CarMax 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

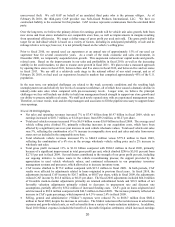

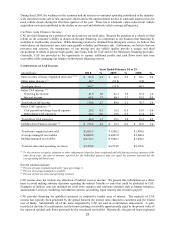

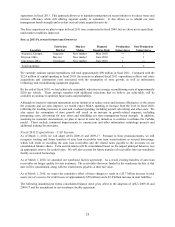

Wholesale Vehicle Gross Profit

Our wholesale vehicle gross profit per unit has steadily increased over the last several years, in part, reflecting the

benefits realized from improvements and refinements in our car-buying strategies, appraisal delivery processes and

in-store auction processes. We have made continuous improvements in these processes, which we believe has

allowed us to become more efficient. Our in-store auctions have benefited from initiatives to increase our dealer-to-

car ratio, which we believe has allowed us to achieve higher prices. In addition, the frequency of our auctions,

which are generally held weekly or bi-weekly, minimizes the depreciation risk on these vehicles.

Fiscal 2010 Versus Fiscal 2009. Our wholesale vehicle gross profit increased by $8.9 million, or 5%, to $171.5

million from $162.5 million in fiscal 2009, reflecting the combination of a 4% improvement in wholesale vehicle

gross profit per unit and the 2% increase in wholesale unit sales. Wholesale gross profit per unit increased $32 to

$869 per unit compared with $837 per unit in fiscal 2009. The improvement in the wholesale vehicle gross profit

per unit primarily reflected the higher year-over-year wholesale pricing environment. We also achieved a new

record dealer-to-car ratio at our auctions in fiscal 2010, with the resulting price competition among bidders

contributing to the strong wholesale gross profit per unit.

Fiscal 2009 Versus Fiscal 2008. Our wholesale vehicle gross profit decreased by $14.2 million, or 8%, to $162.5

million from $176.7 million in fiscal 2008. The reduction was driven by the 13% decline in wholesale vehicle unit

sales, partially offset by an increase in wholesale gross profit per unit of $43, or 5%, to $837 per unit from $794 per

unit in fiscal 2008. We experienced an improvement in our dealer-to-car ratio at our auctions in fiscal 2009, with

the resulting price competition among bidders contributing to the strong wholesale gross profit per unit. Our

wholesale vehicles are predominantly comprised of older, higher mileage vehicles, and we believe the demand for

these types of vehicles remained strong from dealers who specialize in selling to credit-challenged customers.

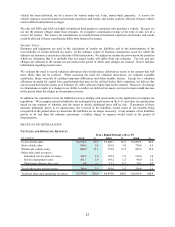

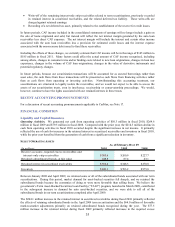

Other Gross Profit

Other gross profit includes profits related to ESP and GAP revenues, net third-party finance fees and service

department sales. We have no cost of sales related to ESP and GAP revenues or net third-party finance fees, as

these represent commissions paid to us by the third-party providers. Accordingly, changes in the relative mix of the

other gross profit components can affect the composition of other gross profit.

Fiscal 2010 Versus Fiscal 2009. Other gross profit increased by $28.6 million, or 19%, to $180.8 million from

$152.2 million in fiscal 2009. Other gross profit per unit increased $68, or 16%, to $495 per unit from $427 per unit

in fiscal 2009. ESP gross profit increased $19.3 million, or 15%, benefiting from the introduction of GAP, the

modifications in pricing made during the second half of fiscal 2009 and the 3% increase in used unit sales. Service

department gross profit grew $23.6 million, primarily because our retail vehicle sale growth outpaced fixed service

overhead costs. The increases in ESP and service department gross profit were partially offset by a $14.3 million

reduction in net third-party finance fees, which were adversely affected by the mix shift among providers and the

termination of our temporary practice of reducing CAF originations by routing more credit applications to our third-

party providers.

Fiscal 2009 Versus Fiscal 2008. Other gross profit decreased by $19.6 million, or 11%, to $152.2 million from

$171.8 million in fiscal 2008. This decrease primarily reflected the reductions in used and new retail unit sales and

the related impact on ESP revenues and third-party finance fees and a $10 decline in other gross profit per unit in

fiscal 2009. The decline in other gross profit per unit was primarily associated with the increase in mix of other

revenues represented by service department sales.

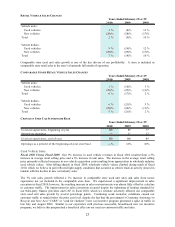

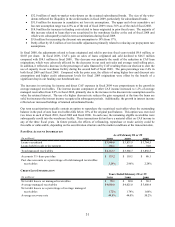

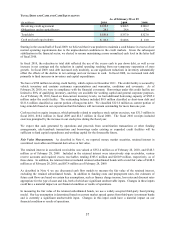

Impact of Inflation

Historically, inflation has not been a significant contributor to results. Profitability is primarily affected by our

ability to achieve targeted unit sales and gross profit dollars per vehicle rather than on average retail prices.

However, increases in average vehicle selling prices benefit the SG&A ratio and CAF income, to the extent the

average amount financed also increases.

During fiscal 2010, we experienced a period of strong appreciation in used vehicle wholesale pricing. We believe

the appreciation resulted, in part, from a reduced supply of used vehicles in the market that was caused by the

dramatic decline in new car industry sales and the associated slow down in used vehicle trade-in activity. The

appreciation also reflected a rebound in pricing compared with the severe depreciation experienced in the previous

year. The higher wholesale values increased both our vehicle acquisition costs and our average selling prices for

used and wholesale vehicles.