CarMax 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

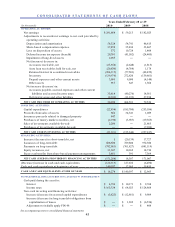

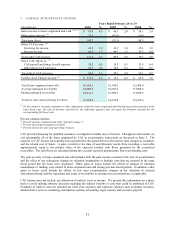

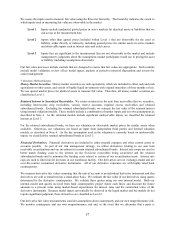

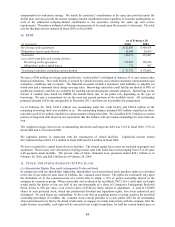

SELECTED CASH FLOWS FROM SECURITIZED RECEIVABLES

(In millions)

Proceeds from new securitizations 1,647.0$ 1,622.8$ 2,040.2$

Proceeds from collections 779.2$ 840.6$ 1,095.0$

Servicing fees received 41.8$ 41.3$ 37.0$

Other cash flows received from the retained interest:

Interest-only strip and excess receivables 131.0$ 96.7$ 98.6$

Reserve account releases 16.6$ 6.4$ 9.4$

Interest on retained subordinated bonds 9.5$ 7.5$ 0.2$

2010

Ye ar s Ende d Fe bruar y 2 8 or 2 9

2009 2008

Proceeds from New Securitizations. Proceeds from new securitizations include proceeds from receivables that are

newly securitized in or refinanced through the warehouse facility during the indicated period. Balances previously

outstanding in term securitizations that were refinanced through the warehouse facility totaled $76.0 million in fiscal

2010, $101.0 million in fiscal 2009 and $103.6 million in fiscal 2008. Proceeds received when we refinance

receivables from the warehouse facility are excluded from this table as they are not considered new securitizations.

Proceeds from Collections. Proceeds from collections represent principal amounts collected on receivables

securitized through the warehouse facility that are used to fund new originations.

Servicing Fees Received. Servicing fees received represent cash fees paid to us to service the securitized

receivables.

Other Cash Flows Received from the Retained Interest. Other cash flows received from the retained interest

represents cash that we receive from the securitized receivables other than servicing fees. It includes cash collected

on interest-only strip and excess receivables, amounts released to us from reserve accounts and interest on retained

subordinated bonds.

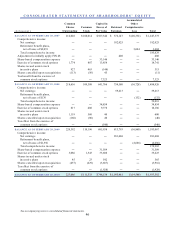

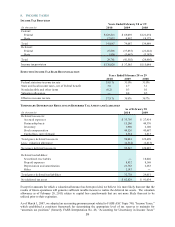

The information in the following table represents selected performance data for CAF’s securitized receivables. It

includes information for both receivables securitized through term securitizations and receivables securitized

through the warehouse facility.

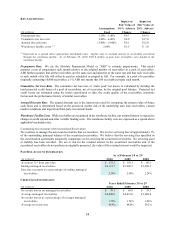

SELECTED PERFORMANCE INFORMATION FOR SECURITIZED RECEIVABLES

(In millions) 2010 % (1) 2009 % (1) 2008 % (1)

Finance and fee income 433.2$ 10.7 419.5$ 10.5 369.0$ 10.3

Interest expense (168.5) (4.1) (188.1) (4.7) (178.8) (5.0)

Net charge-offs (73.9) (1.8) (72.3) (1.8) (40.5) (1.1)

Net interes t margin 190.8$ 4.7 159.1$ 4.0 149.7$ 4.2

Average securitized receivables (2) 4,060.8$ 4,002.4$ 3,590.5$

Ye ar s Ended Fe br uar y 2 8 or 2 9

(1) Percent of average securitized receivables.

(2) Excludes auto loan receivables held for sale and auto loan receivables not eligible for securitization through the warehouse

facility or term securitizations.

Finance and Fee Income. Finance and fee income includes interest and fees charged to customers on the auto loan

receivables, including late fees and insufficient funds fees.

Interest Expense. Interest expense includes interest paid to securitization investors and lending institutions and

other expenses associated with securitization activities, net of interest income earned on restricted cash and reserve

deposits.

Net Charge-Offs. Net charge-offs includes the write-off of outstanding principal balances on uncollectible

accounts, offset by subsequent recoveries of previously charged-off accounts.