CarMax 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.73

required disclosures in our consolidated financial statements and notes for the fiscal year ending February 28, 2010.

The adoption of this pronouncement had no impact on our results of operations, financial condition or cash flows.

See Note 9 for additional information.

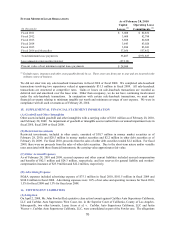

In April 2009, the FASB issued an accounting pronouncement related to fair value measurements (FASB ASC

Topic 820), which provides guidance on estimating fair value when market activity has decreased and on identifying

transactions that are not orderly. Additionally, entities are required to disclose in interim and annual periods the

inputs and valuation techniques used to measure fair value. This pronouncement is effective for interim and annual

periods ending after June 15, 2009. As these requirements are consistent with our previous practice, the adoption of

this pronouncement did not have an impact on our consolidated financial statements.

In May 2009, the FASB issued an accounting pronouncement related to subsequent events (FASB ASC Topic 855),

which established general standards of accounting for and disclosure of events that occur after the balance sheet date

but before the date the financial statements are issued or available to be issued. This pronouncement requires

companies to reflect in their financial statements the effects of subsequent events that provide additional evidence

about conditions at the balance-sheet date. Subsequent events that provide evidence about conditions that arose after

the balance-sheet date should be disclosed if the financial statements would otherwise be misleading. Disclosures

should include the nature of the event and either an estimate of its financial effect or a statement that an estimate

cannot be made. This pronouncement is effective for interim and annual financial periods ending after

June 15, 2009, and should be applied prospectively. As these requirements are consistent with our previous practice,

the adoption of this pronouncement did not have an impact on our consolidated financial statements.

In August 2009, the FASB issued an accounting pronouncement related to fair value measurements and disclosures

(FASB ASC Topic 820), which provides clarification in measuring the fair value of liabilities in circumstances in

which a quoted price in an active market for the identical liability is not available and in circumstances in which a

liability is restricted from being transferred. This pronouncement also clarifies that both a quoted price in an active

market for the identical liability at the measurement date and the quoted price for the identical liability when traded

as an asset in an active market when no adjustments to the quoted price of the asset are required are Level 1 fair

value measurements. This pronouncement was effective for our quarter ended November 30, 2009. As we did not

elect the fair value option for our financial liabilities not already within the scope of this pronouncement, its

adoption did not have an impact on our current consolidated financial statements.

In January 2010, the FASB issued an additional accounting pronouncement related to fair value measurement

disclosures (FASB ASC Topic 820), which requires fair value hierarchy disclosures to be further disaggregated by

class of assets and liabilities. A class is often a subset of assets or liabilities within a line item in the consolidated

balance sheet. In addition, significant transfers in and out of Levels 1 and 2 of the fair value hierarchy and the

reasons for the transfers will be required to be disclosed. This provision of the pronouncement is effective for

reporting periods beginning after December 15, 2009. If applicable, we will include these newly required

disclosures for our fiscal year beginning March 1, 2010. An additional provision, effective for reporting periods

beginning after December 15, 2010, requires that the reconciliation of Level 3 activity present information about

purchases, sales, issuances and settlements on a gross basis instead of as one net number. If applicable, we will

include these newly required disclosures for our fiscal year beginning March 1, 2011.

In February 2010, the FASB issued an additional accounting pronouncement that amended certain requirements for

subsequent events (FASB ASC Topic 855), which requires an SEC filer or a conduit bond obligor to evaluate

subsequent events through the date the financial statements are available to be issued and removes the previous

requirement to disclose the date through which subsequent events have been evaluated. The amended amendments

were effective on issuance of the final pronouncement. The adoption of this pronouncement had no effect on our

consolidated financial statements.