CarMax 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

superstores in fiscal 2013. This approach allows us to maintain momentum on recent initiatives to reduce waste and

increase efficiency while still offering superior quality to customers. It also allows us to rebuild our store

management bench strength and to restart our real estate acquisition activity.

The three superstores we plan to open in fiscal 2011 were constructed in fiscal 2009, but we chose not to open them

until market conditions improved.

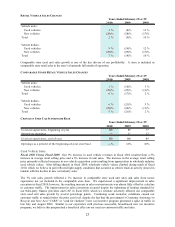

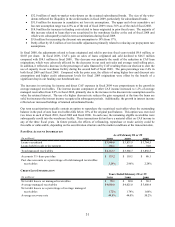

FISCAL 2011 PLANNED SUPERSTORE OPENINGS

Augusta, Georgia Augusta New market May 2010 ―1

Dayton, Ohio Dayton New market June 2010 ―1

Cincinnati, Ohio Cincinnati New market June 2010 1 ―

Total openings 1 2

Planned

Opening Date

Non-Production

SuperstoresLocation

Televi s ion

Mar k e t

Market

Status

Production

Superstores

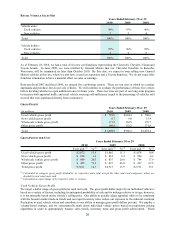

We currently estimate capital expenditures will total approximately $90 million in fiscal 2011. Compared with the

$22.4 million of capital spending in fiscal 2010, the increase in planned fiscal 2011 expenditures reflects real estate

acquisitions and construction costs associated with the resumption of store growth, as well as information

technology and reconditioning equipment upgrades.

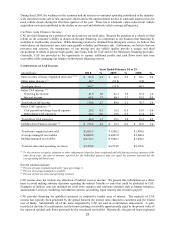

By the end of fiscal 2010, we had achieved a sustainable reduction in average reconditioning costs of approximately

$200 per vehicle. These savings, together with additional reductions that we believe are achievable, will be

available to continue to optimize future sales and profitability.

Although we intend to maintain momentum on our initiatives to reduce waste and increase efficiencies, to the extent

the economy and our sales improve, we would expect SG&A spending to increase from the level in fiscal 2010,

reflecting the resulting increases in store and overhead spending, including payroll, advertising and other costs. We

also expect the resumption of store growth will result in an increase in growth-related expenses, including

preopening costs, advertising for new stores and rebuilding our store management bench strength. In addition,

assuming no economic deterioration, we plan to invest in some key initiatives to continue to enhance the CarMax

model. These include continued improvements to carmax.com and other information technology projects and

additional training for associates.

Fiscal 2011 Expectations – CAF Income

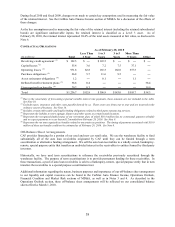

As of March 1, 2010, we will adopt ASUs 2009-16 and 2009-17. Pursuant to these pronouncements, we will

recognize existing and future transfers of auto loan receivables into term securitizations as secured borrowings,

which will result in recording the auto loan receivables and the related notes payable to the investors on our

consolidated balance sheets. Term securitizations will be consolidated based on the unpaid principal balances, less

an appropriate reserve for credit losses. We will also account for future transfers of receivables into our warehouse

facility as secured borrowings.

As of March 1, 2010, we amended our warehouse facility agreement. As a result, existing transfers of auto loan

receivables no longer qualify for sale treatment. The receivables that were funded in the warehouse facility at that

date will be consolidated, along with the related notes payable, at their fair value.

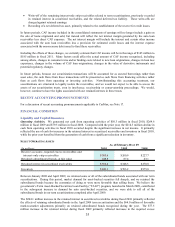

As of March 1, 2010, we expect the cumulative effect of these changes to result in a $3.7 billion increase in total

assets (net of a reserve for credit losses of approximately $58 million) and a $3.8 billion increase in total liabilities.

The following unaudited pro forma consolidated balance sheet gives affect to the adoption of ASUs 2009-16 and

2009-17 and the amendment to our warehouse facility agreement.