CarMax 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

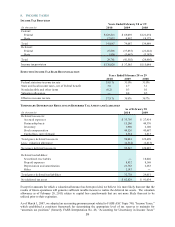

63

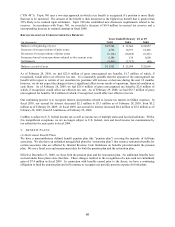

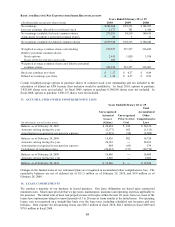

CHANGES NOT RECOGNIZED IN NET PENSION EXPENSE BUT

RECOGNIZED IN OTHER COMPREHENSIVE INCOME

(In thousands, pretax)

Net actuarial loss (gain) 4,914$ (671)$ 4,243$

Total

Res toration

Plan

Pension

Plan

Year Ended February 28, 2010

In fiscal 2011, we anticipate that $0.3 million in estimated actuarial losses of the pension plan will be amortized

from accumulated other comprehensive loss. We do not anticipate that any estimated actuarial losses will be

amortized from accumulated other comprehensive loss for the restoration plan.

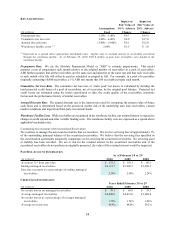

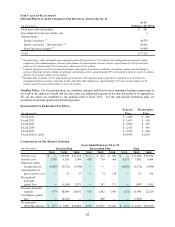

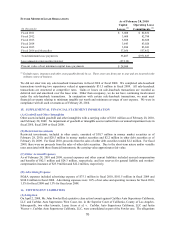

ASSUMPTIONS USED TO DETERMINE NET PENSION EXPENSE

2010 2009 2008 2010 2009 2008

Discount rate (1) 6.85% 6.85% 5.75% 6.85% 6.85% 5.75%

Expected rate of return on plan as s ets 7.75% 8.00% 8.00% ―――

Rate of compensation increase ―5.00% 5.00% ―7.00% 7.00%

Ye ar s Ende d Fe bruar y 2 8 or 2 9

Pension Plan Res toration Plan

(1) For fiscal 2009, a discount rate of 7.70% was used to determine the effects of the curtailment at October 21, 2008.

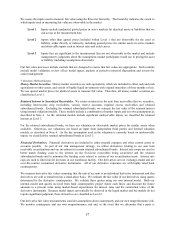

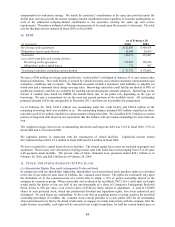

Assumptions. Underlying both the calculation of the PBO and the net pension expense are actuarial calculations of

each plan's liability. These calculations use participant-specific information such as salary, age and years of service,

as well as certain assumptions, the most significant being the discount rate, rate of return on plan assets and

mortality rate. We evaluate these assumptions at least once a year and make changes as necessary.

The discount rate used for retirement benefit plan accounting reflects the yields available on high-quality, fixed

income debt instruments. For our plans, we review high quality corporate bond indices in addition to a hypothetical

portfolio of corporate bonds with maturities that approximate the expected timing of the anticipated benefit

payments.

To determine the expected long-term return on plan assets, we consider the current and anticipated asset allocations,

as well as historical and estimated returns on various categories of plan assets. We apply the estimated rate of return

to a market-related value of assets, which reduces the underlying variability in the asset values. The use of expected

long-term rates of return on pension plan assets could result in recognized asset returns that are greater or less than

the actual returns of those pension plan assets in any given year. Over time, however, the expected long-term

returns are anticipated to approximate the actual long-term returns, and therefore, result in a pattern of income and

expense recognition that more closely matches the pattern of the services provided by the employees. Differences

between actual and expected returns, which are a component of unrecognized actuarial gains/losses, are recognized

over the average future expected service of the active employees in the pension plan.

Given the frozen status of the pension and benefit restoration plans, the rate of compensation increases is not

applicable for periods subsequent to December 31, 2008. Prior to this date, we determined the rate of compensation

increases based upon our long-term plans for these increases. Mortality rate assumptions are based on the life

expectancy of the population and were updated as of February 28, 2009, to account for increases in life expectancy.

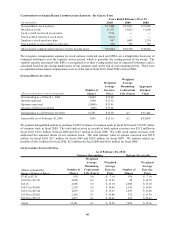

(B) Retirement Savings 401(k) Plan

We sponsor a 401(k) plan for all associates meeting certain eligibility criteria. In conjunction with the retirement

benefit plan curtailments, enhancements were made to the 401(k) plan effective January 1, 2009. The enhancements

increased the maximum salary contribution for eligible associates and increased our matching contribution.

Additionally, an annual company-funded contribution regardless of associate participation was implemented, as well

as an additional company-funded contribution to those associates meeting certain age and service requirements. The

total cost for company contributions was $20.1 million in fiscal 2010, $5.7 million in fiscal 2009 and $3.2 million in

fiscal 2008.

(C) Retirement Restoration Plan

Effective January 1, 2009, we replaced the frozen restoration plan with a new non-qualified retirement plan for

certain senior executives who are affected by Internal Revenue Code limitations on benefits provided under the

retirement savings 401(k) plan. Under this plan, these associates may continue to defer portions of their