CarMax 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.72

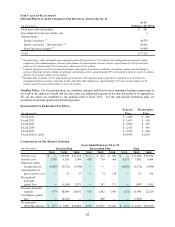

• Consolidation of the auto loan receivables and the related non-recourse notes payable funded in existing term

securitizations.

• Consolidation of the auto loan receivables and the related non-recourse notes payable funded in the

warehouse facility as of March 1, 2010.

• Recognition of a reserve for credit losses on the consolidated auto loan receivables.

• Consolidation of customer loan payments received but not yet distributed by the securitization trusts. These

payments are included in restricted cash.

• Reclassification of auto loan receivables held for sale to auto loans receivable.

• Reclassification of certain balances previously included in retained interest in securitized receivables that

relate to existing term securitizations.

• Write-off of the remaining interest-only strip receivables related to term securitizations, previously recorded

in retained interest in securitized receivables, and the related deferred tax liability. These write-offs are

charged against retained earnings.

• Recording of a deferred tax asset, primarily related to the establishment of the reserve for credit losses.

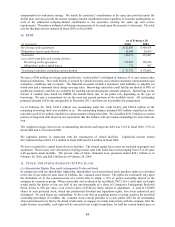

In future periods, CAF income included in the consolidated statements of earnings will no longer include a gain on

the sale of loans originated and sold, but instead will reflect the net interest margin generated by the auto loan

receivables less direct CAF expenses. The net interest margin will include the interest and certain other income

associated with the auto loan receivables less a provision for estimated credit losses and the interest expense

associated with the non-recourse debt issued to fund these receivables. Because our securitization transactions will

be accounted for under the new accounting rules as secured borrowings rather than asset sales, the cash flows from

these transactions will be presented as cash flows from financing activities rather than cash flows from operating or

investing activities.

In June 2009, the FASB issued SFAS No. 168, “The ‘FASB Accounting Standards Codification’ and the Hierarchy

of Generally Accepted Accounting Principles” (“SFAS 168”) and integrated it into FASB ASC Topic 105,

“Generally Accepted Accounting Principles,” (“Topic 105"), as subsequently updated by FASB ASUs 2009-01

through 2010-15. Topic 105 establishes the FASB ASC, which officially launched July 1, 2009, as the source of

authoritative U.S. GAAP recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive

releases of the Securities and Exchange Commission (“SEC”) under authority of federal securities laws are also

sources of authoritative U.S. GAAP for SEC registrants. The subsequent issuances of new standards will be in the

form of FASB ASUs that will be included in the FASB ASC. Generally, the FASB ASC is not expected to change

U.S. GAAP. All other accounting literature excluded from the FASB ASC will be considered nonauthoritative.

Topic 105 is effective for financial statements issued for interim and annual periods ending after

September 15, 2009. We adopted this pronouncement for our quarter ended November 30, 2009. References to

authoritative accounting literature are in accordance with the FASB ASC.

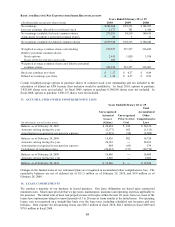

In April 2008, the FASB issued an accounting pronouncement that amends the factors that should be considered in

developing renewal or extension assumptions used to determine the useful life of a recognized intangible asset

(FASB ASC Topic 350), which requires an entity to consider its own historical experience (or, if no experience,

market participant assumptions) adjusted for entity-specific factors. The requirements are effective for financial

statements issued for fiscal years beginning after December 15, 2008, with early adoption prohibited. The guidance

for determining the useful life of a recognized intangible asset shall be applied prospectively to intangible assets

acquired after the effective date. The disclosure requirements shall be applied prospectively to all intangible assets

recognized as of, and subsequent to, the effective date. The adoption of this pronouncement did not have an impact

on our consolidated financial statements.

In June 2008, the FASB issued guidance on determining whether instruments granted in share-based payment

transactions are participating securities prior to vesting in determining earnings per share (FASB ASC Topic 260).

We adopted the guidance effective March 1, 2009, via retrospective application. See Note 12 for additional

information.

In December 2008, the FASB issued an accounting pronouncement related to employers’ disclosures about

postretirement benefit plan assets (FASB ASC Topic 715), which will require employers to disclose information

about how investment allocation decisions are made, the fair value of each major category of plan assets and

information about the inputs and valuation techniques used to develop the fair value measurements of plan assets.

This pronouncement is effective for fiscal years ending after December 15, 2009. We have included the newly