CarMax 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

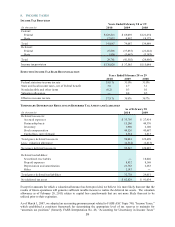

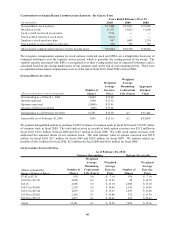

STOCK-SETTLED RESTRICTED STOCK UNIT ACTIVITY

(Shares in thousands)

Outs tanding as of M arch 1, 2009 ― ―$

Stock units granted 406 16.34$

Stock units vested and converted (6) 16.34$

Stock units cancelled (5) 16.34$

Outs tanding as of February 28, 2010 395 16.34$

Number of

Shares

Weighted

Average

Grant Date

Fair Value

The fixed fair value per share for MSUs granted in fiscal 2010 was determined to be $16.34 at the grant date using a

Monte-Carlo simulation and was based on the expected market price of our common stock on the vesting date and

the expected number of converted common shares. The unrecognized compensation costs related to these nonvested

MSUs totaled $3.8 million as of February 28, 2010. These costs are expected to be recognized over a weighted

average period of 2.1 years.

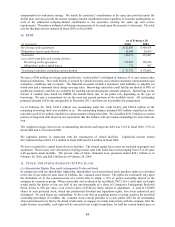

Cash-Settled Restricted Stock Units. The initial fair market value per share for the liability-classified RSUs granted

in fiscal 2010 was $11.43 at the grant date. As of February 28, 2010, we expect the total cash settlement upon

vesting to range between $7.0 million to $18.6 million.

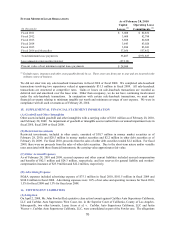

(D) Employee Stock Purchase Plan

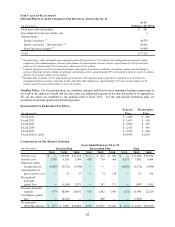

We sponsor an employee stock purchase plan for all associates meeting certain eligibility criteria. Associate

contributions are limited to 10% of eligible compensation, up to a maximum of $7,500 per year. For each $1.00

contributed to the plan by associates, we match $0.15. We have authorized up to 8,000,000 shares of common stock

for the employee stock purchase plan. Shares are acquired through open-market purchases.

As of February 28, 2010, a total of 4,727,259 shares remained available under the plan. Shares purchased on the

open market on behalf of associates totaled 452,936 during fiscal 2010; 677,944 during fiscal 2009; and 409,004

during fiscal 2008. The average price per share for purchases under the plan was $16.71 in fiscal 2010, $12.22 in

fiscal 2009 and $22.24 in fiscal 2008. The total costs for matching contributions are included in share-based

compensation expense.

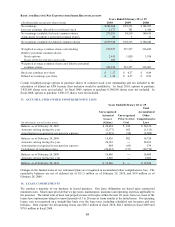

12. NET EARNINGS PER SHARE

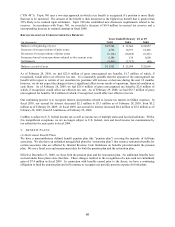

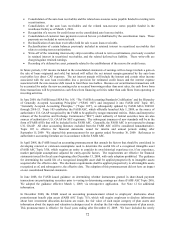

On March 1, 2009, the company adopted the accounting pronouncement related to participating securities, with

retrospective application, which was subsequently integrated into the FASB Accounting Standards Codification

(“FASB ASC”) Topic 260, “Earnings Per Share.” This pronouncement addresses whether instruments granted in

share-based payment transactions are “participating securities” prior to vesting, and therefore need to be included in

the earnings allocation in computing earnings per share under the two-class method, as described in this

pronouncement. Nonvested share-based payment awards that contain nonforfeitable rights to dividends or dividend

equivalents (whether paid or unpaid) are participating securities and should be included in the computation of

earnings per share pursuant to the two-class method. Our restricted stock awards are considered participating

securities because they contain nonforfeitable rights to dividends. Nonvested MSUs and RSUs granted after

February 28, 2009, do not receive nonforfeitable dividend equivalent rights and are therefore not considered

participating securities. The adoption had no impact on previously reported basic net EPS for fiscal 2009 or 2008.

The adoption had no impact on previously reported diluted net EPS for the fiscal year ended February 28, 2009, and

it decreased the previously reported diluted net EPS for the fiscal year ended February 29, 2008, by $0.01.