CarMax 2010 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2010 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

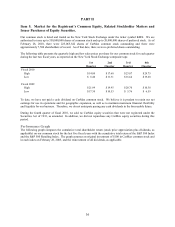

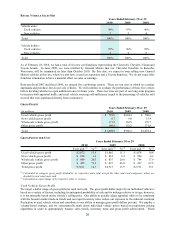

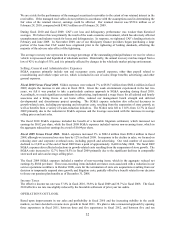

RETAIL VEHICLE SALES CHANGES

Vehicle units:

Used vehicles 3 % (8)% 12 %

New vehicles (29)% (28)% (17)%

Total 2 % (9)% 10 %

Vehicle dollars:

Used vehicles 9 % (14)% 12 %

New vehicles (29)% (29)% (17)%

Total 7 % (14)% 10 %

2009 20082010

Year s Ende d Fe br uar y 2 8 or 2 9

Comparable store used unit sales growth is one of the key drivers of our profitability. A store is included in

comparable store retail sales in the store’s fourteenth full month of operation.

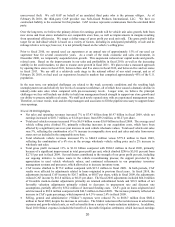

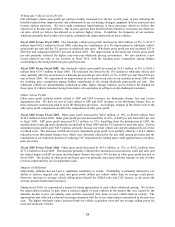

COMPARABLE STORE RETAIL VEHICLE SALES CHANGES

Vehicle units:

Used vehicles 1 % (16)% 3 %

New vehicles (29)% (25)% (11)%

Total 0 % (17)% 2 %

Vehicle dollars:

Used vehicles 6 % (21)% 3 %

New vehicles (29)% (26)% (11)%

Total 5 % (21)% 2 %

Year s Ende d Fe br uar y 2 8 or 2 9

20082010 2009

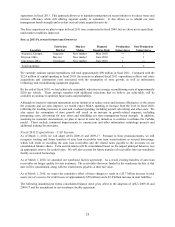

CHANGE IN USED CAR SUPERSTORE BASE

Used car superstores, beginning of year 100 89 77

Superstore openings ― 11 12

Used car superstores, end of year 100 100 89

Openings as a percent of the beginning-of-year store base ―% 12% 16%

20092010 2008

Year s Ende d Fe bruar y 2 8 or 2 9

Used Vehicle Sales

Fiscal 2010 Versus Fiscal 2009. Our 9% increase in used vehicle revenues in fiscal 2010 resulted from a 5%

increase in average retail selling price and a 3% increase in unit sales. The increase in the average retail selling

price primarily reflected increases in our vehicle acquisition costs resulting from appreciation in wholesale industry

used vehicle values. After falling sharply in fiscal 2009, wholesale vehicle values climbed during much of fiscal

2010, which we believe in part reflected tight supply conditions that occurred as vehicle trade-in activity slowed in

tandem with the decline in new car industry sales.

The 3% unit sales growth reflected a 1% increase in comparable store used unit sales and sales from newer

superstores not yet included in the comparable store base. We experienced a significant improvement in sales

execution in fiscal 2010; however, the resulting increase in sales conversion rate was almost fully offset by a decline

in customer traffic. The improvement in sales conversion occurred despite the tightening of lending standards by

our third-party finance providers and CAF in fiscal 2010, which we estimate adversely affected our comparable

store used unit sales growth by several percentage points. Continuing weak economic conditions caused our

customer traffic to remain below the prior year level, despite the fact that the government’s Consumer Assistance to

Recycle and Save Act (“CARS” or “cash for clunkers”) new car incentive program generated a spike in traffic in

late July and August 2009. Similar to our experience with previous successful, broad-based new car incentive

programs, we believe this program had a beneficial effect on our used car customer traffic and sales.