the past year, training enhancements included the rollout of a world class on-boarding program for new associates, as well as new change management... -

Page 5

...VIRGINIA (Address of principal executive offices) 23238 (Zip Code) Registrant's telephone number, including area code: (804) 747-0422 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, par value $0.50 New York... -

Page 6

...Yes ï,¨ No ï¸ The aggregate market value of the registrant's common stock held by non-affiliates as of August 29, 2014, computed by reference to the closing price of the registrant's common stock on the New York Stock Exchange on that date, was $11,355,302,700. On March 31, 2015, there were 207,930... -

Page 7

...Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions and Director Independence Principal Accountant Fees and Services PART IV Item 15. Exhibits and Financial Statement Schedules... -

Page 8

... Finance income. Our expected future expenditures, cash needs and financing sources. The projected number, timing and cost of new store openings. Our gross profit margin, inventory levels and ability to leverage selling, general and administrative and other fixed costs. Our sales and marketing plans... -

Page 9

..., publicly traded company. As of February 28, 2015, we operated 144 used car stores in 73 metropolitan markets. Our home office is located at 12800 Tuckahoe Creek Parkway, Richmond, Virginia. CarMax Business We operate in two reportable segments: CarMax Sales Operations and CarMax Auto Finance... -

Page 10

...returns, CAF financed 41.2% of our retail vehicle unit sales in fiscal 2015. CAF also services all auto loans it originates and is responsible for providing billing statements, collecting payments, maintaining contact with delinquent customers, and arranging for the repossession of vehicles securing... -

Page 11

..., licensed auctioneers conduct our auctions. Dealers pay a fee to us based on the sales price of the vehicles they purchase. Our auctions are generally held on a weekly or bi-weekly basis. Extended Protection Plans. At the time of sale, we offer customers EPP products. We sell these plans on behalf... -

Page 12

..., including our credit processing information system. Our proprietary store technology provides our management with real-time information about many aspects of store operations, such as inventory management, pricing, vehicle transfers, wholesale auctions and sales consultant productivity. Our... -

Page 13

... business, including advertising, sales, financing and employment practices. These laws include consumer protection laws, privacy laws and state franchise laws, as well as other laws and regulations applicable to new and used motor vehicle dealers. These laws also include federal and state wage-hour... -

Page 14

... direct competition and increasing use of the Internet described above, there are companies that sell software solutions to new and used car dealers to enable those dealers to, among other things, more efficiently source and price inventory. Although these companies do not compete with CarMax, the... -

Page 15

... affect our business, sales, results of operations and financial condition. Changes in the availability or cost of capital and working capital financing, including the long-term financing to support our geographic expansion, could adversely affect sales, operating strategies and store growth... -

Page 16

... effect on our business, sales, results of operations and financial condition. We rely on third-party financing providers to finance a significant portion of our customers' vehicle purchases. Accordingly, our sales and results of operations are partially dependent on the actions of these third... -

Page 17

...to purchase a greater percentage of our inventory from third-party auctions, which is generally less profitable for CarMax. Our ability to source vehicles through our appraisal process could also be affected by competition, both from new and used car dealers directly and through third-party websites... -

Page 18

... to manage sales, inventory, our customer-facing websites (carmax.com and carmaxauctions.com), consumer financing and customer information. The failure of these systems to perform as designed, or the failure to maintain or update these systems as necessary, could disrupt our business operations and... -

Page 19

... operations. Our results of operations and financial condition are subject to management's accounting judgments and estimates, as well as changes in accounting policies. The preparation of our financial statements requires us to make estimates and assumptions affecting the reported amounts of CarMax... -

Page 20

...28, 2015, we leased 57 of our 144 used car stores, our new car store and our CAF office building in Atlanta, Georgia. We owned the remaining 87 used car stores currently in operation. We also owned our home office building in Richmond, Virginia, and land associated with planned future store openings... -

Page 21

... details on our future expansion plans, see "Fiscal 2016 Planned Store Openings," included in Part II, Item 7, of this Form 10-K. Item 3. Legal Proceedings. On April 2, 2008, Mr. John Fowler filed a putative class action lawsuit against CarMax Auto Superstores California, LLC and CarMax Auto... -

Page 22

..., Chief Executive Officer and Director 45 Executive Vice President, Human Resources and Administrative Services 50 Executive Vice President and Chief Financial Officer 48 Executive Vice President, Stores 43 Senior Vice President, CarMax Auto Finance 55 Senior Vice President, Strategy and Business... -

Page 23

... expires on December 31, 2015, and $2 billion expires on December 31, 2016. Purchases may be made in open market or privately negotiated transactions at management's discretion and the timing and amount of repurchases are determined based on share price, market conditions, legal requirements and... -

Page 24

...the cumulative total shareholder return (stock price appreciation plus dividends, as applicable) on our common stock for the last five fiscal years with the cumulative total return of the S&P 500 Index and the S&P 500 Retailing Index. The graph assumes an original investment of $100 in CarMax common... -

Page 25

....7 4,013.6 381.2 396,181 263,061 2,156 908 2,173 9.8 % 10.9 33.3 103 15,565 Income statement information Used vehicle sales Wholesale vehicle sales Net sales and operating revenues Gross profit CarMax Auto Finance income Selling, general and administrative expenses Net earnings Share and per share... -

Page 26

... may not total due to rounding. OVERVIEW See Part 1. Item 1 for a detailed description and discussion of the company's business. CarMax is the nation's largest retailer of used vehicles. We operate in two reportable segments: CarMax Sales Operations and CarMax Auto Finance ("CAF"). Our CarMax Sales... -

Page 27

... profit. Wholesale vehicle unit sales grew 9.8%, reflecting improved appraisal traffic and the growth in our store base. During fiscal 2015, other sales and revenues, which include commissions earned on the sale of EPP products, service department sales and net third-party finance fees, increased... -

Page 28

... of sale to a customer or upon delivery to a customer. As part of our customer service strategy, we guarantee the retail vehicles we sell with a 5-day, money-back guarantee. We record a reserve for estimated returns based on historical experience and trends, and results could be affected if future... -

Page 29

... Wholesale vehicle sales Other sales and revenues: Extended service plan revenues Service department sales Third-party finance fees, net Total other sales and revenues Total net sales and operating revenues (47.6) % (6.4) % 14.7 %$ % $ 12,574.3 UNIT SALES Years Ended February 28 2015 2014 2013... -

Page 30

... 131 2013 108 10 118 The fiscal 2015 store openings included 10 stores in 9 new markets (1 store each in Rochester, New York; Dothan, Alabama; Spokane, Washington; Madison, Wisconsin; Lynchburg, Virginia; Tupelo, Mississippi; Reno, Nevada; and Cleveland, Ohio; and 2 stores in Portland, Oregon) and... -

Page 31

... Vehicle Sales Our wholesale auction prices usually reflect the trends in the general wholesale market for the types of vehicles we sell, although they can also be affected by changes in vehicle mix or the average age, mileage or condition of the vehicles bought through our appraisal process... -

Page 32

... sales trends, inventory turns and gross profit achievement. Other factors that may influence gross profit include changes in our vehicle reconditioning costs, changes in the percentage of vehicles sourced directly from consumers through our appraisal process and changes in the wholesale pricing... -

Page 33

Other Gross Profit Other gross profit includes profits related to EPP revenues, net third-party finance fees and service department operations, including used vehicle reconditioning. We have no cost of sales related to EPP revenues or net third-party finance fees, as these represent commissions paid... -

Page 34

... fiscal 2013. RESULTS OF OPERATIONS - CARMAX AUTO FINANCE CAF income primarily reflects interest and fee income generated by CAF's portfolio of auto loan receivables less the interest expense associated with the debt issued to fund these receivables, a provision for estimated loan losses and direct... -

Page 35

... interest and fees charged to consumers and our funding costs, declined as a percentage of total average managed receivables to 6.5% in fiscal 2015 from 6.9% in fiscal 2014. This reflected the combination of (i) a gradual decline in the average contract rate charged on new loan originations in... -

Page 36

... information relates to loans originated net of 3-day payoffs and vehicle returns. Vehicle units financed as a percentage of total retail units sold. The credit scores represent FICO scores, and reflect only receivables with obligors that have a FICO score at the time of application. The FICO score... -

Page 37

... 15 older stores. We currently estimate capital expenditures will total approximately $360 million in fiscal 2016. FISCAL 2016 PLANNED STORE OPENINGS Location Brooklyn Park, Minnesota Sicklerville, New Jersey (2) Gainesville, Florida Cranston, Rhode Island Parker, Colorado Loveland, Colorado... -

Page 38

FINANCIAL CONDITION Liquidity and Capital Resources Our primary ongoing cash requirements are to fund our existing operations, store expansion and improvement (including capital expenditures and inventory purchases) and CAF. Since fiscal 2013, we have also elected to use cash for our share ... -

Page 39

... accounts and the restricted cash from collections on auto loan receivables. We do, however, continue to have the rights associated with the interest we retain in these securitization vehicles. Loans originated in the previously announced CAF loan origination test are being funded using existing... -

Page 40

... funded status of our retirement plans, of which $93.5 million has no contractual payment schedule and we expect payments to occur beyond 12 months from February 28, 2015. See Note 10. Represents the net unrecognized tax benefits related to uncertain tax positions. The timing of payments associated... -

Page 41

... or expected cash payments principally related to the funding of our auto loan receivables. Disruptions in the credit markets could impact the effectiveness of our hedging strategies. Other receivables are financed with working capital. Generally, changes in interest rates associated with underlying... -

Page 42

... 2015. KPMG LLP, the company's independent registered public accounting firm, has issued a report on our internal control over financial reporting. Their report is included herein. THOMAS J. FOLLIARD PRESIDENT AND CHIEF EXECUTIVE OFFICER THOMAS W. REEDY EXECUTIVE VICE PRESIDENT AND CHIEF FINANCIAL... -

Page 43

... these consolidated financial statements and an opinion on the Company's internal control over financial reporting based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and... -

Page 44

CONSOLIDATED STATEMENTS OF EARNINGS Years Ended February 28 (In thousands except per share data) SALES AND OPERATING REVENUES: 2015 % (1) 2014 % (1) 2013 % (1) Used vehicle sales New vehicle sales Wholesale vehicle sales Other sales and revenues NET SALES AND OPERATING REVENUES $ 11,674,... -

Page 45

... Years Ended February 28 (In thousands) NET EARNINGS 2015 $ 597,358 $ 2014 492,586 $ 2013 434,284 Other comprehensive (loss) income, net of taxes: Net change in retirement benefit plan unrecognized actuarial losses Net change in cash flow hedge unrecognized losses Other comprehensive (loss... -

Page 46

...equivalents Restricted cash from collections on auto loan receivables Accounts receivable, net Inventory Deferred income taxes Other current assets TOTAL CURRENT ASSETS Auto loan receivables, net Property and equipment, net Deferred income taxes Other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS... -

Page 47

... from collections on auto loan receivables Increase in restricted cash in reserve accounts Release of restricted cash from reserve accounts Purchases of money market securities, net Purchases of trading securities Sales of trading securities NET CASH USED IN INVESTING ACTIVITIES FINANCING ACTIVITIES... -

Page 48

... Share-based compensation expense Repurchases of common stock Exercise of common stock options Stock incentive plans: Shares issued Shares cancelled Tax effect from the exercise of common stock options BALANCE AS OF FEBRUARY 28, 2015 See accompanying notes to consolidated financial statements. 44 -

Page 49

... the appraisal process that do not meet our retail standards are sold to licensed dealers through on-site wholesale auctions. At select locations we also sell new vehicles under franchise agreements. 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (A) Basis of Presentation and Use of Estimates The... -

Page 50

... market. Vehicle inventory cost is determined by specific identification. Parts and labor used to recondition vehicles, as well as transportation and other incremental expenses associated with acquiring and reconditioning vehicles, are included in inventory. (I) Auto Loan Receivables, Net Auto loan... -

Page 51

... includes money market securities primarily held to satisfy certain insurance program requirements, as well as mutual funds held in a rabbi trust established to fund informally our executive deferred compensation plan. Restricted investments totaled $52.4 million as of February 28, 2015, and... -

Page 52

..., generally either at the time of sale to a customer or upon delivery to a customer. As part of our customer service strategy, we guarantee the retail vehicles we sell with a 5-day, money-back guarantee. We record a reserve for estimated returns based on historical experience and trends. We also... -

Page 53

... and the expected number of converted common shares. Cash-settled restricted stock units are liability awards with fair value measurement based on the market price of CarMax common stock as of the end of each reporting period. Share-based compensation expense is recorded in either cost of sales, CAF... -

Page 54

... loss or a tax credit carryforward. We adopted this pronouncement for our fiscal year beginning March 1, 2014, and there was no effect on our consolidated financial statements. In April 2014, the FASB issued an accounting pronouncement (FASB ASU 2014-8) related to discontinued operations (FASB ASC... -

Page 55

... profitability, the performance of the auto loan receivables including trends in credit losses and delinquencies, and CAF direct expenses. This information is used to assess CAF's performance and make operating decisions including resource allocation. We typically use securitizations to fund loans... -

Page 56

... customers' credit history and certain application information to evaluate and rank their risk. We obtain credit histories and other credit data that includes information such as number, age, type of and payment history for prior or existing credit accounts. The application information that is used... -

Page 57

... contract related to the closing of a $300 million floating rate term loan to manage exposure to variable interest rates associated with the term loan, as further discussed at Note 11. We do not anticipate significant market risk from derivatives as they are predominantly used to match funding costs... -

Page 58

... amounts from a counterparty in exchange for making fixed-rate payments over the estimated life of the note. This derivative is designated and qualifies as a cash flow hedge. The ineffective portion of the change in fair value of the derivatives is recognized directly in CAF income. The hedge... -

Page 59

... maturities of three months or less. We use quoted market prices for identical assets to measure fair value. Therefore, all money market securities are classified as Level 1. Mutual Fund Investments. Mutual fund investments consist of publicly traded mutual funds that primarily include diversified... -

Page 60

... cash from collections on auto loan receivables and restricted cash on deposit in reserve accounts as they are for the benefit of holders of non-recourse notes payable. These amounts are invested in money market securities (Level 1) and totaled $336.8 million as of February 28, 2015, and $291... -

Page 61

...fiscal 2013. 8. CANCELLATION RESERVES We recognize commission revenue for EPP products at the time of sale, net of a reserve for estimated contract cancellations. Cancellations of these services may result from early termination by the customer, or default or prepayment on the finance contract. The... -

Page 62

... Years Ended February 28 2015 2014 2013 35.0 % 35.0 % 35.0 % 3.1 2.9 3.4 0.2 0.2 0.2 (0.1) ― (0.2) 38.2 % 38.1 % 38.4 % Federal statutory income tax rate State and local income taxes, net of federal benefit Nondeductible and other items Credits Effective income tax rate TEMPORARY DIFFERENCES... -

Page 63

... that the amount of the unrecognized tax benefit with respect to certain of our uncertain tax positions will increase or decrease during the next 12 months; however, we do not expect the change to have a significant effect on our results of operations, financial condition or cash flows. As of... -

Page 64

...Plan 2015 2014 2015 Total 2014 2015 2014 Change in projected benefit obligation: Obligation at beginning of year Interest cost Actuarial loss (gain) Benefits paid Obligation at end of year Change in fair value of plan assets: Plan assets at beginning of year Actual return on plan assets Employer... -

Page 65

...the closing price reported on the active market on which those individual securities are traded. The collective funds may be liquidated with minimal restrictions and are classified as Level 2. Funding Policy. For the pension plan, we contribute amounts sufficient to meet minimum funding requirements... -

Page 66

...$ 2015 $ 8,485 (9,030) 1,361 816 Total 2014 2013 Interest cost Expected return on plan assets Recognized actuarial loss Net pension expense $ 8,032 $ 7,583 (9,030) 1,361 $ (7,916) 1,674 $ 453 $ 433 $ 8,016 $ 7,757 (7,916) 1,674 (7,591) 1,200 363 $ 1,341 $ 453 $ 433 $ 1,774 $ 1,366 CHANGES... -

Page 67

...additional company-funded contribution to those associates meeting certain age and service requirements. The total cost for company contributions was $27.9 million in fiscal 2015, $25.0 million in fiscal 2014 and $23.1 million in fiscal 2013. (C) Retirement Restoration Plan Effective January 1, 2009... -

Page 68

... rate derivative contract to manage our exposure to variable interest rates associated with this term loan. Finance and Capital Lease Obligations. Finance and capital lease obligations relate primarily to stores subject to sale-leaseback transactions that did not qualify for sale accounting, and... -

Page 69

... in fiscal 2015; no interest was capitalized in fiscal 2014 or fiscal 2013. Financial Covenants. The credit facility and term loan agreements contain representations and warranties, conditions and covenants. We must also meet financial covenants in conjunction with certain of the sale-leaseback... -

Page 70

...,670 $ 2013 3,010 2,521 57,643 $ 63,174 Cost of sales CarMax Auto Finance income Selling, general and administrative expenses Share-based compensation expense, before income taxes COMPOSITION OF SHARE-BASED COMPENSATION EXPENSE - BY GRANT TYPE Years Ended February 28 (In thousands) 2015 $ 28,954... -

Page 71

... for matching contributions for our employee stock purchase plan are included in share-based compensation expense. There were no capitalized share-based compensation costs as of or for the years ended February 28, 2015, 2014 or 2013. STOCK OPTION ACTIVITY Weighted Average Remaining Contractual Life... -

Page 72

... Measured using historical daily price changes of our stock for a period corresponding to the term of the options and the implied volatility derived from the market prices of traded options on our stock. Based on the U.S. Treasury yield curve at the time of grant. Represents the estimated number of... -

Page 73

... purchased in the open market on behalf of associates totaled 184,390 during fiscal 2015, 188,797 during fiscal 2014 and 251,667 during fiscal 2013. The average price per share for purchases under the plan was $52.18 in fiscal 2015, $47.35 in fiscal 2014 and $32.05 in fiscal 2013. The total costs... -

Page 74

...2015, fiscal 2014 and fiscal 2013, options to purchase... 1,409,809 shares, 1,231,382 shares and 3,877,165 shares of common stock, respectively, were not included. 14. ACCUMULATED OTHER COMPREHENSIVE LOSS CHANGES IN ACCUMULATED OTHER COMPREHENSIVE LOSS BY COMPONENT Total... taxes)... -

Page 75

... 2013 Retirement Benefit Plans (Note 10): Actuarial (loss) gain arising during the year Tax benefit (expense) Actuarial (loss) gain arising during the year, net of tax Actuarial loss amortization reclassifications in net pension expense: Cost of sales CarMax Auto Finance income Selling, general... -

Page 76

... wage statement provisions; (5) unfair competition; and (6) California's Labor Code Private Attorney General Act. The putative class consisted of sales consultants, sales managers, and other hourly employees who worked for the company in California from April 2, 2004, to the present. On May 12, 2009... -

Page 77

... these arrangements. As part of our customer service strategy, we guarantee the used vehicles we retail with at least a 30-day limited warranty. A vehicle in need of repair within this period will be repaired free of charge. As a result, each vehicle sold has an implied liability associated with it... -

Page 78

...per share data) 2nd Quarter 3rd Quarter 4th Quarter (1) Fiscal Year Net sales and operating revenues Gross profit CarMax Auto Finance income Selling, general and administrative expenses Net earnings Net earnings per share: Basic Diluted 2015 3,750,196 $ 501,731 $ 94,615 $ 313,446 $ 169,653... -

Page 79

...within the time periods specified in the U.S. Securities and Exchange Commission's rules and forms. Disclosure controls are also designed to ensure that this information is accumulated and communicated to management, including the chief executive officer ("CEO") and the chief financial officer ("CFO... -

Page 80

..." in our 2015 Proxy Statement. Item 14. Principal Accountant Fees and Services. The information required by this Item is incorporated by reference to the sub-section titled "Auditor Fees and Services" in our 2015 Proxy Statement. Part IV Item 15. Exhibits and Financial Statement Schedules. (a) The... -

Page 81

... Thomas J. Folliard President and Chief Executive Officer April 24, 2015 By: /s/ THOMAS W. REEDY Thomas W. Reedy Executive Vice President and Chief Financial Officer April 24, 2015 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed by the following... -

Page 82

..., Inc. Severance Agreement for Executive Officer, dated January 6, 2015, between CarMax, Inc. and Eric M. Margolin, filed as Exhibit 10.6 to CarMax's Quarterly Report on Form 10-Q, filed January 8, 2015 (File No. 1-31420) is incorporated by this reference. * CarMax, Inc. Benefit Restoration Plan, as... -

Page 83

...executive officers, effective January 1, 2009, filed as Exhibit 10.2 to CarMax's Quarterly Report on Form 10-Q, filed January 8, 2009 (File No. 1-31420), is incorporated by this reference. * Form of Notice of Market Stock Unit Grant between CarMax, Inc. and certain named and other executive officers... -

Page 84

... filed May 13, 2005 (File No. 131420), is incorporated by this reference. * Form of Incentive Award Agreement between CarMax, Inc. and certain executive officers, filed as Exhibit 10.17 to CarMax's Annual Report on Form 10-K, filed May 13, 2005 (File No. 1-31420), is incorporated by this reference... -

Page 85

...101.DEF 101.LAB 101.PRE * CarMax, Inc. Subsidiaries, filed herewith. Consent of KPMG LLP, filed herewith. Powers of Attorney, filed herewith. Certification of the Chief Executive Officer Pursuant to Rule 13a-14(a), filed herewith. Certification of the Chief Financial Officer Pursuant to Rule 13a-14... -

Page 86

... President and Chief Executive Officer Bill Nash EVP, Human Resources and Administrative Services Tom Reedy EVP, Chief Financial Officer Cliff Wood EVP, Stores Jon Daniels SVP, CarMax Auto Finance Ed Hill SVP, Strategy and Business Transformation Jim Lyski SVP, Chief Marketing Officer Eric Margolin... -

Page 87

..., Service Operations Chicago Region Cherri Heart AVP, Chief Information Security Officer Veronica Hinckle AVP, Assistant Controller Andy Ingraham RVP, Service Operations Atlanta Region Rusty Jordan AVP, Consumer Finance Chad Kulas AVP, Human Resources Sarah Lane AVP, Marketing & Sales Strategy Jason... -

Page 88

This page has been intentionally left blank. -

Page 89

This page has been intentionally left blank. -

Page 90

This page has been intentionally left blank. -

Page 91

... sales and earnings information, ï¬nancial reports, ï¬lings with the Securities and Exchange Commission, news releases and other investor information, please visit our investor website at investors.carmax.com. Information may also be obtained from the Investor Relations Department at: Email... -

Page 92

C ARM AX, INC. 12800 TUCKAHOE CREEK PARKWAY RICHMOND, VIRGINIA 23238 804•747•0422 WWW.CARMAX.COM