CarMax 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

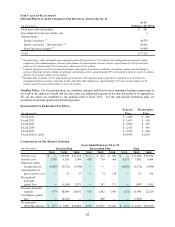

4. SECURITIZATIONS

We maintain a revolving securitization program (“warehouse facility”) that currently provides financing of up to

$1.2 billion to fund substantially all of the auto loan receivables originated by CAF until they can be funded through

a term securitization or alternative funding arrangement. We sell the auto loan receivables to a wholly owned,

bankruptcy-remote, special purpose entity that transfers an undivided interest in the receivables to entities formed by

third-party investors (“bank conduits”). The bank conduits issue asset-backed commercial paper supported by the

transferred receivables, and the proceeds from the sale of the commercial paper are used to pay for the securitized

receivables. The return requirements of investors in the bank conduits could fluctuate significantly depending on

market conditions. The warehouse facility has a 364-day term ending in August 2010. At renewal, the cost,

structure and capacity of the facility could change. These changes could have a significant impact on our funding

costs.

The bank conduits may be considered variable interest entities, but are not consolidated because we are not the

primary beneficiary and our interest does not constitute a variable interest in the entities. We hold a variable interest

in specified assets transferred to the entities rather than interests in the entities themselves.

Historically, we have used term securitizations to refinance the receivables previously securitized through the

warehouse facility. The purpose of term securitizations is to provide permanent funding for these receivables. In

these transactions, a pool of auto loan receivables is sold to a bankruptcy-remote, special purpose entity that in turn

transfers the receivables to a special purpose securitization trust. The securitization trust issues asset-backed

securities, secured or otherwise supported by the transferred receivables, and the proceeds from the sale of the

securities are used to pay for the securitized receivables. Refinancing receivables in a term securitization could have

a significant impact on our results of operations depending on the transaction structure and market conditions.

The warehouse facility and each term securitization are governed by various legal documents that limit and specify

the activities of the special purpose entities and securitization trusts (collectively, “securitization vehicles”) used to

facilitate the securitizations. The securitization vehicles are generally allowed to acquire the receivables being sold

to them, issue asset-backed securities to investors to fund the acquisition of the receivables and enter into derivatives

or other yield maintenance contracts to hedge or mitigate certain risks related to the pool of receivables or asset-

backed securities. Additionally, the securitization vehicles are required to service the receivables they hold and the

securities they have issued. These servicing functions are performed by CarMax as appointed within the underlying

legal documents. Servicing functions include, but are not limited to, collecting payments from borrowers,

monitoring delinquencies, liquidating assets, investing funds until distribution, remitting payments to the trustee

who in turn remits payments to the investors, and accounting for and reporting information to investors.

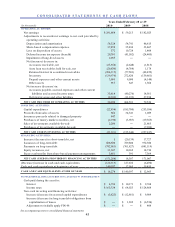

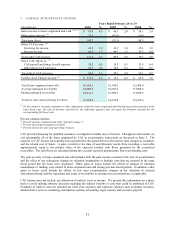

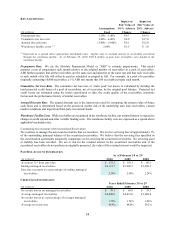

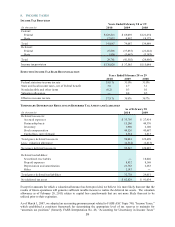

ENDING MANAGED RECEIVABLES

(In m illions)

Warehouse facility 331.0$ 1,215.0$ 854.5$

Term securitizations 3,615.6 2,616.9 2,910.0

Loans held for inves tment 135.5 145.1 69.0

Loans held for sale 30.6 9.7 5.0

Total ending managed receivables 4,112.7$ 3,986.7$ 3,838.5$

As of February 28 or 29

2010 2009 2008

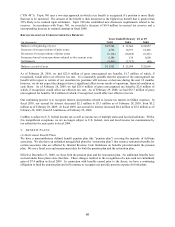

The special purpose entities and investors have no recourse to our assets. Our risk under these arrangements is

limited to the retained interest. We have not provided financial or other support to the special purpose entities or

investors that was not previously contractually required. There are no additional arrangements, guarantees or other

commitments that could require us to provide financial support or that would affect the fair value of our retained

interest. All transfers of receivables are accounted for as sales. When the receivables are securitized, we recognize

a gain or loss on the sale of the receivables as described in Note 3. However, as described in Note 17, pursuant to

ASUs 2009-16 and 2009-17, the transferred auto loan receivables, and the related non-recourse notes payable to the

investors, will be accounted for as secured borrowings effective March 1, 2010, and will be reported on our

consolidated balance sheets.

Retained Interest

We retain an interest in the auto loan receivables that we securitize. The retained interest includes the present value

of the expected residual cash flows generated by the securitized receivables, or “interest-only strip receivables,”